CNOOC NET PROFIT UP 113.5%

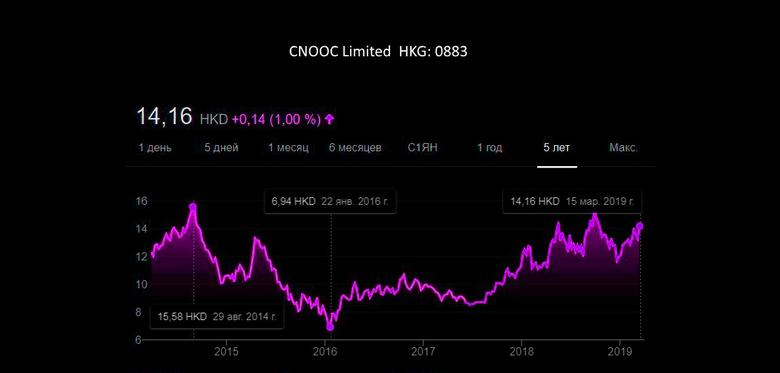

CNOOC - CNOOC Limited (the "Company", SEHK: 00883, NYSE: CEO, TSX: CNU) today announced its 2018 annual results for the year ended December 31, 2018.

In 2018, CNOOC Limited expanded its oil and gas reserves and production at a steady pace, strengthened its cost control and achieved remarkable results. Total net oil and gas production of the Company achieved 475 million barrels of oil equivalent ("BOE"), successfully meeting the annual target set at the year beginning. During the year, the Company made 17 commercial discoveries and successfully appraised 17 oil and gas structures. In offshore China, multiple high quality mid-to-large size oil and gas fields, including Bozhong 19-6 and Bozhong 29-6, were successfully appraised. In overseas, 5 new world-class discoveries were made in the Stabroek block in Guyana. CNOOC Limited's reserve replacement ratio reached 126% and its reserve life improved to 10.5 years. At the end of 2018, the net proved reserves of CNOOC Limited were 4.96 billion BOE, reaching a historic high. Therefore, the Company's resource foundation for sustainable development in the future was further strengthened.

In 2018, the Company's average realized oil price was US$67.22 per barrel, representing an increase of 27.7% year-over-year (YoY). The average realized natural gas price was US$6.41 per thousand cubic feet, representing an increase of 9.8% YoY. In addition, the Company's oil and gas sales revenue was RMB185.9 billion, an increase of 22.4% YoY. The Company focused on technological and management innovation to fuel quality and efficiency enhancements, and achieved cost reduction for the fifth consecutive year. In 2018, the Company's all-in cost decreased to US$30.39 per BOE by 6.6% YoY, and maintained its cost competitiveness. Due to higher international oil prices and improvements in cost control, the Company's net profit increased significantly to RMB52.7 billion, representing an increase of 113.5% YoY.

During the year, the Company maintained a healthy financial position and had abundant free cash flow. The capital expenditures were RMB62.6 billion.

In 2018, the Company's basic earnings per share was RMB1.18. The Board of Directors has proposed a year-end dividend of HK$0.40 per share (tax inclusive).

Mr. Yang Hua, Chairman of CNOOC Limited, said: "In 2018, facing the complex external environment, CNOOC Limited focused on high-quality development, and maintained strong cost competitiveness. The Company steadily expanded the oil and gas reserves and production, achieved a significant growth in net profit. In the future, the Company will continue to increase oil and gas reserves and production, actively implement low-carbon development strategies, speed up the transformation and upgrading, and continuously create value for shareholders."

-----

Earlier:

2019, February, 6, 10:30:00

MOZAMBIQUE LNG FOR CHINAPLATTS - US-based Anadarko Petroleum has agreed to sell 1.5 million mt/year of LNG from its planned 12.9 million mt/year Mozambique LNG project to China's CNOOC for a period of 13 years. |

2018, October, 22, 11:30:00

TOTAL - CNOOC LNGREUTERS - French energy group Total and China’s CNOOC have strengthened their existing partnership in the liquefied natural gas (LNG) sector to increase their output, the companies said on Monday. |

2018, August, 24, 11:00:00

CNOOC NET PROFIT UP 56.8%CNOOC - In the first half of 2018, the Company maintained a healthy profitability and a sound financial position. Oil and gas sales reached RMB 90.31 billion, representing a year-on-year increase of 20.5%. Net profit reached RMB 25.48 billion, representing a significant increase of 56.8% year-on-year (“YoY”). The Company’s average realized oil price was US$ 67.36 per barrel, representing an increase of 33.6% YoY. The average realized natural gas price increased by 13.0% YoY to US$ 6.42 per thousand cubic feet. Despite the international oil prices rebound and industry costs inflation, the Company maintained a competitive all-in cost of US$ 31.83/BOE during the first half of the year. |

2018, July, 16, 10:35:00

CHINA'S INVESTMENT FOR NIGERIA: $14+3 BLNAN - China National Offshore Oil Corp. (CNOOC) is willing to invest $3 billion in its existing oil and gas operation in Nigeria, the Nigerian National Petroleum Corporation (NNPC) said on Sunday following a meeting with the Chinese in Abuja. |

2017, November, 29, 09:40:00

SOUTH CHINA SEA OILOGJ - Phase II production from Weizhou 12-2 oil field has been brought on stream, CNOOC Ltd. said of its project in Beibu Gulf in the South China Sea. |

2017, April, 3, 18:40:00

LNG OVERSUPPLYKorea Gas Corp (KOGAS), Japan's JERA and China National Offshore Oil Corp (CNOOC) [SASACY.UL] - whose joint liquefied natural gas volumes account for a third of global LNG trade - are attempting to cement a shift in power from producers to importers amid a supply glut that is expected to persist into the early-2020s. |

2017, January, 20, 18:50:00

CHINA'S CNOOC INVESTMENT UP TO 39%Cnooc said it plans to lift capital spending to between Rmb60bn and RMB70bn this year, from budgeted capex of Rmb50.3bn in 2016. It intends to produce between 450m and 460m barrels of oil equivalent this year, compared with an estimated 476m last year. |