BP PROFIT $9.4 BLN

ЛУКОЙЛ - В 2018 году среднесуточная добыча углеводородов Группой «ЛУКОЙЛ» без учета проекта Западная Курна-2 составила 2 319 тыс. барр. н. э./сут, что на 3,8% больше по сравнению с 2017 годом. В четвертом квартале 2018 года среднесуточная добыча углеводородов составила 2 371 тыс. барр. н. э./сут, увеличившись на 1,9% по сравнению с третьим кварталом 2018 года. Рост добычи в основном связан с развитием газовых проектов в Узбекистане.

Добыча углеводородов, тыс. барр. н. э./сут

Добыча нефти за 2018 год без учета проекта Западная Курна-2 составила 85,6 млн т, что соответствует уровню 2017 года. В четвертом квартале 2018 года было добыто 21,8 млн тонн нефти, что на 0,5% выше уровня третьего квартала 2018 года.

Добыча нефти, тыс. тонн

| 21 832 |

21 717 |

Итого (без проекта Западная Курна-2) |

85 610 |

85 592 |

| 20 922 |

20 865 |

Россия |

82 045 |

81 879 |

| 20 763 |

20 706 |

Дочерние общества |

81 412 |

80 995 |

| 159 |

159 |

Доля в добыче зависимых обществ |

633 |

884 |

| 910 |

852 |

За рубежом |

3 565 |

3 713 |

| 497 |

457 |

Дочерние общества |

1 901 |

2 003 |

| 413 |

395 |

Доля в добыче зависимых обществ |

1 664 |

1 710 |

| 276 |

469 |

Компенсационная нефть по проекту Западная Курна-2 |

1 514 |

1 822 |

Продолжилась активная работа по развитию приоритетных проектов. В частности, в четвертом квартале в эксплуатацию введена пятая скважина на второй очереди освоения месторождения им. В. Филановского. За 2018 год на месторождении добыто 6,1 млн тонн нефти, что на 32% больше по сравнению с 2017 годом.

На месторождении им. Ю. Корчагина в четвертом квартале 2018 года добыча выросла на 15% по сравнению с предыдущим кварталом в результате ввода второй добывающей скважины на второй очереди месторождения.

Разработка Ярегского месторождения и пермокарбоновой залежи Усинского месторождения, включая ввод новых парогенераторных мощностей, позволила нарастить добычу высоковязкой нефти за 2018 год до 4,3 млн тонн, или на 25% по сравнению с 2017 годом.

Добыча нефти и газового конденсата на Пякяхинском месторождении в Западной Сибири за 2018 год выросла на 4%, до 1,6 млн тонн.

Доля пяти вышеперечисленных проектов в суммарной добыче нефти Группой «ЛУКОЙЛ» без учета проекта Западная Курна-2 составила за 2018 год 15%, что на 3 процентных пункта превышает уровень 2017 года.

Добыча газа, млн куб. м

| 8 905 |

8 512 |

Итого |

33 543 |

28 861 |

| 4 405 |

4 447 |

Россия |

17 804 |

18 176 |

| 4 385 |

4 423 |

Дочерние общества |

17 712 |

18 080 |

| 20 |

24 |

Доля в добыче зависимых обществ |

92 |

96 |

| 4 500 |

4 065 |

За рубежом |

15 739 |

10 685 |

| 4 341 |

3 919 |

Дочерние общества |

15 096 |

9 885 |

Добыча газа Группой «ЛУКОЙЛ» за 2018 год составила 33,5 млрд куб. м, что на 16% больше по сравнению с 2017 годом. В четвертом квартале 2018 года добыча газа составила 8,9 млрд куб. м, что на 5% выше уровня третьего квартала 2018 года.

Основным фактором роста добычи газа стало развитие проектов в Узбекистане. Благодаря запуску новых мощностей по подготовке газа добыча по проектам Кандым и Гиссар за 2018 год выросла до 13,4 млрд куб. м (в доле Группы «ЛУКОЙЛ»), что на 67% больше, чем в 2017 году.

Переработка нефтяного сырья на НПЗ, тыс. тонн

| 17 002 |

17 467 |

Итого НПЗ Группы «ЛУКОЙЛ» |

67 316 |

67 240 |

| 10 927 |

10 939 |

Россия |

43 189 |

43 107 |

| 6 075 |

6 528 |

За рубежом |

24 127 |

24 133 |

| 5 544 |

5 837 |

Переработка нефти |

21 270 |

21 970 |

| 531 |

691 |

Переработка нефтепродуктов |

2 857 |

2 163 |

В 2018 году объем переработки нефтяного сырья на НПЗ Группы «ЛУКОЙЛ» практически не изменился по сравнению с 2017 годом и составил 67,3 млн тонн.

В четвертом квартале 2018 года на НПЗ Группы «ЛУКОЙЛ» было переработано 17,0 млн тонн нефтяного сырья, что на 2,7% меньше, чем в третьем квартале 2018 года. Снижение связано с ремонтными работами на НПЗ ISAB в Италии в четвертом квартале 2018 года.

