ARMENIA'S GDP UP 4-5%

IMF - IMF Staff Completes 2019 Article IV Mission and Reaches a Staff-Level Agreement with Armenia on a Precautionary Stand-By Arrangement

- The Armenian authorities and IMF staff reached staff-level agreement on a 3-year precautionary SBA. The agreement is subject to approval by the IMF Executive Board and is expected to be considered in May 2019.

- The proposed arrangement will support the authorities’ comprehensive economic program to achieve stronger and more inclusive growth, while preserving fiscal sustainability and reducing external vulnerabilities.

- The authorities’ structural reform agenda appropriately focuses on improving the business environment, developing human capital and infrastructure, fighting corruption, and enhancing governance.

At the request of the Armenian authorities, a staff team from the International Monetary Fund, led by Mr. Hossein Samiei, visited Yerevan during February 12-26 to discuss a three-year economic program supported by an IMF precautionary Stand-By Arrangement and to conduct the 2019 Article IV consultation. At the conclusion of the mission, Mr. Samiei issued the following statement:

“I am pleased to announce that the IMF team and the Armenian authorities have reached staff-level agreement on a precautionary Stand-By Arrangement for the amount of $250 million to support the new government’s reform plans and strengthen resilience against external shocks. These plans aim at maintaining strong policies to preserve macroeconomic and financial stability and advancing reforms to promote inclusive growth. The agreement is subject to approval by the IMF Executive Board, which is expected to consider it in May 2019.

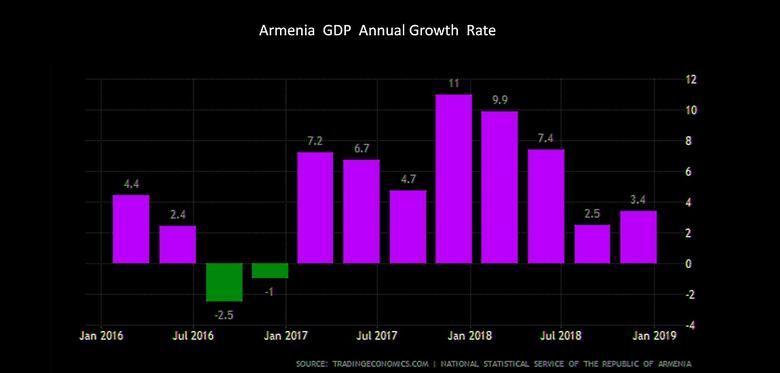

“Guided by sound macroeconomic policies, Armenia’s economic performance has been robust. Growth moderated somewhat to more sustainable levels in 2018, reflecting in part a slowdown in trading partners. Fiscal consolidation remained on track, supported by strong tax administration effort, and public debt as a percentage of GDP declined. Monetary and financial conditions remain stable, with CPI inflation below 1 percent in January 2019 and limited pressure on the exchange rate. The banking sector is well-capitalized and credit growth has been supporting economic activity. On the structural front, pension reform came into effect in July 2018; the upgraded fiscal rule has been operationalized; and a draft public-private partnership (PPP) law is being prepared.

“Looking ahead, growth is expected to moderate to about 4½ percent in 2019, reflecting a weaker global environment and copper prices, and remain in the 4-5 percent range over the medium term. CPI inflation is projected to gradually converge to the CBA’s target of 4 percent over the next two years, as one-off factors wane. The current account deficit is expected to gradually narrow to around 5 percent of GDP. The risks to the outlook are mainly external.

“On the policy front, fiscal efforts should continue to aim at preserving debt sustainability while maintaining space for investment and social spending. In this regard, staff welcomes the authorities’ commitment, guided by the revamped fiscal rule, to bring central government debt below 50 percent of GDP within five years. The fiscal deficit is projected at around 2½ percent of GDP in 2019 and 2 percent of GDP in the medium term.

