2019-03-13 11:30:00

OIL PRICES 2019-20: $63-$62

EIA - SHORT-TERM ENERGY OUTLOOK

Forecast Highlights

Global liquid fuels

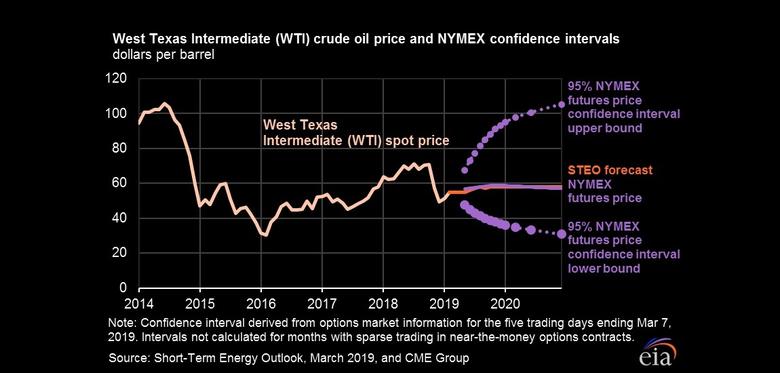

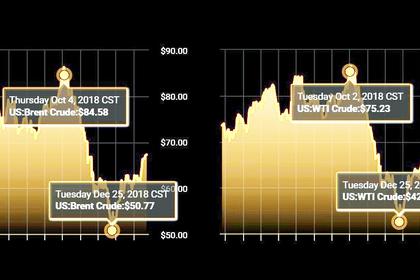

- Brent crude oil spot prices averaged $64 per barrel (b) in February, up $5/b from January 2019 and about $1/b lower than at the same time last year. EIA forecasts Brent spot prices will average $63/b in 2019 and $62/b in 2020, compared with an average of $71/b in 2018. EIA expects that West Texas Intermediate (WTI) crude oil prices will average $9/b lower than Brent prices in the first half of 2019 before the discount gradually falls to $4/b in the fourth quarter of 2019 and throughout 2020.

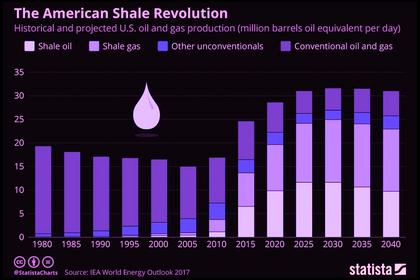

- EIA estimates that U.S. crude oil production averaged 11.9 million barrels per day (b/d) in February, down slightly from the January average. EIA forecasts that U.S. crude oil production will average 12.3 million b/d in 2019 and 13.0 million b/d in 2020, with most of the growth coming from the Permian region of Texas and New Mexico.

- Net imports of U.S. crude oil and petroleum products fell from an average of 3.8 million b/d in 2017 to an average of 2.3 million b/d in 2018. EIA forecasts that net imports will continue to fall to an average of 1.0 million b/d in 2019 and to an average net export level of 0.1 million b/d in 2020. In the fourth quarter of 2020, EIA forecasts that the United States will be a net exporter of crude oil and petroleum products by about 0.9 million b/d.

Natural gas

- The Henry Hub natural gas spot price averaged $2.69/million British thermal units (MMBtu) in February, down 42 cents/MMBtu from January. EIA expects strong growth in U.S. natural gas production to put downward pressure on prices in 2019. EIA expects Henry Hub natural gas spot prices will average $2.85/MMBtu in 2019, down 30 cents/MMBtu from 2018. NYMEX futures and options contract values for June 2019 delivery traded during the five-day period ending March 7, 2019, suggest a range of $2.40/MMBtu to $3.51/MMBtu encompasses the market expectation for June 2019 Henry Hub natural gas prices at the 95% confidence level.

- EIA forecasts that dry natural gas production will average 90.7 billion cubic feet per day (Bcf/d) in 2019, up 7.4 Bcf/d from 2018. EIA expects natural gas production will continue to rise in 2020 to an average of 92.0 Bcf/d.

- EIA expects natural gas inventories will end March at 1.2 trillion cubic feet (Tcf), which would be 14% lower than levels from a year earlier and 28% lower than the five-year (2014–18) average. EIA forecasts that natural gas storage injections will outpace the previous five-year average during the April-through-October injection season and that inventories will reach 3.6 Tcf at the end of October, which would be 12% higher than October 2018 levels and 2% below the five-year average.

Electricity, coal, renewables, and emissions

- EIA expects the share of U.S. total utility-scale electricity generation from natural gas-fired power plants to rise from 35% in 2018 to 37% in 2019 and in 2020. EIA forecasts that the share of electricity generation from coal will average 25% in 2019 and 23% in 2020, down from 27% in 2018. The nuclear share of generation was 19% in 2018, and EIA forecasts that it will stay near that level in 2019 and in 2020. The generation share of hydropower is forecast to average slightly less than 7% of total generation in 2019 and in 2020, similar to 2018. Wind, solar, and other nonhydropower renewables together provided about 10% of electricity generation in 2018. EIA expects they will provide 11% in 2019 and 13% in 2020.

- In 2019, EIA expects wind’s annual share of electricity generation will exceed hydropower’s share for the first time. EIA forecasts that wind generation will rise from 753,000 megawatt hours per day (MWh/d) in 2018 to 861,000 MWh/d in 2019 (a share of 8%). Wind generation is projected to rise to 963,000 MWh/d (a share of 9%) by 2020.

- EIA estimates that U.S. coal exports increased by 19 million short tons (MMst) (19%) in 2018, totaling 116 MMst. EIA expects declines in both steam coal and metallurgical coal (used in the steelmaking process) exports in 2019 and in 2020. Metallurgical coal exports are forecast to decline by 10 MMst (16%) in 2019 and by an additional 3 MMst (5%) in 2020 as the forecast’s global economic growth slows and decreases the demand for steel. Exports of steam coal, used primarily in electricity generation, are expected to decline by 5 MMst (10%) in 2019 and in 2020. Although forecast steam coal exports to non-traditional markets (North Africa, non-EU Europe, Central and South America) remain strong, exports to traditional markets, particularly the EU, will see demand for steam coal decline as countries initiate plans to limit/eliminate coal-fired electricity generation.

- After rising by 2.9% in 2018, EIA forecasts that U.S. energy-related carbon dioxide (CO2) emissions will decline by 1.6% in 2019 and by 0.5% in 2020. The 2018 increase largely reflected increased weather-related natural gas use because of additional heating needs during a colder winter and for higher electric generation to support more summer cooling use than in 2017. EIA expects emissions to fall in 2019 and in 2020 because of forecasted temperatures that will return to near normal and natural gas and renewables making up a higher share of electricity generation. Energy-related CO2 emissions are sensitive to changes in weather, economic growth, energy prices, and fuel mix.

-----

Earlier:

2019, March, 11, 11:55:00

OIL PRICE: NEAR $66 YET

Oil prices edged up on Monday after Saudi oil minister Khalid al-Falih said an end to OPEC-led supply cuts was unlikely before June, while a report showed U.S. drilling activity fell for a third straight week.

2019, March, 11, 11:40:00

BALANCE FOR OIL MARKET

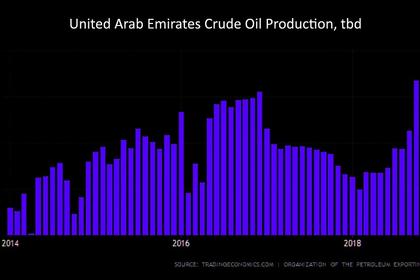

The United Arab Emirates (UAE) will continue to deliver on crude oil supply cuts under a producer agreement until the global market is re-balanced, Minister of Energy and Industry Suhail al-Mazrouei said on Sunday.

2019, February, 27, 09:40:00

OPEC CONTINUE CUTS

REUTERS - Based on current market data, the so-called OPEC+ group is “likely to continue with the production cuts until the end of the year”, the source told Reuters.

2019, February, 25, 11:55:00

U.S. SHALE OIL WEAKNESS

REUTERS - Weak returns at U.S. shale producers could cost more executives their jobs and lead to increasing battles with activist investors, analysts said following changes at two producers.