SHAKY INDIA'S LNG

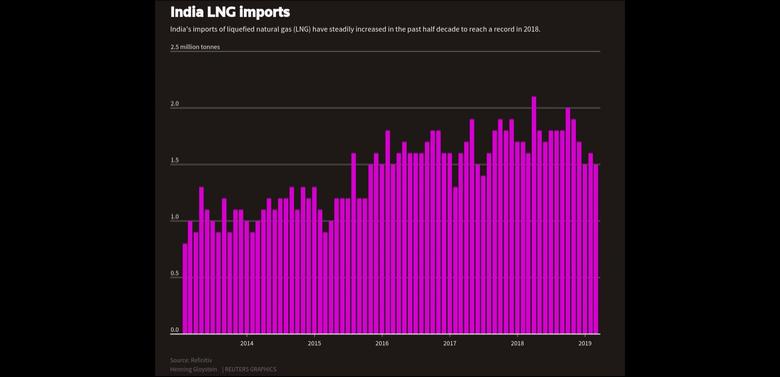

REUTERS - India's demand for liquefied natural gas (LNG) is set to rise by about 10 percent this year even as the country adds import capacity at a faster clip, because infrastructure constraints keep gas from getting to consumers and hinder growth rates.

New Delhi made a commitment in the Paris Agreement of 2015 to reduce the carbon emissions intensity of India's economy by one-third, and aims to more than double the share gas has in its energy mix to 15 percent by 2030, from 6.2 percent now.

India had four terminals receiving LNG last year, taking in 21 million to 23 million tonnes of the super-chilled fuel, up nearly 10 to 13 percent from 2017, according to data from the Petroleum Planning and Analysis Cell and shipping data.

Over the next seven years the government plans to build another 11 terminals. One of those was commissioned this month, and two more are expected to start up later this year.

"The strongest growth rate is expected in city gas demand, primarily due to an increase in consumption by commercial users on the back of growth in city-gas infrastructure," said Poorna Rajendran, senior analyst for consultancy FGE.

But with existing terminal capacity now at 35 million tonnes a year, and additions and expansions expected to bring that to 41.5 million tonnes by end-2019, India's LNG import terminals are likely to remain underutilized for years to come.

Driven by demand from city gas distribution and transportation, India's LNG demand is expected to grow by 9 to 11 percent to about 25 million to 26 million tonnes this year, said analysts from Wood Mackenzie and FGE. That would still put terminal utilization at just over 60 percent at year-end.

While India's ruling party plans to invest billions of dollars to extend the gas pipeline network across the country, progress is slow and half of the existing terminals operate at well below their capacity, several industry sources said.

The government aims to run all LNG terminals at full capacity by 2022 as it works to complete the entire pipeline grid, India's Oil Secretary M M Kutty told Reuters.

Analysts, though, say India will struggle to do this.

"The pace at which (planned projects) come on-stream will be dictated by the financial and technical capabilities of the promoters as well as wider infrastructure and land-related challenges in India," said Wood Mackenzie's senior analyst, Kaushik Chatterjee.

-----

Earlier: