BULGARIA'S GROWTH 3.3%

IMF - On March 20, 2019,the Executive Board of the International Monetary Fund (IMF) concluded the Article IV consultation with Bulgaria.

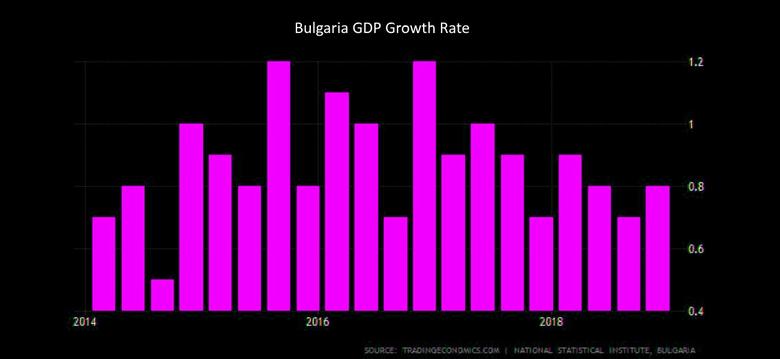

The Bulgarian economy continues to grow strongly, supported by buoyant domestic demand. Growth exceeded 3 percent in 2018 and is projected to maintain its momentum in 2019. Capacity constraints are becoming more binding yet inflationary pressure has eased after peaking in August last year, reflecting developments in commodity and tourism-related prices. The unemployment rate has reached a historical low and wages are rising rapidly amid increasing skill shortages. The current account surplus remained sizable in 2018 but is projected to decline. Risks are tilted to the downside especially from weaker-than-expected growth of trading partners.

The fiscal balance recorded a small surplus of 0.1 percent of GDP in 2018, exceeding the budgeted deficit of 1 percent of GDP, owing to strong revenue performance and capital underspending. Credit growth has picked up across the board. The banking sector is profitable and asset quality continues to improve. Non-performing loans have fallen below 9 percent of total loans in 2018Q3. The central bank has made steady progress in strengthening banking sector supervision.

Robust economic performance needs to translate into sustainable and inclusive growth. Bulgaria’s income level is still half of the EU average and income inequality is high among EU countries. It also faces long-term growth and fiscal challenges due to demographic headwinds.

The Bulgarian authorities and ERM II parties have agreed that Bulgaria will join ERM II and the banking union simultaneously upon completing several commitments. These include strengthening financial sector supervision, improving SOE governance, and strengthening the anti-money laundering (AML) framework.

Executive Board Assessment

Executive Directors welcomed Bulgaria’s robust economic growth, historically low unemployment, and improved financial sector conditions. While prospects remain good, Directors considered that downside risks have recently risen, emanating mostly from the weakening in trading‑partner growth and global trade. With sound macroeconomic policies in Bulgaria, Directors emphasized the need to implement broad‑based structural reforms to boost potential growth, accelerate EU income convergence, and address unfavorable demographic dynamics. Improving the efficiency of public spending, the quality of public institutions, and the governance framework will be key to bolstering prospects.

Directors welcomed the strong fiscal outturn in 2018, and supported the authorities’ fiscal policy plan to preserve buffers against downside risks. They were reassured that Bulgaria’s low public debt provides ample room to allow automatic stabilizers to operate in the event of a negative shock. Directors encouraged the authorities to continue to improve revenue and spending efficiency.

Directors highlighted that sound institutions are important to support inclusive and sustainable growth over the medium term, and encouraged the authorities to maintain the reform momentum through effective implementation. They considered that stronger public investment management will have dual benefits of improving investment efficiency and strengthening public institutions. Directors welcomed recent progress on reforms to improve the judiciary and the fight against corruption, and commended the authorities’ plan to strengthen the anti‑money laundering framework and governance of state‑owned enterprises.

Directors stressed that improving education and healthcare and addressing labor market bottlenecks would enhance human capital and mitigate labor shortages and skill mismatches. Directors emphasized that effective labor market policies and a deeper collaboration between educational institutions and business could help alleviate these challenges.

Directors commended the authorities’ progress in strengthening financial supervision, including operationalizing the new governance framework, strengthening legislation for related‑party lending, and formalizing the supervisory review and evaluation process. They welcomed the recent decline in non‑performing loans (NPLs), and encouraged the central bank to ensure that banks with high NPLs maintain sufficient capital buffers.

Directors noted that Bulgaria’s preparations for ERM II and the banking union would help support reforms and enhance the quality of institutions, including by strengthening financial sector supervision.