-----

Раньше:

2018, December, 7, 07:30:00

ЛУКОЙЛ - Президент ПАО «ЛУКОЙЛ» Вагит Алекперов и Председатель Правления АО НК «КазМунайГаз» Алик Айдарбаев подписали соглашения о совместной деятельности и о финансировании по проекту «Женис» в казахстанском секторе Каспийского моря. Документы определяют условия освоения блока.

|

| |

2018, November, 30, 11:00:00

ЛУКОЙЛ - За девять месяцев 2018 года выручка от реализации выросла на 40,2% и составила 5 992,7 млрд руб. Основное положительное влияние на динамику выручки оказали увеличение цен на углеводороды, ослабление рубля, рост объемов трейдинга нефтью, а также увеличение объемов реализации газа.

|

| |

2018, November, 14, 11:40:00

ЛУКОЙЛ - За девять месяцев 2018 года среднесуточная добыча углеводородов Группой «ЛУКОЙЛ» без учета проекта Западная Курна-2 составила 2 301 тыс. барр. н. э./сут, что на 3,7% больше по сравнению с аналогичным периодом 2017 года.

|

| |

2018, October, 22, 12:20:00

МИНЭНЕРГО РОССИИ - «Ярким примером плодотворного сотрудничества наших стран является совместный проект узбекского «Узбекнефтегаза» и российского «ЛУКОЙЛа» по созданию на Кандымской группе месторождений нового современного газоперерабатывающего комплекса, который начал работу в апреле 2018 года», - сказал глава Минэнерго.

|

| |

2018, September, 19, 14:03:00

МИНЭНЕРГО РОССИИ - «Газпром», «ЛУКОЙЛ», «Татнефть», «Интер РАО» и другие компании активно взаимодействуют с турецкими партнерами. Флагманским совместным проектом выступает строительство газопровода «Турецкий поток», - сказал Александр Новак.

|

| |

2018, May, 30, 13:20:00

ЛУКОЙЛ - Чистая прибыль, относящаяся к акционерам ПАО «ЛУКОЙЛ», составила 109,1 млрд руб., что на 75,0% больше по сравнению с первым кварталом 2017 года. Основное влияние на динамику чистой прибыли оказал значительный отрицательный неденежный эффект от курсовых разниц в первом квартале 2017 года. Без учета данного фактора чистая прибыль выросла на 13,5%.

|

| |

2018, May, 14, 10:50:00

ЛУКОЙЛ - ЛУКОЙЛ и Нефтяная компания Басры подписали план разработки месторождения Западная Курна-2, предусматривающий «полку» добычи нефти на уровне 800 тыс. баррелей в сутки. Документ предполагает достижение уровня 480 тыс. баррелей в сутки в 2020 году и 800 тыс. баррелей в сутки в 2025 году.

