BAHRAIN'S ECONOMIC GROWTH 1.8%

IMF - An International Monetary Fund (IMF) mission led by Mr. Bikas Joshi visited Manama from February 19–March 3, 2019 to conduct discussions for the 2019 Article IV consultation. The mission will submit a report to IMF management and Executive Board, which is tentatively scheduled to discuss the Article IV Consultation in April 2019.

At the conclusion of the visit, Mr. Joshi issued the following statement:

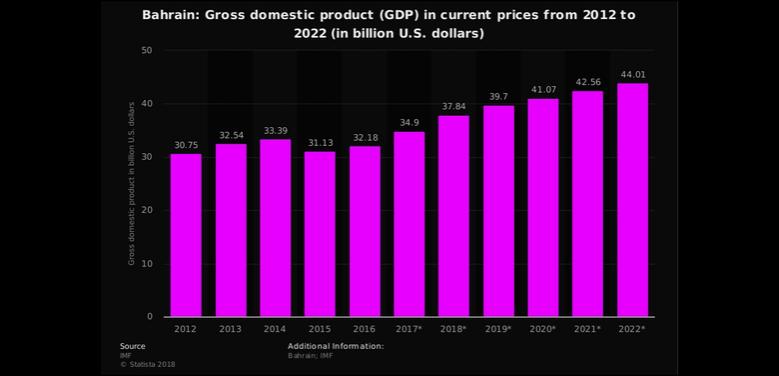

“Economic activity was subdued in 2018. Oil output is expected to have declined by 1.2 percent, while non-oil output growth decelerated to 2.5 percent, driven by slowdowns in retail, hospitality, and financial services sectors. Continued implementation of GCC-funded projects has supported growth in the construction sector. Overall growth in 2018 is estimated at 1.8 percent, with inflation edging up to 2.1 percent, mainly driven by higher food and transport prices. With higher oil prices, the reduction in utility subsidies, and the new excise taxes, the overall deficit in 2018 fell to 11.7 percent of GDP, from 14.2 percent in 2017. Public debt increased to 93 percent of GDP. The current account deficit widened to 5.8 percent, while reserves remained low, covering only about one month of prospective non-oil imports at end 2018.

“Economic growth is anticipated to remain around 1.8 percent in 2019. The authorities’ Fiscal Balance Program, underpinned by the 2019-20 budget, has provided a commendable framework to arrest the decline in fiscal and external buffers since 2014. The introduction of a value-added tax in January 2019 is a particularly significant step, as are plans for cost recovery in utilities and further means-tested subsidy reforms. The measures envisaged under the FBP are expected to further reduce the fiscal deficit over the medium term, but public debt will continue to increase.

“Thus, additional reform efforts, anchored in a more transparent medium-term agenda, will be needed to ensure fiscal sustainability and support the currency peg, which continues to provide a clear and credible monetary anchor. Further revenue measures, including a direct taxation system such as corporate income tax, could be considered and spending reforms should be designed to protect the most vulnerable. The implementation of the Voluntary Retirement Scheme (VRS) is expected to reduce the public wage bill over the medium term. The ultimate impact on public service delivery and public finances should be carefully assessed based on public sector restructuring plans and contingent liabilities of the VRS.

“The banking system remains stable. Ongoing efforts at supervisory and regulatory vigilance, and to further enhance the AML/CFT framework, are welcome. Bahrain has been a leader in fintech, promoting opportunities while revising regulations and collaborating with other regulators.

“Sustained structural reforms would help support inclusive growth and further economic diversification. This requires developing a dynamic private sector, while transforming the role of the government without sacrificing necessary public services. Targeted education and labor market reforms would help promote opportunities and improve productivity. Efforts to place greater emphasis on vocational education and retraining are welcome, particularly as technology is rapidly changing the nature of work. Reforms to streamline regulations should further improve efficiency and catalyze private investment. Improving access to financing for small and medium enterprises would invigorate further the private sector’s contribution to the overall economy.

“The IMF team greatly appreciated the candid discussions with the Bahrain authorities and their hospitality and cooperation.”

-----

Earlier:

2018, July, 16, 10:25:00

BAHRAIN'S GDP UP 3.2%IMF - Output grew by 3.8 percent in 2017, underpinned by a resilient non-hydrocarbon sector, with robust implementation of GCC-funded projects as well as strong activity in the financial, hospitality, and education sectors. The banking system remains stable with large capital buffers. Growth is projected to decelerate over the medium term. |

2018, May, 14, 10:45:00

BAHRAIN ENERGY FUND: $1 BLNOGJ - Bahrain plans to raise $1 billion for energy investments in a fund the government calls unique among Gulf Cooperation Council countries. |

2018, April, 27, 10:45:00

BAHRAIN'S NEW OILAOG - Bahrain, recently announced that it had unearthed around 80 billion barrels of unconventional oil and up to 20 trillion cubic feet of tight gas off its west coast. The discovery could potentially transform the island state’s reserves which currently total well under 200 million barrels. |

2018, April, 2, 09:15:00

BAHRAIN'S NEW OIL&GASREUTERS - The new tight oil and deep gas resource is expected to contain many times the amount of oil produced by Bahrain’s existing oilfields, as well as large amounts of gas, BNA reported. |

2017, August, 28, 19:45:00

IMF: BAHRAIN'S VULNERABILITY UPBahrain’s fiscal and external vulnerabilities have increased in the wake of the oil price decline. Overall GDP grew 3 percent in 2016, supported by strong growth of 3.7 percent in the non-oil sector aided by the implementation of GCC-funded projects. Average inflation remained moderate at 2.8 percent. Bank deposit and private sector credit growth slowed. The banking sector remains well capitalized and liquid. Despite the implementation of significant fiscal adjustment, lower oil prices meant that the overall fiscal deficit reached nearly 18 percent of GDP and government debt rose to 82 percent of GDP. The current account deficit widened to 4.7 percent. International reserves have declined. |

2016, May, 5, 18:50:00

GAZPROM & BAHRAIN LNGRussian state-owned oil and gas giant Gazprom is currently working to create a liquefied natural gas (LNG) distribution hub in Bahrain. The hub will be meant to intake LNG from various sources, including Russia. |