U.S. CURRENT ACCOUNT DEFICIT $124.1 BLN

U.S. BEA - DECEMBER 19, 2019 - U.S. International Transactions, Third Quarter 2019

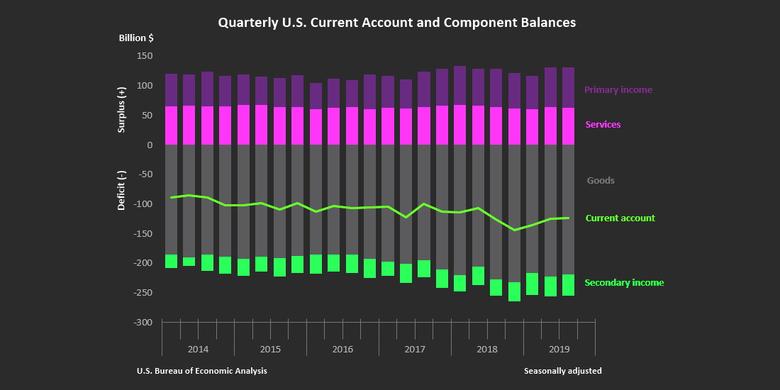

Current Account Deficit Narrows by 0.9 Percent in Third Quarter

Current Account Balance

The U.S. current account deficit, which reflects the combined balances on trade in goods and services and income flows between U.S. residents and residents of other countries, narrowed by $1.1 billion, or 0.9 percent, to $124.1 billion in the third quarter of 2019, according to statistics from the U.S. Bureau of Economic Analysis (BEA). The revised second quarter deficit was $125.2 billion.

The third quarter deficit was 2.3 percent of current dollar gross domestic product, down less than 0.1 percent from the second quarter.

The $1.1 billion narrowing of the current account deficit in the third quarter mainly reflected a reduced deficit on goods and an expanded surplus on primary income.

Current Account Transactions (tables 1-5)

Exports of goods and services to, and income received from, foreign residents decreased $4.3 billion, to $944.4 billion, in the third quarter. Imports of goods and services from, and income paid to, foreign residents decreased $5.4 billion, to $1.07 trillion.

Trade in Goods (table 2)

Exports of goods decreased $0.9 billion, to $413.8 billion, and imports of goods decreased $4.5 billion, to $633.4 billion. The decreases in both exports and imports mainly reflected decreases in industrial supplies and materials, primarily petroleum and products.

Trade in Services (table 3)

Exports of services decreased $0.3 billion, to $212.0 billion, reflecting partly offsetting changes across major categories. Decreases were led by travel, mainly other personal travel, and increases were led by other business services, mainly professional and management consulting services. Imports of services increased $1.6 billion, to $149.8 billion, reflecting increases in nearly all major categories. Increases were led by insurance services, mainly reinsurance.

Primary Income (table 4)

Receipts of primary income decreased $4.1 billion, to $282.0 billion, and payments of primary income decreased $6.2 billion, to $213.3 billion. The decreases in both receipts and payments mainly reflected decreases in direct investment income and in other investment income. Within direct investment income receipts, dividends increased $24.9 billion, to $95.3 billion, in the third quarter and remain elevated since the passage of the 2017 Tax Cuts and Jobs Act, which generally eliminated taxes on repatriated earnings beginning in 2018.

Secondary Income (table 5)

Receipts of secondary income increased $1.0 billion, to $36.6 billion, mainly reflecting an increase in private sector fines and penalties, a component of private transfer receipts. Payments of secondary income increased $3.7 billion, to $72.0 billion, mainly reflecting increases in U.S. government grants and in insurance-related transfers, a component of private transfer payments.

Financial Account Transactions (tables 1, 6, 7, and 8)

Net financial account transactions were −$47.9 billion in the third quarter, reflecting net U.S. borrowing from foreign residents.

Financial Assets (tables 1, 6, 7, and 8)

Third quarter transactions increased U.S. residents' foreign financial assets by $123.5 billion. Transactions increased direct investment assets, primarily equity, by $33.3 billion; portfolio investment assets, mainly debt securities, by $18.5 billion; other investment assets, primarily loans, by $69.9 billion; and reserve assets by $1.9 billion.

Liabilities (tables 1, 6, 7, and 8)

Third quarter transactions increased U.S. liabilities to foreign residents by $164.9 billion. Transactions increased direct investment liabilities, mainly equity, by $37.6 billion; portfolio investment liabilities, mainly debt securities, by $86.5 billion; and other investment liabilities, mainly bank deposits, by $40.8 billion.

Financial Derivatives (table 1)

Net transactions in financial derivatives were −$6.5 billion in the third quarter, reflecting net borrowing from foreign residents.

| Updates to Second Quarter 2019 International Transactions Accounts Balances Billions of dollars, seasonally adjusted |

||

| Preliminary estimate | Revised estimate | |

|---|---|---|

| Current account balance | −128.2 | −125.2 |

| Goods balance | −223.3 | −223.2 |

| Services balance | 60.0 | 64.1 |

| Primary income balance | 67.6 | 66.6 |

| Secondary income balance | −32.5 | −32.7 |

| Net financial account transactions | −155.1 | −213.4 |

-----

Earlier: