U.S. COAL COMPANIES DOWN

РЕЙТЕР -

-----

Раньше:

2018, March, 14, 11:45:00

REUTERS - U.S. West Texas Intermediate (WTI) crude futures CLc1 were at $60.77 a barrel at 0753 GMT, up 6 cents, or 0.1 percent, from their previous settlement. Brent crude futures LCOc1 were at $64.62 per barrel, down just 2 cents from their last close.

|

2018, March, 7, 15:00:00

РЕЙТЕР - К 9.17 МСК фьючерсы на североморскую смесь Brent опустились на 0,85 процента до $65,23 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $62,07 за баррель, что на 0,85 процента ниже предыдущего закрытия.

|

2018, March, 7, 14:00:00

EIA - North Sea Brent crude oil spot prices averaged $65 per barrel (b) in February, a decrease of $4/b from the January level and the first month-over-month average decrease since June 2017. EIA forecasts Brent spot prices will average about $62/b in both 2018 and 2019 compared with an average of $54/b in 2017.

|

2018, March, 5, 11:35:00

РЕЙТЕР - К 9.28 МСК фьючерсы на североморскую смесь Brent поднялись на 0,33 процента до $64,58 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $61,44 за баррель, что на 0,31 процента выше предыдущего закрытия.

|

2018, March, 4, 11:30:00

МИНФИН РОССИИ - Средняя цена нефти марки Urals по итогам января – февраля 2018 года составила $ 65,99 за баррель.

|

2018, February, 27, 14:15:00

РЕЙТЕР - К 9.18 МСК фьючерсы на североморскую смесь Brent опустились на 0,15 процента до $67,40 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $63,80 за баррель, что на 0,17 процента ниже предыдущего закрытия.

|

2018, February, 27, 14:05:00

МИНФИН РОССИИ - Средняя цена на нефть Urals за период мониторинга с 15 января по 14 февраля 2018 года составила $66,26457 за баррель, или $483,7 за тонну.

|

U.S. COAL COMPANIES DOWN

IEEFA- The market capitalization of five of the top 10 U.S. coal companies was sliced by more than half from early January to mid-November 2019.

Those top 10 producers' market value totaled about $4.42 billion as of Nov. 22, a 59.4% drop from $10.88 billion as of Jan. 8, according to data compiled by S&P Global Market Intelligence. The group of companies saw double-digit percentage declines in market capitalization from Jan. 8 to Nov. 22 as domestic demand waned and the seaborne market weakened. Rhino Resource Partners LP, which rounded out the top 10 as of Nov. 22, saw the smallest percentage decline between the periods, with its value falling 18.6% to $11.4 million.

While Cloud Peak Energy Inc. and Westmoreland Coal Co. may have been among the nation's top producers previously, they were excluded because both companies filed for bankruptcy protection during the last year or so and subsequently sold off or transferred their assets.

