U.S. FEDERAL FUNDS RATE 2.25-2.5%

U.S. FRB - Federal Reserve issues FOMC statement

Information received since the Federal Open Market Committee met in December indicates that the labor market has continued to strengthen and that economic activity has been rising at a solid rate. Job gains have been strong, on average, in recent months, and the unemployment rate has remained low. Household spending has continued to grow strongly, while growth of business fixed investment has moderated from its rapid pace earlier last year. On a 12-month basis, both overall inflation and inflation for items other than food and energy remain near 2 percent. Although market-based measures of inflation compensation have moved lower in recent months, survey-based measures of longer-term inflation expectations are little changed.

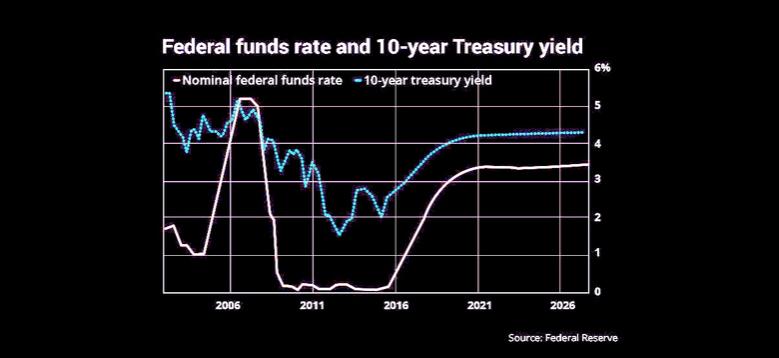

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. In support of these goals, the Committee decided to maintain the target range for the federal funds rate at 2-1/4 to 2-1/2 percent. The Committee continues to view sustained expansion of economic activity, strong labor market conditions, and inflation near the Committee's symmetric 2 percent objective as the most likely outcomes. In light of global economic and financial developments and muted inflation pressures, the Committee will be patient as it determines what future adjustments to the target range for the federal funds rate may be appropriate to support these outcomes.

In determining the timing and size of future adjustments to the target range for the federal funds rate, the Committee will assess realized and expected economic conditions relative to its maximum employment objective and its symmetric 2 percent inflation objective. This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments.

Voting for the FOMC monetary policy action were: Jerome H. Powell, Chairman; John C. Williams, Vice Chairman; Michelle W. Bowman; Lael Brainard; James Bullard; Richard H. Clarida; Charles L. Evans; Esther L. George; Randal K. Quarles; and Eric S. Rosengren.

-----

Earlier:

2019, January, 30, 11:05:00

U.S. GDP UP 3.2%U.S. DT - Over the first three quarters of 2018, the U.S. economy grew at an annualized rate of 3.2 percent, the fastest pace for the first three quarters of a year since 2005. Initial data for the fourth quarter indicate the economy continued to perform well, although slowing global growth and the housing sector could present headwinds. Private forecasters in the Blue Chip Economic Indicators monthly survey now estimate that real GDP growth slowed to 2.7 percent in the fourth quarter, and will slow further to 2.2 percent in the first quarter of 2019.

|

2019, January, 7, 09:10:00

U.S. UNEMPLOYMENT UP TO 3.9%U.S. BLS - Total nonfarm payroll employment increased by 312,000 in December, and the unemployment rate rose to 3.9 percent, the U.S. Bureau of Labor Statistics reported today. Job gains occurred in health care, food services and drinking places, construction, manufacturing, and retail trade.

|

2018, December, 21, 14:15:00

U.S. DEFICIT UP TO $124.8 BLNU.S. BEA - The U.S. current-account deficit increased to $124.8 billion (preliminary) in the third quarter of 2018 from $101.2 billion (revised) in the second quarter of 2018, according to statistics released by the Bureau of Economic Analysis (BEA). The deficit was 2.4 percent of current-dollar gross domestic product (GDP) in the third quarter, up from 2.0 percent in the second quarter.

|

2018, December, 17, 10:05:00

U.S. INDUSTRIAL PRODUCTION UP 0.6%U.S. FRB - U.S. industrial production rose 0.6 percent in November after moving down 0.2 percent in October; the index for October was previously reported to have edged up 0.1 percent. In November, manufacturing production was unchanged, the output of mining increased 1.7 percent, and the index for utilities gained 3.3 percent.

|

2018, December, 10, 08:30:00

U.S. UNEMPLOYMENT: 3.7%U.S. BLS - Total nonfarm payroll employment increased by 155,000 in November, and the unemployment rate remained unchanged at 3.7 percent, the U.S. Bureau of Labor Statistics reported today. Job gains occurred in health care, in manufacturing, and in transportation and warehousing.

|

2018, December, 7, 08:00:00

U.S. DEFICIT $55.5 BLNU.S. BEA - The U.S. Census Bureau and the U.S. Bureau of Economic Analysis announced that the goods and services deficit was $55.5 billion in October, up $0.9 billion from $54.6 billion in September,

|

2018, November, 30, 11:30:00

U.S. GDP UP OF 3.5%U.S. BEA - Real gross domestic product (GDP) increased at an annual rate of 3.5 percent in the third quarter of 2018, according to the "second" estimate released by the Bureau of Economic Analysis. In the second quarter, real GDP increased 4.2 percent. |