U.S. SHALE OIL WEAKNESS

REUTERS - Weak returns at U.S. shale producers could cost more executives their jobs and lead to increasing battles with activist investors, analysts said following changes at two producers.

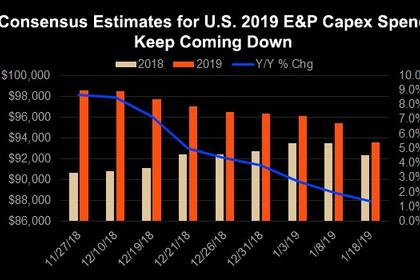

After years of outspending cash flow to expand oil and natural gas production, executives are under pressure to pull back on spending and deliver higher returns. Investors have sold shares in companies that increased their drilling budgets, and some have avoided the sector altogether.

Pioneer Natural Resources Co Chief Executive Tim Dove retired on Thursday after a two-year stint in the job, with founder and former CEO Scott Sheffield returning to the top role.

Halcon Resources Corp CEO Floyd Wilson and two other executives - finance chief Mark Mize and Steve Herod, executive vice president of corporate development - resigned the same day. The company said it began the search for a new CEO.

"It's a what-have-you-done-for-me-lately scenario," said Jason Wangler, analyst with Imperial Capital in Houston. "Not only are investors holding people accountable, they're watching every move." He expects management and board changes at other companies this year.

Activist investor Fir Tree Partners this month called for Halcon to appoint independent board directors, cut costs and sell itself. Fir Tree in a statement on Friday called the management changes "important first steps."

On Friday, Kimmeridge Energy Management Co announced an activist stake in PDC Energy Inc and urged the producer to cut expenses and pay a dividend. PDC in response said it was focused on capital discipline.

Such battles are likely to "be pretty steady in 2019," said Leo Mariani, an analyst at KeyBanc Capital Markets Inc. "The common complaint from activist investors is that a lot of these companies have relatively poor returns on capital and outspend cash flow."

While producers have pledged to pare spending, investors want proof. "There's a difference between saying and actually doing," said Morningstar Inc analyst Dave Meats.

Pioneer, one of the largest U.S. shale producers, last week released financial results that fell short of Wall Street expectations due to hedging-related costs.

Halcon was hard hit by the 2014 oil price drop and emerged from bankruptcy restructuring in 2016. The stock market values its land at less than $5,000 an acre, compared with peers whose land is valued above $20,000 an acre, Fir Tree said in a Feb. 4 letter.

Analysts expect the firm to report a loss of 8 cents per share when it releases quarterly results on Tuesday, according to Refinitiv data.

"They laid out a pretty aggressive growth strategy," Wangler said. "The market obviously has not been conducive to those types of stories, outspending cash to try to grow production."

-----

Earlier: