POWER OF SIBERIA STARTUP

ГАЗПРОМ - Сегодня в Ямало-Ненецком автономном округе состоялось торжественное мероприятие, посвященное началу полномасштабного освоения Харасавэйского месторождения. В церемонии приняли участие Председатель Правления ПАО «Газпром» Алексей Миллер, Губернатор Ямало-Ненецкого автономного округа Дмитрий Артюхов, руководители профильных подразделений и дочерних обществ компании.

С приветственным словом к участникам церемонии в режиме телемоста обратился Президент России Владимир Путин.

Харасавэйское является вторым, после Бованенково, опорным месторождением Ямальского центра газодобычи, созданного «Газпромом». Ямальский центр имеет ключевое значение для развития российской газовой отрасли в XXI веке.

Добыча газа на Харасавэйском месторождении начнется в 2023 году, проектный уровень добычи из сеноман-аптских залежей — 32 млрд куб. м газа в год. В дальнейшем компания будет осваивать более глубоко расположенные неоком-юрские залежи. Месторождение в основном находится на суше, частично — в акватории Карского моря. Скважины для разработки морской части будут буриться с берега.

Сегодня с Бованенковского месторождения по специально построенной сезонной автодороге (зимнику) на Харасавэйское месторождение выдвинулась первая автоколонна со строительной и вспомогательной техникой. Всего в работах по обустройству месторождения будет задействовано около 5,5 тыс. инженеров и строителей, 1764 единицы техники.

В 2019 году планируется отсыпка дорог и площадок для производственных объектов. В июне 2020 года компания намерена начать бурение эксплуатационных скважин.

«Сегодня мы приступаем к полномасштабному освоению Харасавэйского месторождения. Проектные решения максимально унифицированы с теми, что успешно применены нами на Бованенково. Это позволяет существенно оптимизировать инвестиционные и эксплуатационные затраты.

Для добычи газа на месторождении будет применяться только отечественное оборудование. В рамках работы на Харасавэе мы начнем освоение приямальского шельфа», — сказал Алексей Миллер.

-----

Справка

Харасавэйское газоконденсатное месторождение расположено на полуострове Ямал севернее Бованенковского месторождения. По размеру запасов газа — 2 трлн куб. м — Харасавэйское месторождение относится к категории уникальных.

К настоящему времени на месторождении созданы объекты жизнеобеспечения, в частности вахтовый жилой комплекс и электростанция собственных нужд.

Первоочередным объектом освоения станут сеноман-аптские залежи месторождения. Предусмотрено строительство 236 эксплуатационных газовых скважин, установки комплексной подготовки газа, дожимной компрессорной станции, транспортной и энергетической инфраструктуры.

Для транспортировки добытого на Харасавэйском месторождении газа будет построен газопровод-подключение протяженностью 106 км до Бованенковского месторождения. Затем газ будет поступать в Единую систему газоснабжения России.

Принципиально важным для «Газпрома» является обеспечение высокого уровня промышленной безопасности, сохранение уникальной арктической природы. Месторождение характеризуется сложными геокриологическими условиями, в том числе большой толщиной слоя вечной мерзлоты и высокой засоленностью грунта, что осложняет создание промышленных объектов. Чтобы исключить риски оттаивания мерзлоты, предполагается широко использовать парожидкостные охлаждающие установки. Также для предупреждения таяния вечной мерзлоты при добыче газа предусмотрено использование теплоизолированных насосно-компрессорных и обсадных труб в конструкции скважин. Замкнутые системы водоснабжения позволят избежать загрязнения почвы и водоемов. Линейные коммуникации месторождения будут оборудованы специальными переходами для свободного перемещения стад оленей и миграции диких животных.

-----

POWER OF SIBERIA STARTUP

PLATTS - The Power of Siberia natural gas pipeline from Russia to China is on track and gas supply is expected to commence by December this year, a senior executive at state-run PetroChina, China's biggest gas importer and producer, said late Thursday.

