U.S. SHALE NEED INVESTMENT

ГАЗПРОМ - Состоялся рабочий визит делегации ПАО «Газпром» во главе с Председателем Правления Алексеем Миллером в Китай.

В рамках визита в Пекине прошла встреча Алексея Миллера и Председателя Совета директоров CNPC Ван Илиня.

Стороны рассмотрели широкий круг вопросов сотрудничества компаний. Основной темой стал ход подготовки к началу поставок газа в Китай по газопроводу «Сила Сибири».

Отдельное внимание на встрече стороны уделили проектам поставок российского газа в Китай с Дальнего Востока и по «западному» маршруту. Отмечено, что по итогам 2018 года Китай впервые стал крупнейшим импортером природного газа в мире. Объем импорта составил 125,7 млрд куб. м, что на 31% (30,3 млрд куб. м) больше, чем в 2017 году. При этом наибольший прирост пришелся на сжиженный природный газ (СПГ), так как у КНР в настоящее время отсутствует возможность полностью удовлетворять растущее потребление газа за счет существующих трубопроводов.

Как отметил по итогам переговоров Алексей Миллер, «строительство газопровода „Сила Сибири" идет с опережением графика, „Газпром" начнет поставки газа в Китай раньше намеченного срока — уже с 1 декабря 2019 года».

Алексей Миллер и Ван Илинь также обсудили ход взаимодействия в области газовой электрогенерации, использования газомоторного топлива, подземного хранения газа, в сфере науки и культуры.

-----

Справка

Государственная нефтегазовая компания CNPC — основной партнер «Газпрома» в Китае.

21 мая 2014 года «Газпром» и CNPC подписали 30-летний Договор купли-продажи российского газа по «восточному» маршруту (по газопроводу «Сила Сибири»). Документ предполагает поставку в КНР 38 млрд куб. м газа в год.

В 2015 году «Газпром» и CNPC заключили Меморандум о взаимопонимании по проекту трубопроводных поставок природного газа в Китай с Дальнего Востока России.

В 2016 году «Газпром» и CNPC подписали Меморандум о взаимопонимании по хранению газа и электрогенерации на территории КНР и Меморандум о проведении исследования возможности сотрудничества в области газомоторного топлива, а также Соглашение о сотрудничестве в области взаимного признания стандартов и результатов оценки соответствия.

В июле 2017 года «Газпром» и CNPC заключили Дополнительное соглашение к Договору купли-продажи природного газа по «восточному» маршруту, заключенному сторонами в 2014 году.

В декабре 2017 года «Газпром» и CNPC подписали Соглашение об основных условиях поставок природного газа с Дальнего Востока России в Китай.

-----

Раньше:

2019, February, 11, 10:35:00

PLATTS - "Imports of Russian crude oil and LNG do not go through any chokepoints such as the Strait of Hormuz. Therefore they are important for the diversification of Japan's energy import sources, and I hope that Russia will play an even larger role. I would like to continue working to expand our cooperation," Seko said.

|

| |

2019, February, 6, 10:15:00

REUTERS - Steel pipe maker Tenaris will team up with Severstal, one of Russia’s largest steel producers, to make steel pipes in the heart of Russia’s oil and gas sector in Siberia, they said on Tuesday.

|

| |

2019, February, 1, 11:00:00

PLATTS - China consumed 280.30 billion cubic meters of natural gas in 2018, up 18.1% year on year, the National Development and Reform Commission said on its website late Thursday. The natural gas consumption growth in 2018 outpaced the growth rate of 15.3% in 2017 and 6.6% in 2016, respectively, according to the NDRC's historical data, implying China's increasing demand for natural gas.

|

| |

2019, January, 16, 10:55:00

REUTERS - China's natural gas demand will reach 308 billion cubic meters (bcm), CNPC said. That marks an 11.4-percent climb from 2018, although the pace of growth would be down from 16.6 percent recorded previously.

|

| |

2019, January, 14, 11:25:00

BLOOMBERG - Russia’s Novatek PJSC is looking at storing liquefied natural gas produced in the Arctic on Japan’s southern island of Kyushu so it can better meet spot demand from China and cut shipping costs.

|

| |

2018, December, 3, 12:30:00

МИНЭНЕРГО РОССИИ - Благодаря усилиям лидеров России и Китая сотрудничество двух стран в сфере энергетики вышло на беспрецедентно высокий уровень и продолжает динамично развиваться по всем направлениям, отметил по итогам встречи Александр Новак.

|

| |

2018, September, 13, 13:55:00

ГАЗПРОМ - во Владивостоке в рамках IV Восточного экономического форума состоялась рабочая встреча Председателя Правления ПАО «Газпром» Алексея Миллера и Председателя Совета директоров CNPC Ван Илиня.

