BHGE NET INCOME $131 MLN

BHGE - Baker Hughes, a GE company Announces Fourth Quarter and Total Year 2018 Results

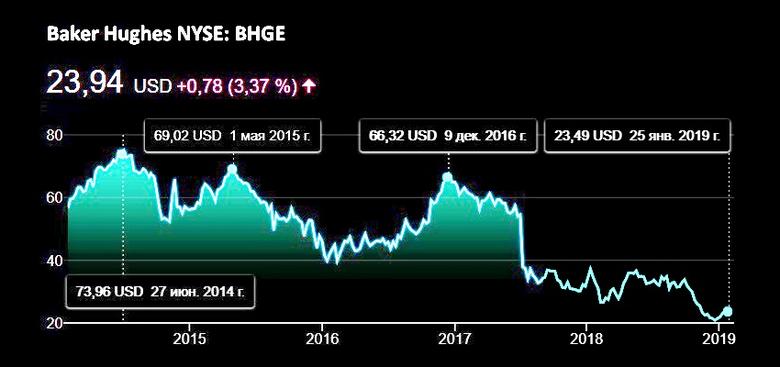

Baker Hughes, a GE company (NYSE: BHGE) ("BHGE" or the "Company") announced results today for the fourth quarter and total year 2018.

| Three Months Ended | Variance | ||||

| December 31, | September 30, | December 31, | Year-over- | ||

| (in $ millions except per share amounts) | 2018 | 2018 | 2017 | Sequential | year |

| Orders | 6,884 | 5,746 | 5,701 | 20% | 21% |

| Revenue | 6,264 | 5,665 | 5,799 | 11% | 8% |

| Operating income (loss) | 382 | 282 | (111) | 35% | F |

| Adjusted operating income (non-GAAP)* | 498 | 377 | 284 | 32% | 75% |

| Net income attributable to BHGE | 131 | 13 | 31 | F | F |

| Adjusted net income (non-GAAP) attributable to BHGE* | 120 | 78 | 65 | 53% | 85% |

| EPS attributable to Class A shareholders | 0.28 | 0.03 | 0.07 | F | F |

| Adjusted EPS (non-GAAP) attributable to Class A shareholders* | 0.26 | 0.19 | 0.15 | 37% | 71% |

| Cash flow from (used in) operating activities | 1,090 | 239 | (215) | F | F |

| Free cash flow (non-GAAP)* | 876 | 146 | (367) | F | F |

*These are non-GAAP financial measures. See section entitled "Charges and Credits" for a reconciliation from GAAP.

"F" is used in most instances when variance is above 100%. Additionally, "U" is used in most instances when variance is below (100)%.

Prior period information has been restated for the adoption of Accounting Standards Codification (ASC) Topic 606, Revenue from Contracts with Customers and Accounting

Standards Update No. 2017-07, Improving the Presentation of Net Periodic Postretirement Benefit Cost, which we adopted on January 1, 2018.

“2018 marked BHGE’s first full year as a combined company and it was a year of significant change and progress for us. We moved beyond the initial integration phase into the next chapter for BHGE. In November, our majority shareholder, GE, reduced their ownership from approximately 62.5% to approximately 50.4%, and we reached critical commercial agreements with GE that position our company for the future. The market environment changed significantly as we progressed through the year. Through these changes, we stayed focused on our priorities of gaining market share, running the company better to improve margin rates and improving cash generation. While there is more work to do, I am very pleased with how we executed for our customers and shareholders, and I am proud of what we accomplished in 2018,” said Lorenzo Simonelli, BHGE Chairman, President and Chief Executive Officer.

“In the fourth quarter, we achieved $6.9 billion in orders, our largest orders quarter in almost 3 years, with sequential growth in all four of our business segments. We delivered $6.3 billion in revenue and adjusted operating income in the quarter was $498 million. Free cash flow in the quarter was $876 million.

“For the total year 2018, orders were $23.9 billion, as we re-built our backlog, and we delivered $22.9 billion of revenue, as we captured market opportunities and grew our market share. In the year, we delivered $1.4 billion of adjusted operating income. We also achieved over $800 million of synergies, ahead of our target. Free cash flow was $1.2 billion in the year, which included approximately $473 million of restructuring, legal and deal related cash outflows.

“In Oilfield Services (OFS), we made significant progress on our objectives of gaining share in key markets, being closer to our customers and expanding margin rates. In the fourth quarter, we secured several important drilling, completions and artificial lift awards in the Middle East and Latin America and continued to deliver superior performance with our leading drilling systems for customers in North America.

“In Oilfield Equipment (OFE), our core focus in the year was to re-build backlog and set the business up for success in the coming years, and we executed very well on this plan. We saw strong orders in the fourth quarter rounding out a solid 2018. We won several important awards during the year, including 34 trees for India'sOil & Natural Gas Corporation's (ONGC) 98/2 project in the fourth quarter. In November, we launched Subsea Connect, a new approach to subsea development to improve the economics of offshore projects, which is gaining traction with our customers.

“Our Turbomachinery & Process Solutions (TPS) segment saw an improved LNG market in 2018. In the fourth quarter, we secured an award to provide modular turbocompressor technology for LNG Canada’s liquefaction plant in Kitimat, British Columbia, the largest LNG project to reach a positive Final Investment Decision (FID) globally since 2014.

"We also secured a number of key contracts in the pipeline market as demand in North America increased throughout 2018, and we continue to gain traction with our versatile lower megawatt NovaLT gas turbine product line.

“In Digital Solutions (DS), we stayed focused on gaining traction with our digital software offerings and launched several important partnerships to enhance our offerings. We also continued our focus on growing core hardware in our measurement and controls product lines across multiple industries, including automotive and consumer electronics.

“The market dynamics in the fourth quarter demonstrated the volatility in our industry. The recent decline in crude prices will have an impact on the more transactional markets of the United States, Canada and Latin America in the first half of 2019. We expect other international markets as well as offshore activity to remain relatively stable. We are seeing a positive change in the LNG market, with likely project sanctioning accelerating faster than we previously anticipated.

“We delivered a strong fourth quarter and finished out a solid 2018 for BHGE. I would like to thank the BHGE team for their hard work and dedication throughout the year. As we look forward to 2019, our core mission as a company is unchanged -- delivering productivity solutions to the oil and gas industry through differentiated technology and innovative commercial models. We are positioning the company to navigate a dynamic macroeconomic environment, while remaining focused on delivering for our customers and on our priorities of share, margins, and cash,” concluded Simonelli.

-----

Earlier:

2019, January, 28, 09:45:00

U.S. RIGS UP 9 TO 1,059BHGE - U.S. Rig Count is up 9 rigs from last week to 1,059 rigs, with oil rigs up 10 to 862 and gas rigs down 1 to 197. Canada Rig Count is up 23 rigs from last week to 232, with oil rigs up 18 to 146 and gas rigs up 5 to 86.

|

2018, November, 14, 11:35:00

BHGE, GE MAXIMIZES VALUEGE - Baker Hughes, a GE company and General Electric Company Announce a Series of Long-Term Agreements to Maximize Value for Both BHGE and GE

|

2018, October, 31, 12:40:00

BHGE NET INCOME $13 MLNBHGE - Orders of $5.7 billion for the quarter, down 5% sequentially and flat year-over-year. Revenue of $5.7 billion for the quarter, up 2% sequentially and up 7% year-over-year. GAAP operating income of $282 million for the quarter, increased $204 million sequentially and increased $475 million year-over-year.

|

2018, October, 10, 07:30:00

BHGE ACCURES 5% IN ADNOC: $11 BLNBHGE - BHGE will acquire a five percent stake in ADNOC Drilling. The transaction values ADNOC Drilling at approximately $11 billion.

|

2018, September, 5, 10:30:00

BAKER HUGHES & SAUDI ARAMCO CONTRACTPLATTS - Saudi Aramco has awarded Baker Hughes a major services contract to boost crude oil production from Saudi Arabia's offshore Marjan oil field.

|

2018, April, 23, 14:05:00

BAKER HUGHES GE NET INCOME $70 MLNBHGE - Baker Hughes, a GE company Announces First Quarter 2018 Results Revenue of $5.4 billion for the quarter, down 7% sequentially and up 1% year-over-year on a combined business basis GAAP operating loss of $41 million for the quarter, decreased 63% sequentially and increased unfavorably year-over-year on a combined business basis Adjusted operating income (a non-GAAP measure) of $228 million for the quarter, down 20% sequentially and down 19% year-over-year on a combined business basis

|

2017, October, 23, 11:05:00

BAKER HUGHES NET LOSS $104 BLN“The combination of GE Oil & Gas and Baker Hughes closed on July 3, and we are pleased with our progress during our first operating quarter. Despite the continuing challenging environment, we delivered solid orders growth and secured important wins from customers, advanced existing projects and enhanced our technology offerings in the quarter. We also achieved key integration milestones and made significant progress working as a combined company. I am now more convinced than ever that we combined the right companies at the right time,” said Lorenzo Simonelli, BHGE chairman and chief executive officer.

|

2017, July, 5, 12:10:00

GE & BAKER HUGHES DEALGeneral Electric Co. closed its deal to combine its long-suffering energy business with Baker Hughes Inc. on Monday, creating one of the largest companies in the oil-field services industry. |