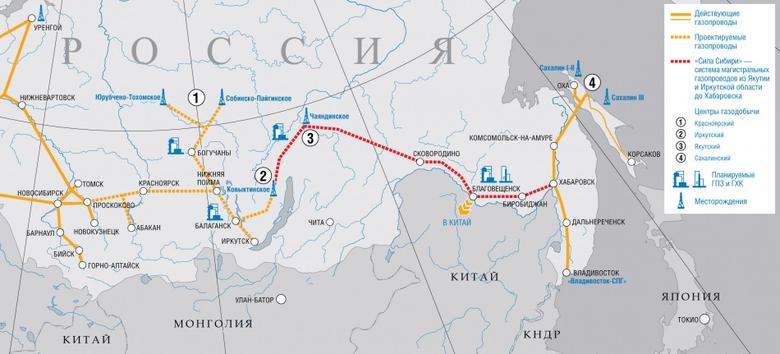

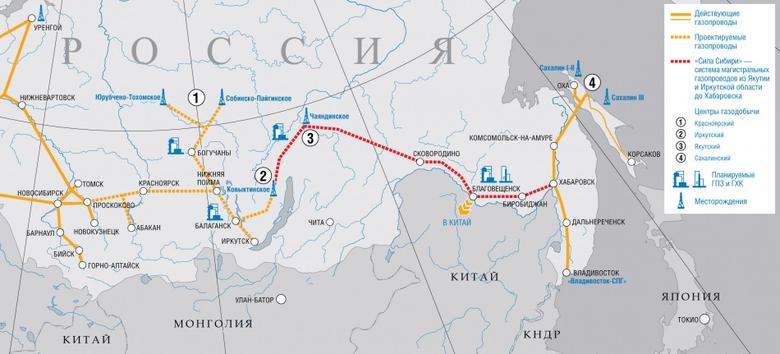

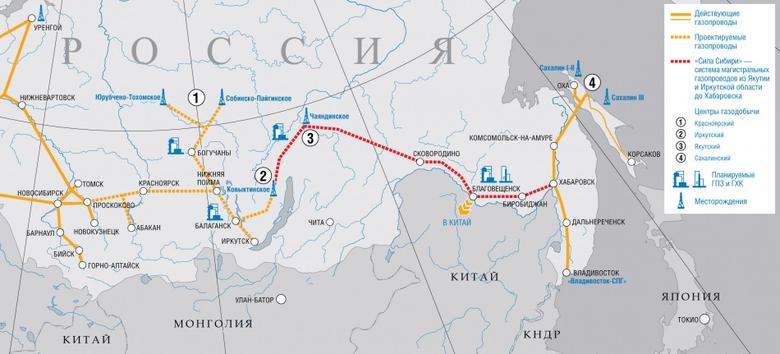

The Power of Siberia pipeline is one of the most anticipated energy projects in Asia, expected to eventually pump 38 Bcm/year of natural gas from East Siberia to China. It has huge implications for China's natural gas supply, LNG import demand and Moscow's strategic pivot to Asian markets.

"Currently the pipeline construction process is right on track and we think we can hit the target to get the supply by December 20, 2019," Ling Xiao, PetroChina's vice president and head of the gas and pipeline business, said at a briefing in Hong Kong.

"According to the agreement, Russia will supply 5 Bcm of gas in 2020 and will increase the annual volume year on year to hit 38 Bcm in 2025," Ling said.

PetroChina's parent company China National Petroleum Corp or CNPC signed the 30-year sale and purchase agreement to supply gas from the Power of Siberia pipeline with Russia's Gazprom in May 2014. Russia committed to start gas supplies from December 20, 2019.

In mid-February 2019, Gazprom chief executive Alexei Miller said during talks with CNPC in Beijing that flows would start even earlier on December 1.

PIPELINE GAS ECONOMICS

However, PetroChina could be impacted by high costs because the price for importing Russian pipeline gas is higher than current domestic city-gate prices, executives said.

"It is difficult for us to pass through the Russian gas cost to end-users as the government has adjusted the city-gate price several times since 2014 when [both parties] set the import price and signed the contract," Ling said, adding that the company would try to lower losses on gas sales.

PetroChina's imported natural gas sales, including both pipeline and LNG imports, rose 27.5% or 15.75 Bcm year-on-year to 72.89 Bcm in 2018, comprising 48.4 Bcm from central Asia, 3.29 Bcm from Myanmar and 21.2 Bcm of LNG, according to Ling. It sold 159.6 Bcm of gas in the domestic market last year, up 19.6% from 2017, according to the company's annual report.

It incurred a loss of Yuan 24.91 billion ($3.71 billion) in selling imported gas and LNG last year, which was Yuan 960 million more than 2017 levels due to higher volume and prices, Ling said.

Import costs increased by Yuan 21 billion in 2018, for both pipeline gas and LNG, through term contracts and spot buying, because gas prices are linked with oil prices, Ling said.

Brent crude prices averaged $72/b in 2018, nearly $17/b more than 2017. Platts JKM spot LNG price averaged $9.76/MMBtu in 2018 compared with $7.13/MMBtu in 2017.

PetroChina plans to renegotiate prices with central Asian gas suppliers and optimize term LNG imports in summer and winter, while trying to sell spot supplies at a profit, to mitigate its losses, Ling said.

DOMESTIC OUTPUT TO GROW

PetroChina's domestic natural gas output will maintain an annual growth rate of 5-6% in the coming years, with a target to produce 150 Bcm by 2025, up from around 120 Bcm in 2020, chief financial officer Chai Shouping said.

In 2018, PetroChina's domestic natural gas production rose 5.4% year on year to 94.16 Bcm, accounting for 58.8% of China's total gas output, according to company data and data from National Bureau of Statistics.

Chai expects unconventional gas to become an important source of gas production eventually.

PetroChina plans to raise its capex by 17.4% year on year to Yuan 300.6 billion in 2019. About 76% of the budget will go to upstream exploration and development, up 16% year on year.

-----

Earlier:

2019, March, 22, 10:30:00

COMPETITIVE RUSSIAN LNG

Russian LNG is well positioned to compete with North American projects to reach new markets in Asia and the Atlantic Basin despite the challenges, a Shell executive said Wednesday at the LNG Congress in Moscow.

2019, March, 20, 10:50:00

GAZPROM'S INVESTMENT PROJECTS

The Gazprom Board of Directors expressed its approval the Company’s ongoing work on its major investment projects.

2019, March, 18, 13:00:00

U.S., RUSSIA SANCTIONS FOREVER

U.S. DT - the U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC) designated six Russian individuals and eight entities in response to Russia’s continued and ongoing aggression in Ukraine.

2019, March, 15, 10:15:00

U.S. LNG FOR CHINA DOWN

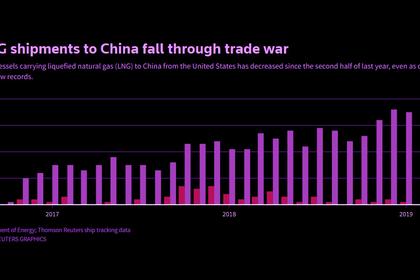

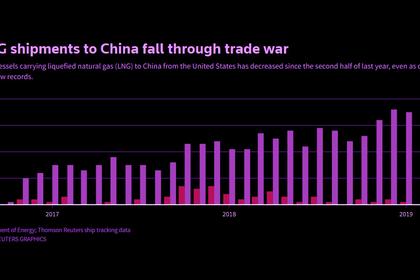

Only one liquefied natural gas (LNG) vessel that left the United States in 2019 went to China, Reuters shipping data show, as the eight-month trade war between the two nations starts to cool.

All Publications »

Tags:

RUSSIA,

CHINA,

GAS,

GAZPROM,

PETROCHINA,

PIPELINE