U.S., VENEZUELA SANCTIONS

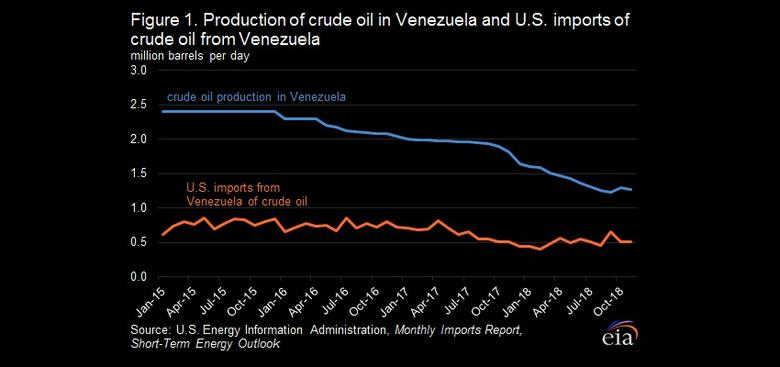

U.S. EIA - U.S. imports of Venezuelan crude oil have decreased in recent years as production in Venezuela declined (Figure 1). Recently announced U.S. sanctions directed at Venezuela's energy sector and state oil company, Petróleos de Venezuela, S.A. (PDVSA), will essentially eliminate U.S. imports of Venezuelan crude oil as the full effects of the sanctions emerge. However, the U.S. Energy Information Administration (EIA) does not anticipate any significant decrease in U.S. refinery runs as a result of these sanctions. U.S. imports of Venezuelan crude oil have been falling for several years and refineries have been replacing Venezuelan crude oil with other heavy crude oils. Moving forward, refineries may also choose to run lighter crude oils because transportation constraints may limit the availability of heavy crude oils. Refiners with significant asphalt and road oils processing unit capacity, for which Venezuelan crude oil is well suited, may have a harder time finding adequate replacements; however, these refineries have also limited imports from Venezuela recently.

On January 23, 2019, the United States officially recognized the President of the Venezuelan National Assembly, Juan Guaido, as the Interim President of Venezuela. On January 25, 2019, the White house issued Executive Order 13857, Taking Additional Steps to Address the National Emergency with Respect to Venezuela, which expanded U.S. sanctions by including PDVSA in sanctions against the Maduro regime. Although there is a wind-down period for purchasing petroleum and petroleum products, payments must be placed into an escrow account that is not accessible by PDVSA. EIA expects this action to have an immediate impact, essentially eliminating U.S. imports from Venezuela as the full effects of the sanctions are felt. The sanctions apply not only to U.S. persons, but also to any transaction involving the U.S. financial system. The Office of Foreign Assets Control at the U.S. Treasury Department indicates that sanctions may be lifted after control of PDVSA is transferred to Interim President Juan Guaido or a subsequent democratically elected government.

The sanctions also prohibit the United States from exporting petroleum products to Venezuela. This prohibition includes diluent, which PDVSA uses to mix with its much heavier crude oils. If PDVSA cannot find another source for diluent in a relatively short period of time, Venezuela's crude oil production is likely to decline.

In the first 11 months of 2018, U.S. Gulf Coast refineries ran crude oil with an average sulfur content of 1.4% and an average API gravity of 32.6 degrees. The average API gravity was 30.0 degrees in 2013 and this change reflects the trend of Gulf Coast refineries running lighter crude oil slates. The lightening of the crude slate is likely the result of increased refinery capacity and availability of lighter crude oils and is not indicative of a decrease in demand for heavy crude oil, which Gulf Coast refineries are generally optimized to run.

U.S. imports of crude oil with an API gravity of 30.0 degrees or lower (heavier) have increased, while U.S. imports of crude oils with an API gravity greater than 30.0 degrees (lighter) have decreased (Figure 2). Through the first 11 months in 2018, Gulf Coast imports had an average API gravity of 23.2 degrees, compared with the API gravity of 25.5 degrees in 2013, indicating that imports have been getting heavier. This trend likely reflects refiners' efforts to continue to run heavy crude oils while U.S. production of lighter crude oils is increasing.

Imports from Canada, Mexico, Saudi Arabia, and Venezuela accounted for more than 70% of Gulf Coast crude oil imports for the first 11 months of 2018 (the most recent months for which data are available). Imports from Venezuela had a weighted average API gravity of 17.1 degrees, while imports from Canada and Mexico were slightly higher (indicating lighter crude oils) at 21.6 and 20.3, respectively. Imports from Saudi Arabia averaged nearly 32.0, but this average likely reflects imports of both heavy and lighter crude oils.

Although still a significant share of Gulf Coast imports, imports from Venezuela have been declining in recent years amid political turmoil and declining Venezuelan production. Gulf Coast imports of Venezuelan crude oil fell from an average of 618,000 barrels per day (b/d) in the first 11 months of 2017 to 498,000 b/d over the same period in 2018.

Of the 14 U.S. refineries that imported crude oil from Venezuela in 2018 (12 of which are in the Gulf Coast), imports through November fell by 129,000 b/d compared with the same period in 2017 (Figure 3). Although imports from Venezuela declined, imports from Canada and Mexico to these refineries increased by 113,000 b/d and 48,000 b/d, respectively, from 2017 levels.