|

Bulgaria: Selected Economic Indicators, 2015–19 1/ |

|||||

|

2015 |

2016 |

2017 |

2018 |

2019 |

|

|

Est. |

Proj. |

||||

|

Real GDP |

3.5 |

3.9 |

3.8 |

3.2 |

3.3 |

|

Real domestic demand |

3.3 |

1.7 |

4.9 |

6.3 |

4.9 |

|

Public consumption |

1.4 |

2.2 |

3.7 |

3.8 |

4.2 |

|

Private consumption |

4.5 |

3.5 |

4.5 |

7.0 |

5.0 |

|

Gross capital formation |

1.5 |

-4.3 |

7.3 |

5.7 |

5.2 |

|

Private investment |

-3.4 |

-1.5 |

6.4 |

2.4 |

4.0 |

|

Public investment |

20.3 |

-18.6 |

-5.9 |

13.5 |

10.1 |

|

Stock building 2/ |

-0.2 |

0.5 |

0.8 |

0.2 |

0.0 |

|

Net exports 2/ |

0.1 |

2.2 |

-1.1 |

-3.2 |

-1.8 |

|

Exports of goods and services 3/ |

5.7 |

8.1 |

5.8 |

-1.5 |

2.7 |

|

Imports of goods and services |

5.4 |

4.5 |

7.5 |

3.2 |

5.3 |

|

Resource utilization |

|||||

|

Potential GDP |

2.7 |

3.0 |

3.2 |

3.2 |

3.2 |

|

Output gap (percent of potential GDP) |

-1.2 |

-0.4 |

0.2 |

0.2 |

0.2 |

|

Unemployment rate (percent of labor force) |

9.2 |

7.7 |

6.2 |

4.7 |

5.0 |

|

Price |

|||||

|

GDP deflator |

2.2 |

2.2 |

3.4 |

3.1 |

2.9 |

|

Consumer price index (HICP, average) |

-1.1 |

-1.3 |

1.2 |

2.6 |

2.4 |

|

Consumer price index (HICP, end of period) |

-0.9 |

-0.5 |

1.8 |

2.3 |

2.2 |

|

Fiscal indicators (percent of GDP) |

|||||

|

General government net lending/borrowing (cash basis) |

-2.8 |

1.6 |

0.8 |

0.1 |

-0.6 |

|

General government primary balance |

-2.0 |

2.3 |

1.6 |

0.8 |

-0.1 |

|

Structural overall balance |

-2.4 |

1.7 |

0.8 |

0.1 |

-0.7 |

|

Structural primary balance |

-1.6 |

2.5 |

1.5 |

0.7 |

-0.1 |

|

General government gross debt |

25.6 |

27.4 |

23.3 |

20.5 |

19.3 |

|

Monetary aggregates |

|||||

|

Broad money |

8.8 |

7.6 |

7.7 |

8.8 |

8.0 |

|

Domestic private credit |

-1.6 |

1.8 |

4.5 |

8.9 |

7.1 |

|

Exchange rates regime |

|||||

|

Leva per U.S. dollar (end of period) |

1.8 |

1.9 |

1.6 |

1.7 |

… |

|

Nominal effective rate |

-1.2 |

2.5 |

3.1 |

5.0 |

… |

|

External sector (percent of GDP) |

|||||

|

Current account balance |

0.0 |

2.6 |

6.5 |

4.6 |

2.2 |

|

o/w: Merchandise trade balance |

-5.8 |

-2.0 |

-1.5 |

-4.1 |

-4.9 |

|

Sources: Bulgarian authorities; World Development Indicators; and IMF staff estimates. |

|||||

|

1/ Data as of February 28, 2019. 2/ Contribution to GDP growth. 3/ Exports suffered from maintenance work in the main refinery in 2018 and are expected to recover in 2019. |

|||||

-----

Earlier:

2019, March, 6, 11:40:00

РУССКИЕ ИНВЕСТИЦИИ В БОЛГАРИЮМИНЭНЕРГО РОССИИ - «Россия продолжает обеспечивать бесперебойные поставки газа в республику. В 2018 году в Болгарию было направлено 3,17 млрд куб м газа, Россия остается и основным поставщиком нефти на НПЗ Болгарии. Именно российские компании становятся крупнейшими иностранными инвесторами в экономику страны», - сообщил глава Минэнерго России. |

2019, February, 4, 09:35:00

BULGARIA'S GDP UP 3.3%IMF - Output is estimated to have grown by 3.2 percent in 2018, unemployment to have fallen to close to 5 percent, and the current account to have recorded another sizable surplus. Prospects for 2019 are for more of the same––we are projecting real GDP growth of 3.3 percent. However, the downside risks to this outlook have recently risen, owing to a sharper-than-anticipated slowdown in global trade and unsettled financial markets. |

2018, October, 29, 12:35:00

СОТРУДНИЧЕСТВО БОЛГАРИИ И РОССИИМИНЭНЕРГО РОССИИ - В газовой сфере сотрудничество России и Болгарии насчитывает более 40 лет, поставки ведутся с 1974 года. За это время в страну поставлено около 167 млрд куб. м российского природного газа. В прошлом 2017 году Россия поставила Болгарии 3,3 млрд куб. м. |

2018, July, 11, 08:50:00

PLASMA PLANT IN BULGARIAEBRD - Using plasma technology, the facility will significantly reduce the volume of low- and intermediate-level radioactive waste from the Kozloduy reactors 1 to 4, which were shut down between 2002 and 2006, and reactors 5 and 6, which are in operation. |

2018, June, 1, 09:40:00

СОТРУДНИЧЕСТВО РОССИИ И БОЛГАРИИМИНЭНЕРГО РОССИИ - Глава Российской Федерации отметил, что через территорию Болгарии проходят транзитные потоки российских углеводородов в другие страны Юго-Восточной Европы. «Есть возможности развивать сотрудничество в этой важнейшей сфере – тем самым вносить ещё больший вклад в обеспечение европейской энергетической безопасности», - подчеркнул Владимир Путин. |

2016, September, 19, 18:35:00

EBRD BOUGHT BULGARIAPresident Chakrabarti welcomed Bulgaria’s recent actions to strengthen the stability of its financial sector and promote the liberalisation of the energy market. He reconfirmed the EBRD’s commitment to support these reforms with investment and technical advice. |

2016, August, 8, 18:45:00

СНОВА ЮЖНЫЙ ПОТОК"Болгария и Россия договорились создать рабочие группы по восстановлению российских энергетических проектов, включая строительство газопровода "Южный поток" |