“The fiscal objectives will be supported by tax and spending reforms. The authorities are considering a tax reform package to promote compliance and medium-term growth. This reform will entail revenue losses in the near term as the anticipated expansion in compliance is likely to materialize only over time. Therefore, it is crucial to implement the envisaged package of tax policy measures to fully offset these losses, while being mindful of the reform’s possible impact on equity. In this regard, staff particularly welcomes the authorities’ commitment to overhaul property taxation within 2019-20 to increase fairness, and urges further efforts to strengthen tax administration and combat deep-seated tax evasion. On the expenditure side, the 2019-21 medium-term expenditure framework aims at increasing capital spending as a share of GDP by restraining current spending. Accelerating public finance management reforms and strengthening the public investment management are among the priorities.

“Monetary policy should remain focused on price stability. The current policy stance is appropriate and in line with the CBA’s medium-term target. Staff welcomes the authorities’ intention to maintain the existing flexible exchange rate regime, while aiming to ensure international reserves adequacy.

“The financial sector has continued to strengthen, and access to credit has improved. Drawing on the recommendations of the 2018 financial stability assessment program (FSAP) the authorities are taking steps to strengthen financial stability and promote financial development. Specific measures include building stronger liquidity buffers, improving systemic liquidity management, strengthening macroprudential measures to reduce dollarization, and developing capital markets.

“The new government’s ambitious structural reform agenda appropriately focuses on fighting corruption, improving the business environment, and developing human capital and infrastructure. In this regard, key measures include establishing an anti-corruption agency, strengthening corporate transparency and governance, and implementing active labor market policies. These reforms should be carried out decisively to help promote fair competition and equal opportunity, boost the private sector’s role as a growth engine, and reduce poverty and unemployment.

“The IMF team would like to thank all the counterparts for the open and constructive discussions and collaboration.”

-----

Earlier:

2018, December, 29, 14:13:00

СТРАТЕГИЧЕСКОЕ ПАРТНЕРСТВО РОССИИ И АРМЕНИИМИНЭНЕРГО РОССИИ - «Наше сотрудничество насчитывает долгие годы конструктивного взаимодействия. Мы ведем совместную работу по формированию общих рынков газа, нефти, нефтепродуктов и электроэнергии ЕАЭС. Россия осуществляет стабильные поставки в Республику нефтепродуктов и газа», - отметил Министр. |

2018, August, 15, 10:40:00

РОСАТОМ ДЛЯ ЕВРАЗИИРОСАТОМ - «Подписание сегодняшнего Соглашения между отраслевым комплексом Госкорпорации «Росатом» – «Русатом – Международная Сеть» и Евразийским банком развития создаёт дополнительные предпосылки для успешной реализации проектов в области традиционной и возобновляемой энергетики, ядерной медицины и других областях в странах-участницах ЕАБР, в которых предприятия Росатома участвуют, как поставщики оборудования и услуг, реализуют те или иные проекты, являются партнёрами местных государственных и частных компаний», – сказал Александр Мертен. |

2018, January, 24, 11:45:00

IRANIAN NUCLEAR POWER - 2017WNA - Iran produced 275 TWh gross in 2014, comprising 196 TWh from gas, 59 TWh from oil, both of which it has in abundance, 14 TWh from hydro which is less reliably available, and 4.5 TWh from nuclear power. Demand is growing about 4% per year, and Iran trades electricity with Afghanistan, Armenia, Azerbaijan, Iraq, Pakistan, Syria, Turkmenistan and Turkey. Net export is about 6 TWh/yr. Turkey and Iraq account for 90% of exports. Consumption in 2014 was about 223 TWh, per capita about 2700 kWh/yr.In mid-2015 generating capacity was 74 GWe, including 12 GWe hydro. The country plans to boost generating capacity to 122 GWe by 2022, with substantial export potential. |

2015, December, 28, 19:40:00

GEORGIAN GAS GROWTHNext year Georgia plans to increase the volume of natural gas it imports from Russia by 25.2% against 2015 up to 250.5 mcm. According to the natural gas balance for 2016 approved by the Georgian Energy Ministry, it plans to import 65.9 mcm of commercial gas from Russia. Georgia will receive 184.6 million cub.m. (down from 7.7%) from Russian gas transit to Armenia, for which Georgia gets 10% in volume. |