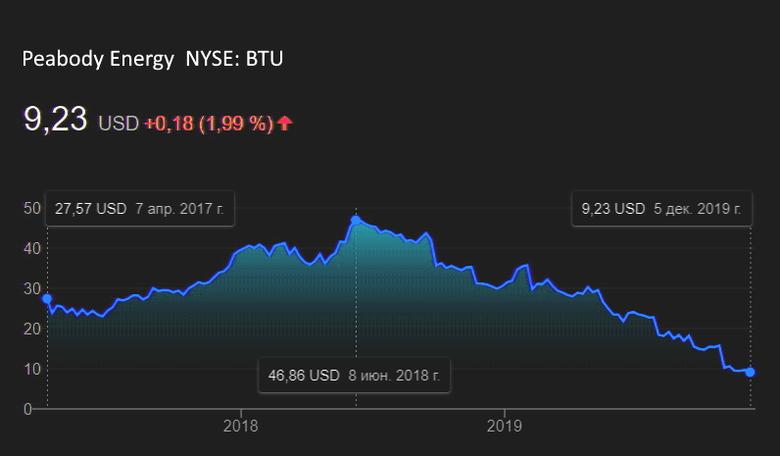

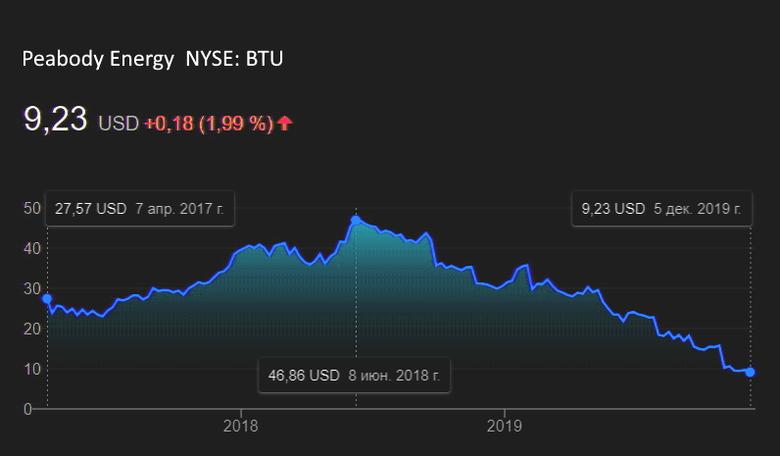

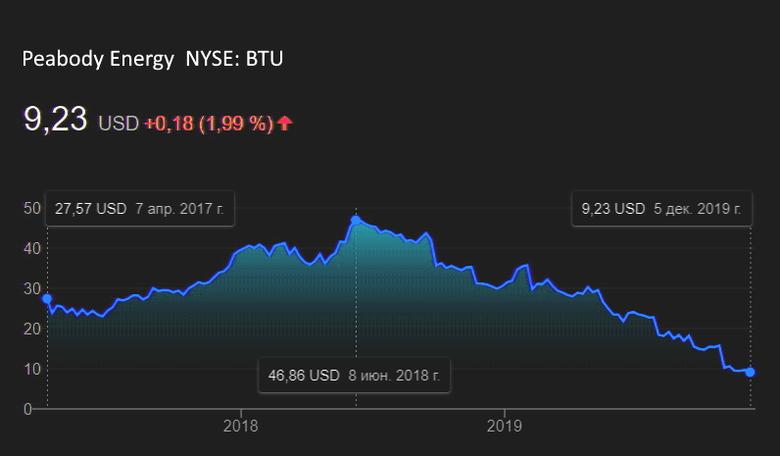

Peabody Energy Corp., which has been hailed as the leading U.S. coal producer, saw its value plummet 73.5% to $914.8 million on Nov. 22 from nearly $3.45 billion as of Jan. 8. That decline dropped Peabody down to third place in terms of market capitalization, behind Alliance Resource Partners LP and Arch Coal Inc., the only two U.S. producers with a value exceeding $1 billion as of Nov. 22.

Several analysts said Alliance is one of the strongest, if not the strongest, thermal-focused U.S. coal producer. Given declining domestic utility demand, coupled with weakened export markets for U.S. miners, the company's overall strength has proven to be an anomaly in the space. Several of the other top U.S. coal companies reorganized and shed some debt in recent years or benefited primarily from their metallurgical coal investments.

The company with the most significant percentage decline in market value was recently delisted from the NYSE. Foresight Energy LP's market capitalization plunged 97.1% to $14.6 million from January to November following its affiliated company's bankruptcy protection filing in October and a less than impressive third quarter that may foreshadow the company's own trip to a bankruptcy court.

-----

Earlier:

2019, December, 4, 12:10:00

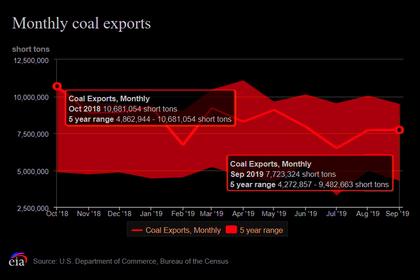

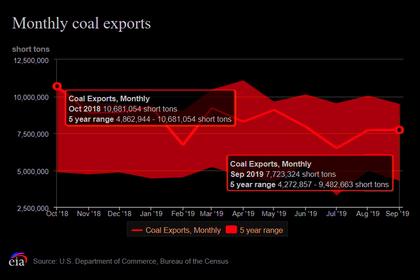

U.S. COAL EXPORTS DOWN

In the first nine months of 2019, US thermal exports were more than 10 million mt below the year-ago period's total, and vessel tracking data show October exports are expected to come in close to September levels.

2019, November, 27, 11:45:00

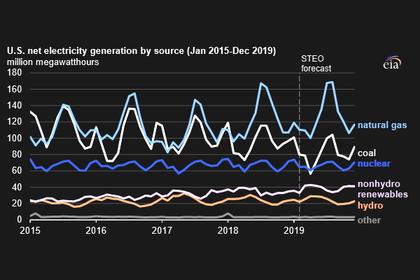

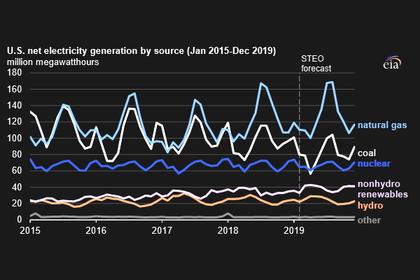

U.S. COAL GENERATION DOWN

US coal-fired power generation totaled 85.9 TWh in September, down 8.8% from August,

All Publications »

Tags:

USA,

COAL