PETROBRAS NET INCOME $7.17 BLN

PETROBRAS - Petrobras posted R$ 25.8 billion net income in 2018. The first positive annual result in five years is also the highest since 2011. The company posted two financial records: Adjusted EBITDA of R$ 114.9 billion and, for the fourth year in a row, a positive free cash flow of R$ 54.6 billion.

"Petrobras' performance in 2018 was undoubtedly the best in many years, which includes the achievement of some historical records, namely free cash flow and adjusted EBITDA, and breaking a four-year sequence of losses," says Petrobras' CEO, Roberto Castello Branco, in a letter sent to the market on Wednesday (2/27).

The solid result brought by the company in 2018 reflects factors such as higher margins in refined oil product sales in Brazil and in oil exports, following the increase in the Brent price and the appreciation of the US dollar. There was also a recovery of market share in diesel and a decrease in general and administrative expenses. Also contributing to the result were the reduction of interest expenses, due to the lower indebtedness, and the settlement of credits with Eletrobras.

Special items being excluded - the signing of an agreement with ANP related to Parque das Baleias, the impairment (losses on the book value of assets) and losses with contingencies, among others - the net income would have been R$ 36 billion, and the adjusted EBITDA R$ 122 billion. These non-recurring items reached R$ 10 billion in 2018.

Total compensation to shareholders for the fiscal year 2018 will reach R$ 7.1 billion, considering the advances made during the year. Profit sharing will also be paid to employees.

In 2018, Petrobras generated R$ 151.5 billion in municipal, state and federal taxes, in addition to government take. Profit sharing will also be paid to employees.

Achieved performance metrics on safety and reduction of indebtedness

Petrobras has achieved performance metrics related to safety and the reduction of indebtedness. The focus on continuous improvement of culture and safety management has contributed to a reduction in the TAR (rate of recorded accidents per million man-hour), which fell to 1.01, in line with the limit set for 2018.

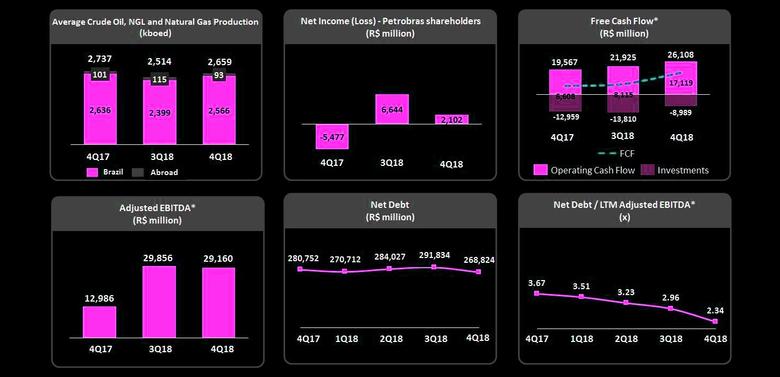

The company surpassed the target of the net debt indicator on adjusted EBITDA, which reduced to 2.34 in 2018, lower than the 2.5 established for the year. Net debt decreased 18% compared to 2017, reaching US$ 69.4 billion. With debt management, there was also the lengthening of the average term to 9.14 years, with an average rate of 6.1%.

Petrobras operating income in 2018

Oil and gas production reached 2.63 million barrels of oil equivalent per day (Mboed), 2.53 Mboed in Brazil and 101,000 boed in other countries, 5% lower than in 2017. This performance reflects divestments made and the natural decline of mature fields. Another operational highlight is the start-up of six new production systems (up to February 2019), five of which were in the pre-salt - P-74, P-75 and P-76 in the Búzios field and P-69 and P- 67 in the Lula field - and one in Tartaruga Verde, in the Campos Basin. "The start-up of new platforms gives us confidence on our production growth target of 5% per year until 2023," said Castello Branco. There was also a resumption of exploratory activity with the contracting of 11 new blocks in 2018.

Other highlights

In 2018, Petrobras reduced risks by signing agreements with US authorities to close investigations with the Department of Justice (DOJ) and the Securities and Exchange Commission (SEC) in the amount of R$ 3.5 billion.

The company reported a cash inflow of about US$ 6.1 billion with divestments. Partnerships with Equinor, Total and Murphy were also signed for business development in the E&P and renewable energy areas.

Numbers in the 4Q2018

Petrobras posted R$ 2.1 billion net income in the last quarter of 2018. The result reflected the decrease in Brent prices and margins in refined oil products sales, as well as the occurrence of special items, in the total of R$ 6.3 billion, among them the signing of an agreement with ANP related to Parque das Baleias, the impairment booking (loss in the book value of assets) and contingency losses. On the other hand, there was a growth of 6% in production and 45% in oil exports. The adjusted EBITDA reached R$ 29.2 billion, and free cash flow reached R$ 17.1 billion.

Special items excluded, the net income would have been R$ 8 billion and the adjusted EBITDA would reach R$ 31 billion.

Perspective for 2019

In 2019, Petrobras projects an increase in oil and natural gas production to 2.8 million boed, with 2.3 million bpd of oil in Brazil. This growth will be possible through an increased production (ramp up) at the newly installed platforms, as well as the start-up of the P-77 and P-68. The company will continue to divest and reduce financial leverage, maintaining capital discipline and optimizing portfolio, debt and cash management.

-----

Earlier:

2018, December, 29, 13:50:00

PETROBRAS OIL DOWNPLATTS - Brazilian state-led oil company Petrobras registered a 1.4% month-on-month slide in domestic crude oil output in November as ongoing maintenance work at offshore floating production units offset fresh flows from new wells. |

2018, November, 7, 10:50:00

PETROBRAS NET INCOME $6.6 BLNPETROBRAS - Net income attributable to the shareholders of Petrobras was US$ 6,622 million in 9M-2018, a 315% increase compared to US$ 1,596 million in 9M-2017. The result improved mainly due to increase in domestic oil products and oil exports margins and to the drop in net finance expenses. |

2018, October, 17, 09:55:00

PETROBRAS - CNPC COOPERATIONPLATTS - Petrobras is to form two joint venture companies with China National Petroleum Corp. (CNPC) to complete construction of a refinery and revitalize four mature fields in the offshore Campos Basin, the state-owned Brazilian company said |

2018, September, 26, 09:00:00

СПГ НОВАТЭК ДЛЯ БРАЗИЛИИНОВАТЭК - ПАО «НОВАТЭК» (далее – «НОВАТЭК» и/или Компания) сообщает, что дочернее общество Компании Novatek Gas and Power Asia Pte. Ltd. поставило на рынок Бразилии первую партию сжиженного природного газа (СПГ), произведенную на проекте «Ямал СПГ». Партия была доставлена компании Petrobras на регазификационный терминал Баия. |

2018, August, 8, 11:35:00

PETROBRAS NET INCOME R$ 17 BLNPETROBRAS - Petrobras reported net income of R$ 17 billion in the first half of 2018. The positive result was mainly influenced by the increase in international oil prices, associated with the depreciation of the Brazilian Real against the US dollar. In the same period, net debt fell 13% compared to December 2017, to US$ 73.66 billion. |

2018, July, 30, 13:40:00

PETROBRAS NEEDS CHINAREUTERS - The new supply could enlarge Brazil’s market share in China as buyers there cut oil imports from the United States following Beijing’s announcement it would impose tariffs on U.S. crude in retaliation against similar moves by Washington. |

2018, May, 10, 13:00:00

PETROBRAS NET INCOME $2.145 BLNPETROBRAS - Net income attributable to the shareholders of Petrobras was US$ 2,145 million in 1Q-2018, a 51% increase compared to US$ 1,417 million in 1Q-2017. The result improved mainly due to increase in Brent prices and gains with divestments. |