|

BP PROFIT $9.4 BLN

BP - BP p.l.c. Group results Fourth quarter and full year 2018

- More than double full-year earnings, near double returns

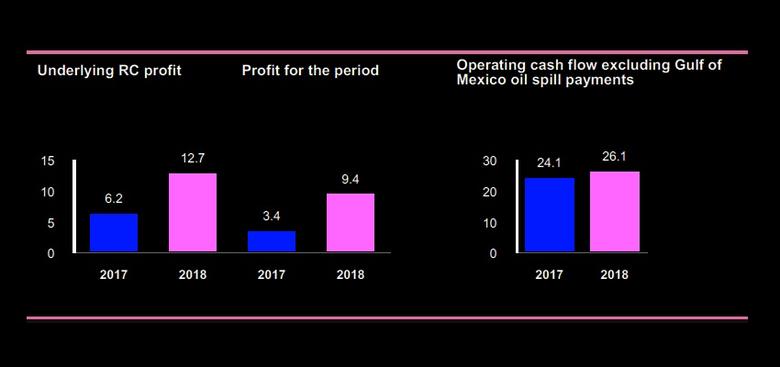

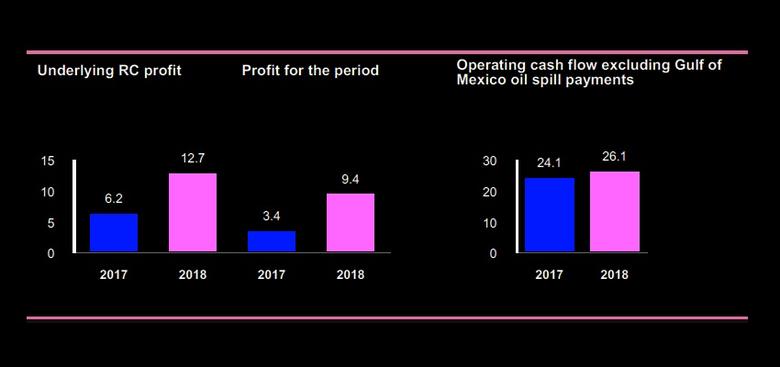

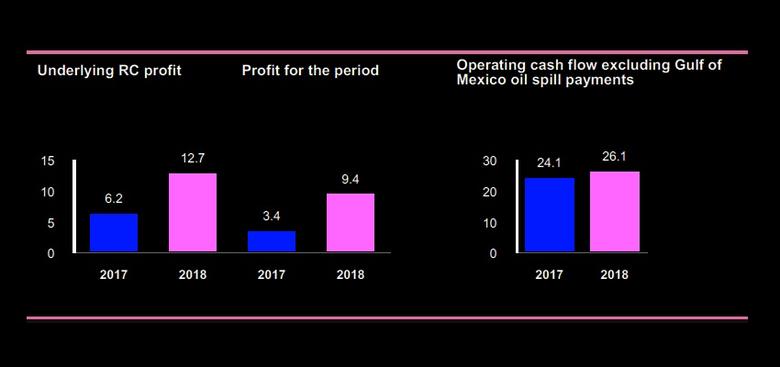

– Underlying replacement cost profit for full year 2018 was $12.7 billion, more than double that reported for 2017. The fourth quarter result was $3.5 billion, driven by the strong operating performance across all business segments.

– Return on average capital employed was 11.2% compared to 5.8% in 2017.

– Operating cash flow, excluding Gulf of Mexico oil spill payments, for full year 2018 was $26.1 billion, including a $2.6 billion working capital build (after adjusting for inventory holding losses). This compares with $24.1 billion for 2017, which included a working capital release of $2.6 billion.

– Gulf of Mexico oil spill payments in 2018 totalled $3.2 billion on a post-tax basis.

– Total divestments and other proceeds in 2018 were $3.5 billion. BP intends to complete more than $10 billion divestments over the next two years, which includes plans announced following the BHP transaction.

– Dividend of 10.25 cents a share announced for the fourth quarter, 2.5% higher than a year earlier.

- Record Upstream reliability, record refining throughput

– Operational reliability was very strong in 2018 for both main business segments.

– For the year, BP-operated Upstream plant reliability was a record 96%, and Downstream delivered refining availability of 95% and record refining throughput.

– Reported oil and gas production averaged 3.7 million barrels of oil equivalent a day for 2018. Upstream underlying production, which excludes Rosneft, was 8.2% higher than 2017.

- Growing the business, advancing the energy transition

– Six Upstream major projects started up in 2018, making a total of 19 brought online since 2016.

– Reserves replacement ratio (RRR) for 2018, including Rosneft, is 100%. Including acquisitions and disposals, RRR is 209%, primarily reflecting the BHP transaction.

– Fuels marketing continued to grow, with over 25% more convenience partnership sites, as well as further retail expansion in Mexico.

– BP set out its approach to advancing the energy transition in 2018, introducing its ‘reduce-improve-create’ framework and setting clear targets for operational greenhouse gas emissions, towards which it is already making significant progress.

– BP acquired UK electric vehicle charging company Chargemaster and Lightsource BP saw important expansion internationally.

Bob Dudley – Group chief executive:

We now have a powerful track record of safe and reliable performance, efficient execution and capital discipline. And we're doing this while growing the business – bringing more high-quality projects online, expanding marketing in the Downstream and doing transformative deals such as BHP. Our strategy is clearly working and will serve the company and our shareholders well through the energy transition.

PDF version

-----

Earlier:

2018, November, 2, 11:45:00

BP - BP has completed the $10.5 billion acquisition of BHP’s U.S. unconventional assets in a landmark deal that will significantly upgrade BP’s U.S. onshore oil and gas portfolio and help drive long-term growth.

|

| |

2018, October, 31, 12:55:00

BP - For the third quarter, underlying RC profit was $3,838 million, compared with $1,865 million in 2017. Underlying RC profit is after adjusting RC profit for a net charge for non-operating items of $649 million and net adverse fair value accounting effects of $98 million (both on a post-tax basis). RC profit was $3,091 million for the third quarter, compared with $1,379 million in 2017.

|

| |

2018, October, 12, 11:25:00

PLATTS - "If sanctions were put on Rosneft or Lukoil or Gazprom, like what happened to Rusal, you would virtually shut down the energy systems of Europe," Dudley said.

|

| |

2018, October, 10, 07:35:00

BP - Libya’s National Oil Corporation, BP and Eni today signed an agreement expected to lead to Eni and BP working together to resume exploration activities on a major exploration and production contract in Libya.

|

| |

2018, August, 1, 09:05:00

BP - BP’s profit for the second quarter and half year was $2,799 million and $5,268 million respectively, compared with $144 million and $1,593 million for the same periods in 2017.

|

| |

2018, July, 27, 12:25:00

BP - “This is a transformational acquisition for our Lower 48 business, a major step in delivering our Upstream strategy and a world-class addition to BP’s distinctive portfolio. Given our confidence in BP’s future – further bolstered by additional earnings and cash flow from this deal – we are increasing the dividend, reflecting our long-standing commitment to growing distributions to shareholders.”

|

| |

2018, July, 11, 08:45:00

BP - BP Ventures, in support of BP Alternative Energy’s strategy in low-carbon power, storage and digital energy, has invested £1.5 million in Voltaware, whose innovative energy monitor offers businesses the ability to track their energy demand in detail, down to individual appliances.

|

Tags:

BP,

FINANCE,

PROFIT