BRENT OIL: UNDERVALUED

|

Andy Warr, contributor, Owner of Tophat Finance company.

Tophat Finance deals in transmission of trading data for financial instruments (FX, Indices Futures, OIL, Metals(XAG/,XAU)) with Quantitative Analysis and Research to interested clients so as to gain financial wealth & knowledge. |

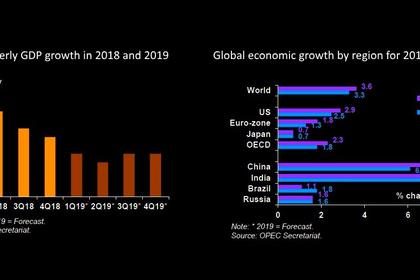

In the context of supply and demand balance,the current price of BRENT oil is undervalued.Neither OPEC nor the IEA has considerably brought down their forecasts for global oil demand in the current year.

In January, hedge funds actively bought OIL ,over the last month oil has shown minimum volatility being supported,on one hand by the political crisis in Venezuela and the decline in OIL production in OPEC countries and Russia.;and on the other handbeing underpressure by concerns of global growth.

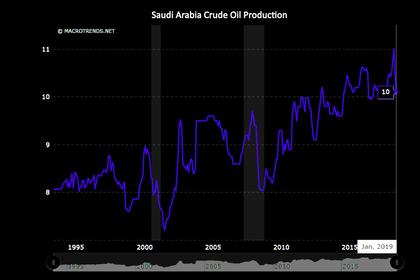

Lets recall what OPEC decided in December(OPEC Week):In view of the current fundamentals,and the consensus view of a growing imbalance in 2019,the conference decided to adjust OPEC overall production by 0.8million barrels per day from October 2018 levels.,effective as of January 2019 for initial period of 6 months with a review of April 2019.

Now lets recall how much OIL OPEC countries produced in October,,.As we see,in October..OPEC oil production was at 332.976 million barrels per day,but this is with account taken of Qatar leaving the cartel.Without Qatar,Oil production was 32.36 million barrels per day.We subtract 0.8m barrels per day from this figure,we get 31.6million barrels per day.This is the target level for OPEC oil production at end of Q1.

Averaging our,it can be predicted that in Q1,OPEC Oil production will be 31.6million barrels per day and in Q2 it will be 31.6 million barrels per day.

Based on these calculations,and the latest OPEC forecast regarding the structure of global supply and demand in the oil market,we obtain the following structure of the global oil market balance for the next six months.

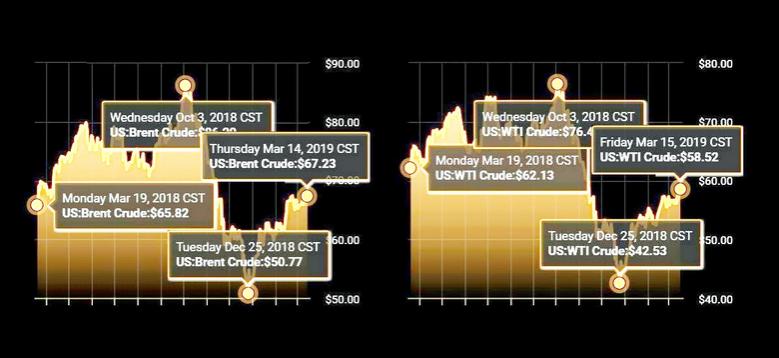

So, judging by the OPEC data,the global oil market is to have a stable surplus for two quarters.Now ,lets estimate what this means for the price of oil.

In the long-run,in the oil market correlating to other commodity markets,the price is formed on basis of supply and demand.One of the markers of this balance is Stocks.

That is there is good long term relationship(R2=0.85) between the price of BRENT OIL and the OECD commercial closing stocks levels.

OPEC publishes oil-stock reports for the OECD with on quarter delay,therefore,we will calculate them on our own.

Given that consumption by OECD countries is approximately 50% of the global consumption levels,it can be assumed that the possible deficit or surplus in the global market will be compensated by 50% due to Oil inventory by OECD Countries.This means that the expected surplus in the oil market can increase oil stocks in OECD countries by -2950m/b by end of Q2.

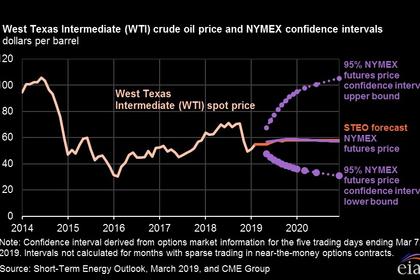

As we can see from this model,it means that the current price of BRENT OIL almost corresponds to the forecasted level of OIL stock in the OECD countries in Q2.

Noted is that this is a good indicator of the balanced BRENT oil price for the past 8 years.However the model does not put into accountb the element of Demand and agreed that the same level of stocks but with different levels of consumption affects price differently.Therefore the next step is to consider the relationship between price of BRENT oil and the number of daysof forward consumption in OECD (stock divided by daily consumption).

In accordance to this model,the current price of BRENT oil remains undervalued bu -10$.

In other words, in terms of expected demand,the expected increase of OIL stocks in the OECD will not have a disastrous effect on the price of OIL. Moreso,if we calculate the data based on the IEA forecast,we will get a slight surplus in Q1 and almost same deficit in Q2.IEA Global oil stocks will not change significantly in the first half of year which within the bounds of the proposed models means that the price of BRENT oil is clearly below the balanced level.

-----

Earlier: