SAUDI ARAMCO LISTED $25.6 BLN

SAUDI ARAMCO - RIYADH, December [11], 2019: - Saudi Arabian Oil Company (Saudi Aramco): Listed on Tadawul

The Saudi Arabian Oil Company (‘Saudi Aramco’ or ‘the Company’) has officially listed on the Saudi Stock Exchange (Tadawul) today, marking the successful Initial Public Offering (‘IPO’) of the Company. Saudi Aramco’s stock symbol ticker is (TADAWUL: ARAMCO) and its shares began trading at SAR32.

The Offering process, which concluded on December 4, generated subscriptions by Institutional and Individual Subscribers of SAR446billion / USD119 billion, or 4.65 times the total Offer Shares (assuming no exercise of the Purchase Option). The Offering attracted more than 5 million subscribers.

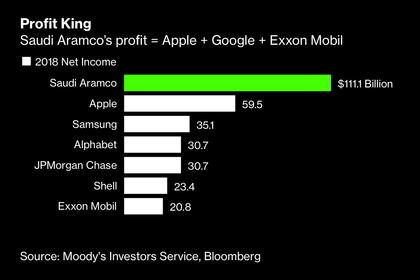

The Kingdom of Saudi Arabia sold 3 billion shares (excluding any exercise of the Purchase Option), equivalent to 1.5% of the Company’s share capital. Priced at the top of the indicated range, the Offering generated proceeds of SAR96.0 billion / USD25.6 billion (assuming no exercise of the Purchase Option), making it the world’s largest IPO.

Saudi Aramco’s listing and share trading debut was marked by a symbolic ringing of the Tadawul bell by His Excellency Yasir Othman Al-Rumayyan, Chairman of the Board of Directors, and Amin H. Nasser, President and Chief Executive Officer.

Celebrating and sharing the historic milestone were Saudi Aramco’s Board of Directors and Executive Management team, Tadawul’s Chairperson, Sarah Al-Suhaimi, and Chief Executive Officer, Khalid Abdullah Al Hussan, as well as other dignitaries from the Government of the Kingdom of Saudi Arabia.

His Excellency Yasir Othman Al-Rumayyan, Chairman of the Board of Directors of Saudi Aramco, said: “This is a proud and historic moment for Saudi Aramco and our majority shareholder, the Kingdom, as Saudi Aramco begins life as a listed company on Tadawul, together with all our new individual and institutional shareholders here in the Kingdom, in the region and around the world.”

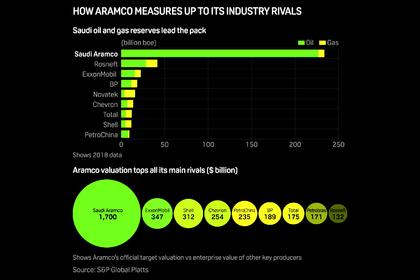

"My focus, and that of our Board of Directors, is to work in the interests of all shareholders, guiding Saudi Aramco as it continues to fulfil its vital role in global energy supply, whilst striving to create long-term value to benefit all shareholders. Our approach is underpinned by a disciplined capital allocation process and a highly experienced senior management team."

"Today's milestone underlines the Kingdom's commitment to nurturing a strong capital market and demonstrates further significant progress in delivering Vision 2030 - the Kingdom's transformation, economic growth and diversification program that continues with pace and determination."

Mr. Amin H. Nasser, President and Chief Executive Officer of Saudi Aramco, said: "Saudi Aramco's trading debut on Tadawul marks the completion of the world's largest IPO and the beginning of an important new chapter in our history. We are a company with a rich history here in the Kingdom dating back to 1933. Our success since that time is based on the strong foundation and values created by our pioneers and reinforced by subsequent generations of Aramcons. Today, that foundation, those values and this legacy are being carried forward by my colleagues around the world."

"We believe the demand from a broad base of individual investors and such a wide range of institutions reflects trust in our long-term strategy and our vision to become the world's preeminent integrated energy and chemicals company, operating in a safe, sustainable and reliable manner."

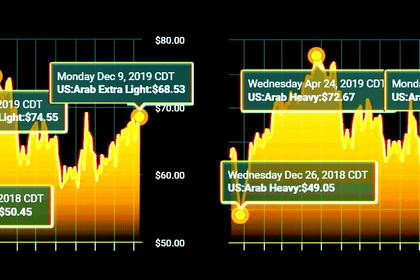

"Building on our low-cost production and our reliable supply of low carbon-intensity crude oil to our customers, we will remain focused on providing our shareholders with resilient value creation through crude oil price cycles."

-----

Earlier: