OIL DEMAND GROWTH 1.4 MBD

IEA - Oil Market Report February 2019

Highlights

- Growth in 4Q18 was robust at 1.4 mb/d y-o-y and for 2018 as a whole growth was 1.3 mb/d. China (0.44 mb/d), India (0.21 mb/d) and the US (0.54 mb/d) contributed 1.19 mb/d of the total.

- Growth in demand in 2019 is expected to be 1.4 mb/d. It is supported by lower prices and the start-up of petrochemical projects in China and the US. Slowing economic growth will, however, limit any upside.

- Global supply fell 1.4 mb/d to 99.7 mb/d in January as the Vienna Agreement and Alberta's cuts took effect. Non-OPEC growth estimates have increased to 2.7 mb/d in 2018 and to 1.8 mb/d in 2019. This is mainly due to higher US output.

- OPEC crude output was 930 kb/d lower in January at 30.83 mb/d, a near four-year low. Compliance with the Vienna Agreement was 86%, with Saudi Arabia, UAE and Kuwait cutting by more than promised. Compliance by non-OPEC participants was only 25%.

- In December, global refining throughput fell 0.7 mb/d y-o-y instead of an expected increase due to lower activity in Asia's four largest refiners: China, India, Japan and Korea. 2019 forecast is unchanged, with runs expected to grow by 1.2 mb/d.

- At end-December, OECD oil company stocks were 5.6 mb below the November level at 2 858 mb, up 4.6 mb compared with end-2017. The major stock build in 2H18 was in non-OECD countries. Government stocks drew in 2018 by 22.1 mb, mainly in the US and Europe.

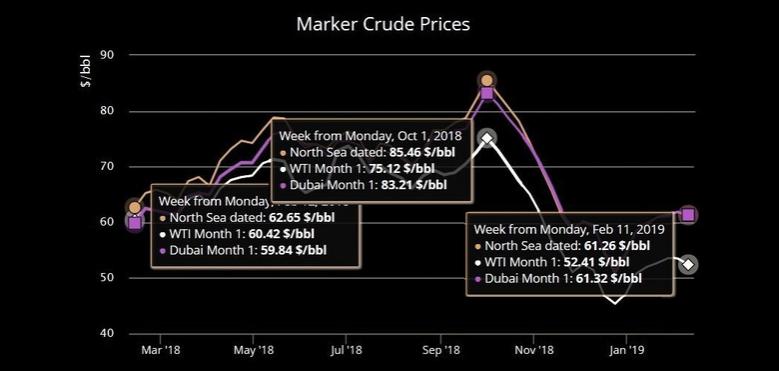

- Brent futures reached a two-month high of $62.75/bbl in early February, with WTI prices around $10/bbl below. The Brent-Dubai EFS narrowed to an eight-year low as sour crude markets tightened. Ample supplies of gasoline saw cracks decline into negative territory.

Quality matters

The imposition of sanctions by the United States against Venezuela's state oil company Petroleos de Venezuela (PDVSA) is another reminder of the huge importance for oil of political events. In 2018, about 450 kb/d was shipped to the US, although this is only a fraction of the 1.7 mb/d exported in 1998 when President Chavez was on the verge of power. Much of the oil is used in PDVSA's US refining system, run by its subsidiary Citgo. The collapse in exports mirrors the collapse of production over the same period from 3.4 mb/d to about 1.3 mb/d today. In addition, Venezuela took a political decision to ship oil to China; initially to diversify export markets as Canada's shipments to the US soared, but more recently as repayment for tens of billions of dollars of loans. Shipments to India too, have grown, reaching 360 kb/d in 2017, but last year they fell by 11%.

What we do know is that the sanctions are already making it difficult for PDVSA to export oil. Even so, headline benchmark crude oil prices have hardly changed on news of the sanctions. This is because, in terms of crude oil quantity, markets may be able to adjust after initial logistical dislocations. Stocks in most markets are currently ample and, with the implementation of the new Vienna Agreement at the start of the year, there is more spare production capacity available.

Crude oil quality is another issue, and, in the wider context of supply in the early part of 2019, it is even more important. Sanctions against Iran, a fall in OPEC supply of 930 kb/d in January, sanctions against PDVSA and Alberta supply cuts all impact directly on the supply of heavy, sour oil. In the case of PDVSA, its oil is typically of the heaviest quality and requires the addition of significant quantities of imported diluents or domestic blending. With the import of diluents now sanctioned by the US, and problems in producing its own lighter crudes, PDVSA will have a tough job to make enough on spec barrels available for export. This is before it gets to the issue of who will buy them.

Long before the US shale revolution took off, Gulf Coast refiners had invested in equipment to process barrels expected to get heavier and sourer. Instead, Venezuelan supplies dwindled, as did Mexico's, and Saudi exports to the US fell sharply as they turned their attention to fast growing Asian markets. Meanwhile, Canadian exports, mainly of heavier, sourer crude, poured into the Gulf to partly fill the gap. In addition, despite the preference of refiners for heavier crudes, huge volumes of cheap shale oil became available because exports were not allowed and stocks built up to record levels. In time, the US export ban was lifted and producers could sell oil abroad at significantly higher prices. Therefore, Gulf Coast importers would continue to need the kind of crude produced by Venezuela and some Middle Eastern countries.

With heavy barrels being removed from the market, refiners have to pay more. The premium of Light Louisiana Sweet crude over Mars crude has fallen to below $1/bbl from more than $4/bbl in November. Since the US sanctions against Venezuela were announced, the premium of Mars over WTI has soared from $4.50/bbl to over $7.50/bbl.

So far, there are no signs that other producers, e.g. Saudi Arabia, are intending to push more barrels into the market to offset shortfalls. Oil prices have not increased alarmingly because the market is still working off the surpluses built up in the second half of 2018, when global supply is estimated to have exceeded demand by 1.3 mb/d. In quantity terms, in 2019 the US alone will grow its crude oil production by more than Venezuela's current output. In qualityterms, it is more complicated. Quality matters.

-----

Earlier:

2019, February, 15, 12:50:05

OIL PRICE: ABOVE $64 YETREUTERS - Brent crude oil briefly reached 2019 highs above $65 per barrel on Friday, as OPEC-led supply cuts and the announcement of a higher-than-expected cut by Saudi Arabia this week encouraged investors. |

2019, February, 15, 12:00:00

OPEC REMAINS HARDPLATTS - "Our primary objective is to ensure that the oil market remains in balance throughout 2019 and beyond in order to build on the success of the past couple of years," added Barkindo. |

2019, February, 15, 11:50:00

BP ENERGY OUTLOOK 2019BP - The 2019 edition of BP’s Energy Outlook, published today, explores the key uncertainties that could impact the shape of global energy markets out to 2040. The greatest uncertainties over this period involve the need for more energy to support continued global economic growth and rising prosperity, together with the need for a more rapid transition to a lower-carbon future. |

2019, February, 13, 12:15:00

OPEC OIL PRODUCTION 30.81 MBDPLATTS - OPEC has painted a bearish picture for 2019, with demand for its crude oil expected to fall due to weak demand growth and a sharp rise in output from producers outside the group. |

2019, February, 8, 12:10:00

OPEC PRODUCTION DOWN 970 TBDPLATTS - OPEC pumped the fewest barrels since March 2015 in January, with crude output plunging to 30.86 million b/d, a fall of 970,000 b/d from December as new supply quotas went into force, according to an S&P Global Platts survey of industry officials, analysts and shipping data. |

2019, February, 4, 10:10:00

RUSSIA'S OIL DOWN TO 11.38 MBDREUTERS - Russian oil output declined to 11.38 million barrels per day (bpd) in January, or by around 35,000 bpd from the October 2018 level, |

2019, February, 1, 11:25:00

U.S. OIL PRODUCTION 11.9 MBDU.S. EIA - U.S. crude oil production rose to a new high of 11.9 million barrels per day in November, up 345,000 bpd from the previous month, |