UAE GDP UP 3.7%

IMF - IMF Executive Board Concludes 2018 Article IV Consultation with the United Arab Emirates

On November 26, 2018, the Executive Board of the International Monetary Fund (IMF) concluded the Article IV consultation with the United Arab Emirates.

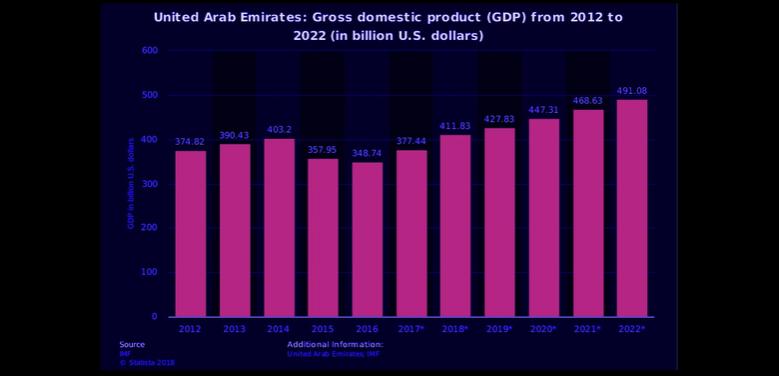

The economy is starting to recover from the 2015–16 slowdown caused by a decline in oil prices. Growth momentum is expected to strengthen in the next few years with increased investment and private sector credit, improved prospects in trading partners, and a boost to tourism from Expo 2020. Non-oil growth is projected to rise to 3.9 percent in 2019 and 4.2 percent in 2020. The oil sector's prospects have also improved with higher oil prices and output. Overall real GDP growth is projected at around 3.7 percent for 2019–20. Inflation is expected to remain low, notwithstanding the introduction of the value-added tax (VAT) earlier in 2018. Although nonperforming loans rose during the slowdown, banks remain liquid and well capitalized.

Fiscal easing is underway to facilitate the recovery. In tandem with stepped-up structural reforms to boost medium-term prospects, the authorities announced plans for a fiscal stimulus over the next three years, augmenting the planned increase in investment ahead of Expo 2020. As private sector activity picks up and stimulus measures are phased out, fiscal consolidation is expected to resume, to ensure sufficient saving of oil wealth for future generations. The overall fiscal balance is projected to turn to a surplus next year on higher oil prices and remain positive over the medium term.

The external position has also improved. The current account surplus nearly doubled last year to 6.9 percent of GDP as imports remained flat and is expected to rise further to nearly 8 percent of GDP by 2019 owing to higher oil revenues. Over the medium term, however, the current account surplus is projected settle at a lower level as oil prices soften. Downside external risks have increased in recent months, driven by tightening global financial conditions, heightened volatility in emerging markets, geopolitical tensions, and rising protectionism.

Executive Board Assessment

Executive Directors noted of the challenges the UAE economy has been facing, particularly a prolonged decline in oil prices, and commended the authorities for their strong policy response, including the introduction of the value-added tax, stepped up structural reforms, and the upgrading of the prudential framework. While noting the improved economic prospects, Directors stressed that the external downside risks to the outlook have risen and encouraged the authorities to continue their efforts to bolster economic growth and safeguard macro-financial stability. In this context, Directors stressed the importance of increasing supervisory vigilance and strengthening management of contingent liabilities from borrowing by government-related enterprises, government guarantees, and public-private partnerships.

Directors agreed that the main fiscal policy priority is to support economic growth in the short term and resume fiscal consolidation once the recovery takes hold, to ensure sufficient savings of exhaustible oil revenue for future generations and debt sustainability. Directors welcomed the authorities' efforts to strengthen their fiscal policy frameworks and coordination, noting the importance of continuing progress in this area to realize the authorities' socio-economic Vision 2021 agenda, avoid policy procyclicality, and improve risk management.

Directors agreed that creating a vibrant, diversified, and knowledge-based economy will require continued reforms to boost the role of the private sector and promote talent and inclusiveness. They welcomed the recently announced reforms, including the liberalization of foreign investment, and encouraged the authorities to swiftly implement them, while broadening and deepening policy initiatives to improve productivity and competitiveness.

Directors commended the authorities on their implementation of the Enhanced General Data Dissemination Systems and other steps to improve economic statistics. They emphasized the need for further progress, including improving labor, fiscal, national accounts, and international investment position statistics, to facilitate decision-making and enhance transparency.

United Arab Emirates: Selected Macroeconomic Indicators, 2015–19

|

(Quota: SDR 2,311.2 million million as of June 2018) |

|||||||||||||||||||||||||||||||||

|

(Population: 10.1 million, nationals: 1 million) |

|||||||||||||||||||||||||||||||||

|

(Per capita GDP-2017: $37,879; poverty rate: n.a.; unemployment rate: 4.2% (2009)) |

|||||||||||||||||||||||||||||||||

|

Est. |

Proj. |

Proj. |

|||||||||||||||||||||||||||||||

|

2015 |

2016 |

2017 |

2018 |

2019 |

|||||||||||||||||||||||||||||

|

Oil sector |

|||||||||||||||||||||||||||||||||

|

Exports of oil (incl. oil products and gas) (in billions of U.S. dollars) |

61.5 |

46.5 |

58.1 |

75.4 |

84.9 |

||||||||||||||||||||||||||||

|

Average crude oil export price (in U.S. dollar per barrel) |

52.4 |

44.0 |

54.4 |

71.9 |

72.3 |

||||||||||||||||||||||||||||

|

Crude oil production (in millions of barrels per day) |

2.9 |

3.0 |

2.9 |

3.0 |

3.1 |

||||||||||||||||||||||||||||

|

(Annual percent change, unless otherwise indicated) |

|||||||||||||||||||||||||||||||||

|

Output and prices |

|||||||||||||||||||||||||||||||||

|

Nominal GDP (in billions of UAE dirhams) |

1,315 |

1,311 |

1,405 |

1,589 |

1,673 |

||||||||||||||||||||||||||||

|

Nominal GDP (in billions of U.S. dollars) |

358 |

357 |

383 |

433 |

456 |

||||||||||||||||||||||||||||

|

Real GDP |

5.1 |

3.0 |

0.8 |

2.9 |

3.7 |

||||||||||||||||||||||||||||

|

Real oil GDP |

5.2 |

2.6 |

-3.0 |

2.9 |

3.1 |

||||||||||||||||||||||||||||

|

Real nonoil GDP |

5.0 |

3.2 |

2.5 |

2.9 |

3.9 |

||||||||||||||||||||||||||||

|

CPI inflation (average) |

4.1 |

1.6 |

2.0 |

3.5 |

1.9 |

||||||||||||||||||||||||||||

|

(Percent of GDP, unless otherwise indicated) |

|||||||||||||||||||||||||||||||||

|

Investment and saving |

|||||||||||||||||||||||||||||||||

|

Gross domestic investment |

25.8 |

27.1 |

21.6 |

22.5 |

23.1 |

||||||||||||||||||||||||||||

|

Total fixed capital formation |

23.4 |

24.5 |

19.1 |

20.3 |

21.0 |

||||||||||||||||||||||||||||

|

Public |

11.1 |

11.4 |

8.2 |

8.5 |

8.7 |

||||||||||||||||||||||||||||

|

Private |

12.3 |

13.0 |

10.9 |

11.8 |

12.3 |

||||||||||||||||||||||||||||

|

Gross national saving |

30.7 |

30.8 |

28.5 |

29.6 |

31.0 |

||||||||||||||||||||||||||||

|

Public |

3.0 |

2.2 |

2.9 |

3.1 |

6.8 |

||||||||||||||||||||||||||||

|

Private |

27.6 |

28.7 |

25.6 |

26.5 |

24.2 |

||||||||||||||||||||||||||||

|

Public finances |

|||||||||||||||||||||||||||||||||

|

Revenue |

29.0 |

28.9 |

28.8 |

28.2 |

31.6 |

||||||||||||||||||||||||||||

|

Taxes |

12.5 |

8.9 |

11.9 |

13.3 |

16.8 |

||||||||||||||||||||||||||||

|

Other revenue 1/ |

16.2 |

19.6 |

16.6 |

14.6 |

14.5 |

||||||||||||||||||||||||||||

|

Expenditures |

32.4 |

30.9 |

30.4 |

29.9 |

29.8 |

||||||||||||||||||||||||||||

|

Expense 2/ |

29.7 |

27.9 |

27.8 |

27.1 |

26.7 |

||||||||||||||||||||||||||||

|

Net acquisition of nonfinancial assets |

2.7 |

3.0 |

2.6 |

2.7 |

3.1 |

||||||||||||||||||||||||||||

|

Net lending(+)/borrowing(-) (Revenue minus expenditures) |

-3.4 |

-2.0 |

-1.6 |

-1.6 |

1.8 |

||||||||||||||||||||||||||||

|

Adjusted nonoil primary balance 3/ |

-27.7 |

-21.9 |

-25.7 |

-30.0 |

-27.0 |

||||||||||||||||||||||||||||

|

Gross general government debt |

16.7 |

19.4 |

21.8 |

20.9 |

20.5 |

||||||||||||||||||||||||||||

|

Net of government deposits in the banking system |

3.7 |

4.6 |

6.8 |

5.1 |

3.4 |

||||||||||||||||||||||||||||

|

(Annual percent change) |

|||||||||||||||||||||||||||||||||

|

Monetary sector |

|||||||||||||||||||||||||||||||||

|

Net foreign assets |

-12.8 |

5.0 |

26.8 |

32.3 |

18.5 |

||||||||||||||||||||||||||||

|

Net domestic assets |

11.7 |

2.7 |

-1.8 |

-6.3 |

1.5 |

||||||||||||||||||||||||||||

|

Credit to private sector |

8.4 |

5.8 |

0.7 |

5.4 |

4.6 |

||||||||||||||||||||||||||||

|

Broad money |

5.5 |

3.3 |

4.1 |

3.6 |

7.1 |

||||||||||||||||||||||||||||

|

(Billions of U.S. dollars, unless otherwise indicated) |

|||||||||||||||||||||||||||||||||

|

External sector |

