OIL PRICES 2019-20: ABOVE $60

U.S. EIA - Short-Term Energy Outlook (STEO), February 2019

Global liquid fuels

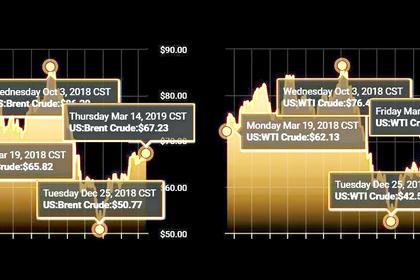

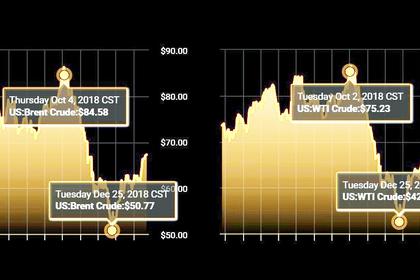

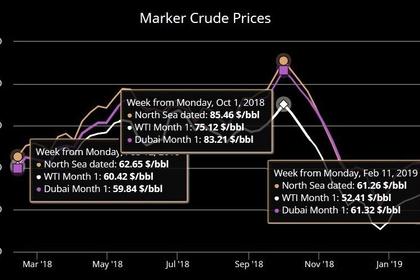

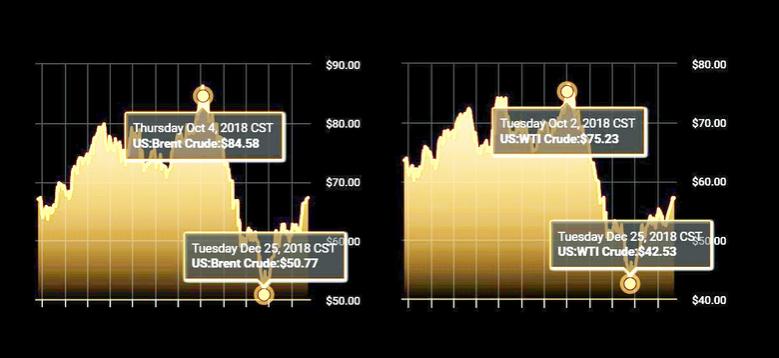

• Brent crude oil spot prices averaged $59 per barrel (b) in January, up $2/b from December 2018 but $10/b lower than the average in January of last year. EIA forecasts Brent spot prices will average $61/b in 2019 and $62/b in 2020, compared with an average of $71/b in 2018. EIA expects that West Texas Intermediate (WTI) crude oil prices will average $8/b lower than Brent prices in the first quarter of 2019 before the discount gradually falls to $4/b in the fourth quarter of 2019 and through 2020.

• EIA estimates that U.S. crude oil production averaged 12.0 million barrels per day (b/d) in January, up 90,000 b/d from December. EIA forecasts U.S. crude oil production to average 12.4 million b/d in 2019 and 13.2 million b/d in 2020, with most of the growth coming from the Permian region of Texas and New Mexico.

• Global liquid fuels inventories grew by an estimated 0.5 million b/d in 2018, and EIA expects they will grow by 0.4 million b/d in 2019 and by 0.6 million b/d in 2020.

• U.S. crude oil and petroleum product net imports are estimated to have fallen from an average of 3.8 million b/d in 2017 to an average of 2.4 million b/d in 2018. EIA forecasts that net imports will continue to fall to an average of 0.9 million b/d in 2019 and to an average net export level of 0.3 million b/d in 2020. In the fourth quarter of 2020, EIA forecasts the United States will be a net exporter of crude oil and petroleum products by about 1.1 million b/d.

Natural gas

• The Henry Hub natural gas spot price averaged $3.13/million British thermal units (MMBtu) in January, down 91 cents/MMBtu from December. Despite a cold snap in late January, average temperatures for the month were milder than normal in much of the country, which contributed to lower prices. EIA expects strong growth in U.S. natural gas production to put downward pressure on prices in 2019. EIA expects Henry Hub natural gas spot prices to average $2.83/MMBtu in 2019, down 32 cents/MMBtu from the 2018 average. NYMEX futures and options contract values for May 2019 delivery traded during the five-day period ending February 7, 2019, suggest a range of $2.15/MMBtu to $3.30/MMBtu encompasses the market expectation for May 2019 Henry Hub natural gas prices at the 95% confidence level.

• EIA forecasts that dry natural gas production will average 90.2 billion cubic feet per day (Bcf/d) in 2019, up 6.9 Bcf/d from 2018. EIA expects natural gas production will continue to rise in 2020 to an average of 92.1 Bcf/d.

Electricity, coal, renewables, and emissions

• EIA expects the share of U.S. total utility-scale electricity generation from natural gasfired power plants to rise from 35% in 2018 to 36% in 2019 and to 37% in 2020. EIA forecasts that the electricity generation share from coal will average 26% in 2019 and 24% in 2020, down from 28% in 2018. The nuclear share of generation was 19% in 2018 and EIA forecasts that it will stay near that level in 2019 and in 2020. The generation share of hydropower is forecast to average slightly less than 7% of total generation in 2019 and 2020, similar to last year. Wind, solar, and other nonhydropower renewables together provided about 10% of electricity generation in 2018. EIA expects them to provide 11% in 2019 and 13% in 2020.

• EIA expects average U.S. solar generation will rise from 265,000 megawatthours per day (MWh/d) in 2018 to 301,000 MWh/d in 2019 (an increase of 14%) and to 358,000 MWh/d in 2020 (an increase of 19%). These forecasts of solar generation include largescale facilities as well as small-scale distributed solar generators, primarily on residential and commercial buildings.

• In 2019, EIA expects wind's annual share of generation will exceed hydropower's share for the first time. EIA forecasts that wind generation will rise from 756,000 MWh/d in 2018 to 859,000 MWh/d in 2019 (a share of 8%). Wind generation is further projected to rise to 964,000 MWh/d (a share of 9%) by 2020.

• EIA estimates that U.S. coal production declined by 21 million short tons (MMst) (3%) in 2018, totaling 754 MMst. EIA expects further declines in coal production of 4% in 2019 and 6% in 2020 because of falling power sector consumption and declines in coal exports. Coal consumed for electricity generation declined by an estimated 4% (27 MMst) in 2018. EIA expects that lower electricity demand, lower natural gas prices, and further retirements of coal-fired capacity will reduce coal consumed for electricity generation by 8% in 2019 and by a further 6% in 2020. Coal exports, which increased by 20% (19 MMst) in 2018, decline by 13% and 8% in 2019 and 2020, respectively, in the forecast.

• After rising by 2.8% in 2018, EIA forecasts that U.S. energy-related carbon dioxide (CO2) emissions will decline by 1.3% in 2019 and by 0.5% in 2020. The 2018 increase largely reflects increased weather-related natural gas consumption because of additional heating needs during a colder winter and for additional electric generation to support more cooling during a warmer summer than in 2017. EIA expects emissions to decline in 2019 and 2020 because of forecasted temperatures that will return to near normal. Energy-related CO2 emissions are sensitive to changes in weather, economic growth, energy prices, and fuel mix.

-----

Earlier: