OIL MARKET IS CALM

PLATTS - Russian energy minister Alexander Novak said Wednesday that he does not currently see a need to take any extra measures or call for an extra meeting by the OPEC/non-OPEC group over the crisis in Venezuela.

"We haven't discussed the situation with [Saudi energy] minister Falih, or other ministers," Novak told reporters. "The markets are currently calm ... and the volatility is insignificant. So there is no need for the extra meeting of OPEC+, at least the Russian side thinks so."

His comments echoed those by Falih. In an interview Monday with Russian news agency RIA Novosti, he said no action was currently required, since the Venezuela situation had so far had no effect on the market.

Novak said the full consequences of the Venezuelan crisis are hard to predict.

"It is hard to speak today about the consequences of those decisions taken by the US regarding Venezuela... I think that today it is impossible to say what the consequences will be for output," he said, reiterating Russia's position that the sanctions are illegal according to international law.

"So we need to monitor the situation and then, as agreed, to evaluate the situation in March," Novak said. "Currently prices are not reacting significantly to the situation in Venezuela."

The OPEC/non-OPEC joint ministerial monitoring committee, which includes both Saudi Arabia and Russia, is due to meet in mid-March to discuss the market situation and the progress of the latest production cut deal.

The US has recognized opposition leader Juan Guaido as interim president, and Monday imposed sanctions against Venezuela's state-owned oil company PDVSA, to divert oil revenues away from President Nicolas Maduro's regime to Guaido's fledgling government.

Russia has not supported Guaido and has said it will defend its extensive business interests in Venezuela, including oil assets and loans.

Novak declined to comment on how these sanctions may affect Russian oil companies.

"I can't comment on all those risks now," he said. "Firstly because there are no [comprehensive] explanations regarding those sanctions introduced by the US against PDVSA. And this is an issue that legal services are to study and make their conclusions before we can comment on this."

Novak said he has not any recent contact with Venezuelan representatives from the oil and gas sector.

Concerns are growing, however, that Russia, including its biggest oil producer Rosneft, could face major losses in the country. It is developing five upstream projects with PDVSA and is owed billions of US dollars under prepayment deals that are scheduled for full repayment by the end of 2019.

-----

Earlier:

2019, January, 21, 11:50:00

OPEC CONFORMITY LEVEL 98%OPEC - The JMMC calls on all participating countries of the ‘Declaration of Cooperation’ to redouble their efforts in the full and timely implementation of the supply adjustments to ensure that the oil market remains in balance in 2019.

|

2019, January, 18, 10:45:00

OPEC PRODUCTION DOWN 751 TBDREUTERS - The Organization of the Petroleum Exporting Countries said in a monthly report that its oil output fell by 751,000 barrels per day (bpd) in December to 31.58 million bpd, the biggest month-on-month drop in almost two years.

|

2019, January, 16, 11:20:00

OIL MARKET BALANCEREUTERS - “If we look beyond the noise of weekly data and speculators’ herd-like behavior, I remain convinced that we’re on the right track, and that the oil market will quickly return to balance,” said Falih, addressing an oil conference in Abu Dhabi.

|

2019, January, 9, 11:15:00

OPEC OIL PRODUCTION DOWN 630 TBDPLATTS - OPEC crude production in December tumbled 630,000 b/d month on month, an S&P Global Platts survey of industry officials, analysts and shipping data showed Tuesday, but the organization still has much more cutting to do to reach its new quotas for 2019.

|

2019, January, 9, 11:10:00

SAUDI'S OIL PRODUCTION DOWN 400 TBDMEOG - Saudi Arabia reportedly cut its crude production by more than 400,000 barrels per day (bpd) in December 2018. Saudi crude production sat at 10.65 million bpd (mbpd) that month, down from 11.07 mbpd in November.

|

2019, January, 4, 11:55:00

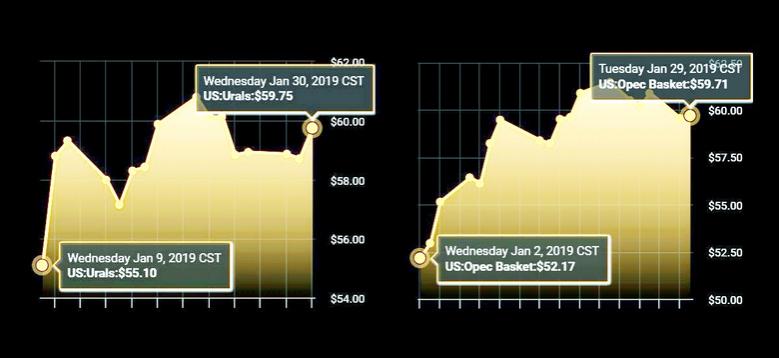

OIL PRICE LEVEL: $60 - 70MEOG - A $60-70 per barrel oil price level appears adequate to incentivise sufficient long-term supply. The cost to develop both tight oil resources and conventional upstream oil projects has declined significantly since the oil price collapse of 2015-16.

|

2018, December, 26, 07:40:00

ОПЕК + РОССИЯ: МИНУС 2.5%МИНЭНЕРГО РОССИИ - Принято консолидированное решение о совместных действиях с коллегами из ОПЕК и не ОПЕК по сокращению добычи на 2,5% для стран ОПЕК и 2% для стран не ОПЕК. |