|

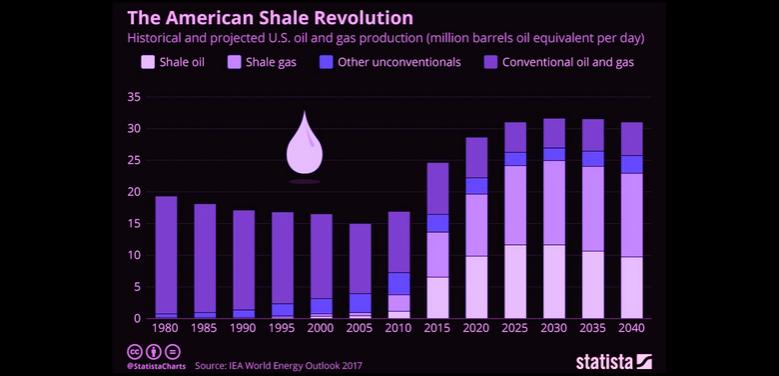

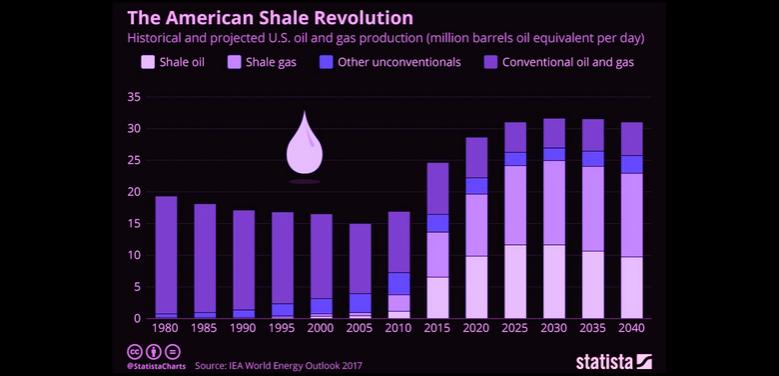

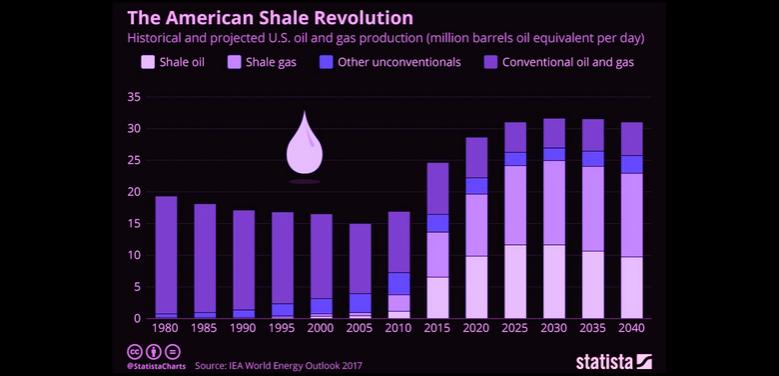

U.S. SHALE NEED INVESTMENT

REUTERS - Drilling curbs by oil producers in the largest U.S. shale field will continue until transport bottlenecks ease and investors stop punishing companies for increasing capital spending, executives at an energy conference said on Thursday.

The price of crude in the Permian Basin of West Texas and New Mexico fell sharply last year, selling as much as $18 below U.S. benchmark prices, as a lack of pipeline capacity landlocked some oil output and as investors pushed producers to reduce spending and boost shareholder returns.

On Thursday, the regional price of crude was at a $1.10 a barrel premium to U.S. crude futures, the strongest in more than a year as companies including Parsley Energy, Pioneer Natural Resources, Goodrich Petroleum Corp have pared their exploration budgets, easing the constraints.

Pioneer Natural Resources Co, one of the Permian's largest producers, said this week it plans to reduce 2019 capital expenditures by 11 percent, or about $350 million, slowing its production growth from prior years.

"There aren't nearly as many drilling dollars available," said Bobby Whiteside, president of Midland, Texas-based oil producer Regions Permian LLC. "If Wall Street wants you to drill within cash flow, you're going to have slower growth."

The Permian is the nation's largest and fastest growing oil field. Its output has driven U.S. crude production to near 12 million barrels per day (bpd), forcing OPEC and allies to cut their output.

-----

Earlier:

2019, February, 15, 12:00:00

PLATTS - "Our primary objective is to ensure that the oil market remains in balance throughout 2019 and beyond in order to build on the success of the past couple of years," added Barkindo.

|

| |

2019, February, 1, 11:25:00

U.S. EIA - U.S. crude oil production rose to a new high of 11.9 million barrels per day in November, up 345,000 bpd from the previous month,

|

| |

2019, January, 28, 10:15:00

API - U.S. production of crude oil (11.7 mb/d) and natural gas liquids (NGLs) (4.8 mb/d); Crude oil exports (2.4 mb/d, tie with Nov. 2018);

|

| |

2019, January, 23, 11:20:00

U.S. EIA - Crude oil production from the major US onshore regions is forecast to increase 62,000 b/d month-over-month in February from 8,117 to 8,179 thousand barrels/day , gas production to increase 849 million cubic feet/day from 76,708 to 77,557 million cubic feet/day .

|

| |

2018, December, 24, 11:55:00

PLATTS - Three aggressive independent Permian Basin upstream operators released capital budgets for 2019 in the last few days that are lower than either prior expectations or actual 2018 spending by at least 12% to 15%, as corporate executives attributed reduced activity to the recent plunge in oil prices.

|

| |

2018, December, 21, 14:25:00

API - The U.S. produced a record 11.6 million barrels of oil per day (mb/d) and a record 4.8 mb/d of NGLs in November. Crude exports also hit a record high at 2.4 million barrels per day last month, and U.S. petroleum net imports fell at their lowest monthly level in more than 50 years at 2.2 million barrels per day.

|

| |

2018, December, 21, 14:20:00

U.S. EIA - Crude oil production from the major US onshore regions is forecast to increase 134,000 b/d month-over-month in January from 8,032 to 8,166 thousand barrels/day , gas production to increase 1,127 million cubic feet/day from 75,789 to 76,916 million cubic feet/day .

|

Tags:

USA,

SHALE,

OIL,

PRODUCTION,

INVESTMENT