Of the 14 U.S. refineries that imported Venezuelan crude oil in the first 11 months of 2018, 5 are either subsidiaries of PDVSA or former joint venture partnerships. Through its ownership of Citgo Petroleum Corp., PDVSA currently has three refineries in the United States: in Lake Charles, Louisiana; Corpus Christi, Texas; and Lemont, Illinois. Citgo Lake Charles and Citgo Corpus Christi are responsible for a significant share of U.S. crude oil imports from Venezuela, while Citgo Lemont sources its heavy crude oil imports primarily from Canada rather than Venezuela.

The physical properties of Venezuelan crude oil make it especially well-suited to be processed into asphalt and road oils, and the sanctions are most likely to have an effect on refineries with significant capacity in this area. Five of the U.S. refineries that imported Venezuelan crude oil in the first 11 months of 2018 have significant asphalt and road oils processing unit capacity. Two of these refineries are in the top five largest refineries with asphalt and road oils processing units in the United States –Valero Corpus Christi and Marathon Garyville– and each continued to import Venezuelan crude oil in 2018, albeit at reduced volumes. As each refinery's imports from Venezuela declined, imports from Iraq, Canada, and Mexico increased.

U.S. average regular gasoline price decreases, diesel price increases slightly

The U.S. average regular gasoline retail price fell less than 1 cent from the previous week to $2.25 per gallon on February 4, down 38 cents from the same time last year. Rocky Mountain prices decreased nearly 6 cents to $2.18 per gallon, Gulf Coast prices fell nearly 3 cents to $1.93 per gallon, West Coast prices decreased nearly 2 cents to $2.91 per gallon, and East Coast prices fell less than a cent to $2.24 per gallon.

The U.S. average diesel fuel price rose slightly, remaining virtually unchanged at $2.97 per gallon on February 4, 12 cents lower than a year ago. Midwest prices rose more than 3 cents to $2.84 per gallon. Rocky Mountain prices fell nearly 3 cents to $2.88 per gallon, West Coast and East Coast prices each decreased more than 1 cent to $3.44 per gallon and $3.04 per gallon respectively, and Gulf Coast prices fell 1 cent to $2.78 per gallon.

Propane/propylene inventories decline

U.S. propane/propylene stocks decreased by 2.6 million barrels last week to 57.5 million barrels as of February 1, 2019, 1.3 million barrels (2.4%) greater than the five-year (2014-2018) average inventory levels for this same time of year. Midwest and Gulf Coast inventories decreased by 1.1 million barrels and 1.0 million barrels, respectively, and East Coast and Rocky Mountain/West Coast inventories each decreased by 0.3 million barrels. Propylene non-fuel-use inventories represented 10.0% of total propane/propylene inventories.

Residential heating fuel prices increase

As of February 4, 2019, residential heating oil prices averaged $3.18 per gallon, 1 cent per gallon higher than last week's price but almost 2 cents per gallon lower than last year's price at this time. Wholesale heating oil prices averaged $2.03 per gallon, nearly 3 cents per gallon more than last week but almost 16 cents per gallon below last year's price.

Residential propane prices averaged $2.43 per gallon, less than 1 cent per gallon higher than last week but nearly 16 cents per gallon lower than a year ago. Wholesale propane prices averaged nearly $0.83 per gallon, 2 cents per gallon higher than last week but almost 32 cents per gallon lower than a year ago.

-----

Earlier:

2019, February, 1, 11:30:00

U.S. LOOSE VENEZUELA'S OIL 500 TBDPLATTS- US refiners cannot rely on Mexico to replace Venezuelan heavy oil imports as the country is battling to reverse its declining production and Pemex's oil is sold under contractual basis, analysts and others say. |

2019, January, 30, 11:35:00

WEAK VENEZUELA SANCTIONSOGJ - “The sanctions will affect refinery margins in the US. Now they will have to import heavy crude from the Middle East at a premium. US refiners will be amongst the biggest losers, as we have noted earlier,” Rodriguez-Masiu said. |

2019, January, 30, 11:30:00

U.S., VENEZUELA SANCTIONS ALWAYSPLATTS - The Trump administration announced Monday that it will sanction PDVSA, Venezuela's state-owned oil company, a move that could suspend roughly 500,000 b/d of Venezuelan crude exports to US Gulf Coast refineries and shut down US exports of diluents to the South American nation. |

2019, January, 25, 08:20:00

U.S. - VENEZUELA SANCTIONSPLATTS - Chevron, PBF Energy, Valero and Citgo, which is owned by PDVSA, are the largest US refiners of Venezuelan crude, according to the US Energy Information Administration. Spokesmen for those four companies did not respond to requests for comment Wednesday. |

2019, January, 9, 10:45:00

VENEZUELA'S OIL PRODUCTION: BELOW 1 MBDPLATTS - The US Energy Information Administration forecasts that Venezuelan oil production will fall below 1 million b/d in the second half of 2019, according to Erik Kreil, an international energy analysis team leader with the EIA. |

2018, September, 17, 15:00:00

VENEZUELA - CHINA COOPERATIONREUTERS - Venezuela gave China another stake in the OPEC nation’s oil industry and signed several other deals in the energy sector, but Beijing made no mention of new funds for Caracas during President Nicolas Maduro’s visit to his key financier on Friday. |

2018, July, 25, 09:15:00

VENEZUELA'S ECONOMIC COLLAPSEIMF - On Venezuela, it is difficult to discuss because it is in a state of economic collapse. We have not engaged with them in over a decade on their economic policies. |