|||||||||||||||||||||||||||||||||

|

Exports and re-exports of goods, of which: |

300 |

295 |

309 |

329 |

343 |

||||||||||||||||||||||||||||

|

Oil |

61 |

46 |

58 |

75 |

85 |

||||||||||||||||||||||||||||

|

Nonoil, excluding re-exports |

104 |

103 |

104 |

105 |

106 |

||||||||||||||||||||||||||||

|

Imports of goods |

224 |

227 |

229 |

240 |

246 |

||||||||||||||||||||||||||||

|

Current account balance |

17.6 |

13.2 |

26.5 |

30.5 |

35.9 |

||||||||||||||||||||||||||||

|

Current account balance (in percent of GDP) |

4.9 |

3.7 |

6.9 |

7.1 |

7.9 |

||||||||||||||||||||||||||||

|

External debt (in percent of GDP) |

67.6 |

70.8 |

73.5 |

66.9 |

64.2 |

||||||||||||||||||||||||||||

|

Gross official reserves 4/ |

94.0 |

85.4 |

95.4 |

111.2 |

129.5 |

||||||||||||||||||||||||||||

|

In months of next year's imports of goods & services, |

6.7 |

6.0 |

6.0 |

6.8 |

7.6 |

||||||||||||||||||||||||||||

|

Memorandum items: |

|||||||||||||||||||||||||||||||||

|

Local currency per U.S. dollar (period average) |

3.67 |

3.67 |

3.67 |

.. |

.. |

||||||||||||||||||||||||||||

|

Nominal effective exchange rate (2010 = 100) |

122.1 |

125.2 |

125.7 |

.. |

.. |

||||||||||||||||||||||||||||

|

Real effective exchange rate (2010 = 100) |

108.9 |

111.1 |

110.9 |

.. |

.. |

||||||||||||||||||||||||||||

|

Sources: Country authorities; and IMF staff estimates and projections. |

|||||||||||||||||||||||||||||||||

|

1/ Includes staff estimates of profit transfers from the national oil company to SWF and SWF returns (investment income). 2/ Includes loans and equity to finance development projects. 3/ In percent of nonoil GDP. Excludes staff estimates of SWF investment income. 4/ Excludes staff estimates of foreign assets of sovereign wealth funds.

|

|||||||||||||||||||||||||||||||||

-----

Earlier:

2019, January, 28, 09:50:00

ENI, OMV, ADNOC: $5.8 BLNREUTERS - Italy’s Eni and Austria’s OMV have agreed to pay a combined $5.8 billion to take a stake in Abu Dhabi National Oil Company’s (ADNOC) refining business and establish a new trading operation owned by the three partners.

|

2019, January, 23, 10:40:00

SAUDI ARABIA, UAE CRYPTOCURRENCYAN - Saudi Arabia and the UAE have launched a joint cryptocurrency during the first meeting of the Saudi-Emirati Coordination council Saturday in Abu Dhabi, UAE’s national press agency WAM said.

|

2019, January, 21, 11:15:00

EMIRATES RENEWABLE INVESTMENT AED4.4 BLNENA - Mohammed Saif Al Suwaidi, Director-General of ADFD, said, "The Abu Dhabi Fund for Development believes in the vital role the renewable energy sector plays in attaining the sustainable development goals in developing countries. This important sector stimulates economic growth, creates employment opportunities, drives innovation, supports the advancement of other key sectors, and optimises the use of natural resources – all crucial factors in improving people’s lives." |

2018, December, 24, 11:30:00

UAE HELP PAKISTAN $3 BLNAN - The United Arab Emirates plans to deposit $3 billion in Pakistan's central bank "in the next few days", the UAE state news agency WAM reported on Friday, while a Pakistani official said Islamabad also hopes it will allow deferred payments for oil supplies.

|

2018, December, 24, 11:25:00

OMV, ADNOC CONCESSION: 5%ADNOC - The Abu Dhabi government and the Abu Dhabi National Oil Company (ADNOC) have awarded Austria's OMV a 5 percent stake in the Ghasha ultra-sour gas concession that comprises the Hail, Ghasha, Dalma, Nasr, Sarb and Mubarraz sour gas fields.

|

2018, December, 14, 09:05:00

UAE OIL INVESTMENTPLATTS - "The UAE is investing because we feel there is a requirement for this production, but we are not going to put that production into the market unless we feel there is a need for it," Mazrouei said after last week's OPEC meeting in Vienna.

|

2018, December, 10, 08:15:00

ADNOC INCREASES VALUEADNOC - The Abu Dhabi National Oil Company (ADNOC) has announced its successful collaboration with IBM, piloting a Blockchain-based automated system to integrate oil and gas production across the full value chain. |