U.S. OIL PRODUCTION 12.1 MBD

РЕЙТЕР -

-----

Раньше:

2018, March, 14, 11:45:00

REUTERS - U.S. West Texas Intermediate (WTI) crude futures CLc1 were at $60.77 a barrel at 0753 GMT, up 6 cents, or 0.1 percent, from their previous settlement. Brent crude futures LCOc1 were at $64.62 per barrel, down just 2 cents from their last close.

|

2018, March, 7, 15:00:00

РЕЙТЕР - К 9.17 МСК фьючерсы на североморскую смесь Brent опустились на 0,85 процента до $65,23 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $62,07 за баррель, что на 0,85 процента ниже предыдущего закрытия.

|

2018, March, 7, 14:00:00

EIA - North Sea Brent crude oil spot prices averaged $65 per barrel (b) in February, a decrease of $4/b from the January level and the first month-over-month average decrease since June 2017. EIA forecasts Brent spot prices will average about $62/b in both 2018 and 2019 compared with an average of $54/b in 2017.

|

2018, March, 5, 11:35:00

РЕЙТЕР - К 9.28 МСК фьючерсы на североморскую смесь Brent поднялись на 0,33 процента до $64,58 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $61,44 за баррель, что на 0,31 процента выше предыдущего закрытия.

|

2018, March, 4, 11:30:00

МИНФИН РОССИИ - Средняя цена нефти марки Urals по итогам января – февраля 2018 года составила $ 65,99 за баррель.

|

2018, February, 27, 14:15:00

РЕЙТЕР - К 9.18 МСК фьючерсы на североморскую смесь Brent опустились на 0,15 процента до $67,40 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $63,80 за баррель, что на 0,17 процента ниже предыдущего закрытия.

|

2018, February, 27, 14:05:00

МИНФИН РОССИИ - Средняя цена на нефть Urals за период мониторинга с 15 января по 14 февраля 2018 года составила $66,26457 за баррель, или $483,7 за тонну.

|

U.S. OIL PRODUCTION 12.1 MBD

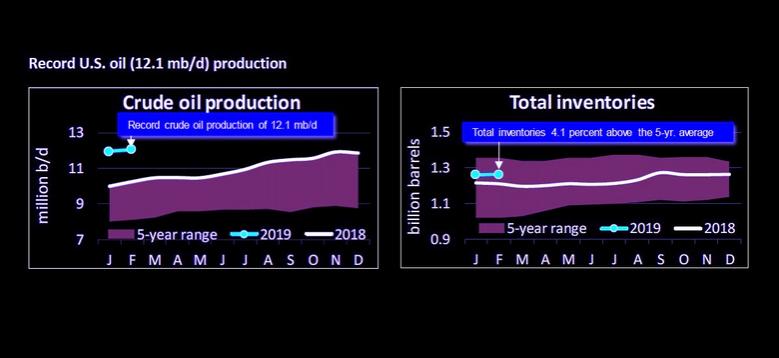

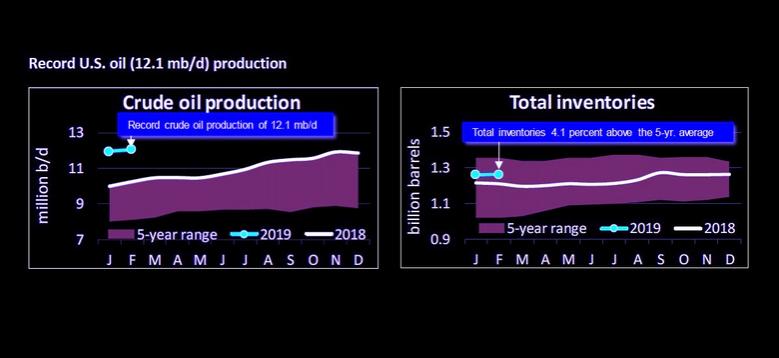

API - the American Petroleum Institute's latest monthly statistical report showed that the U.S set a new record for oil production at 12.1 million barrels a day (mb/d) in February, continuing America's position as the world's leading oil producer. The increased production reflects the rise in drilling activity development over the past quarter. In addition, petroleum demand in February was the strongest for that month in more than a decade at 20.4 (mb/d).

"High U.S. consumer demand for gasoline, diesel and jet fuel is being met right here at home with record U.S. oil production," said API Chief Economist Dean Foreman. "America's natural gas and oil industry is driving safe and responsible production to meet demand here and abroad. A strong energy industry benefits all Americans and strengthens our nation's economy and national security. Due to industry's leadership, U.S. consumers continue to enjoy low prices at the pump, and our allies overseas have a friendly energy partner by their sides."

February 2019 highlights:

- Gasoline demand 8.9 mb/d grew by 1.0 percent year to year

- Distillate demand 4.2 mb/d strongest for February since 2015

- Strongest February jet fuel demand 1.6 mb/d since 2005

- Other oils' (refinery and petrochemical feedstock) demand 5.5 mb/d highest for February on record

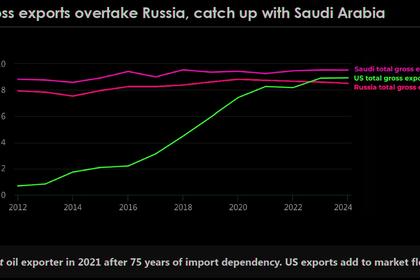

- U.S. petroleum net imports of 1.1 mb/d

- Refinery throughput 16.1 mb/d and capacity utilization at 86.7 percent

- Total petroleum inventories 4.1 percent above the 5-year average

"Thanks to affordable, abundant and reliable American-made natural gas and oil, Americans are saving more money on their energy bills while also reducing CO2 emissions at home and abroad. In fact, API's Industry Outlook found that Americans saved $300 billion on energy costs between 2013 and 2016. It's a win-win deal for consumers and the environment, and as the U.S. progresses towards being a net exporter of oil as well as natural gas, industry looks forward to advancing the next chapter of this success story to new heights."

-----

Earlier:

2019, March, 20, 11:05:00

U.S. OIL WILL UP

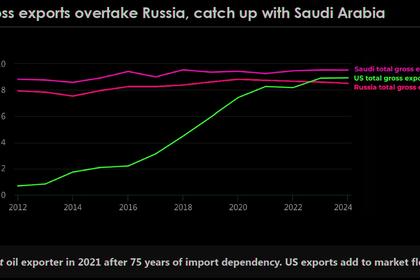

IEA - The United States will drive global oil supply growth over the next five years thanks to the remarkable strength of its shale industry, triggering a rapid transformation of world oil markets

2019, March, 20, 11:00:00

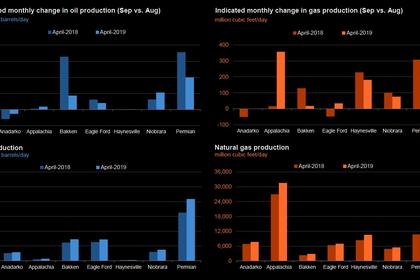

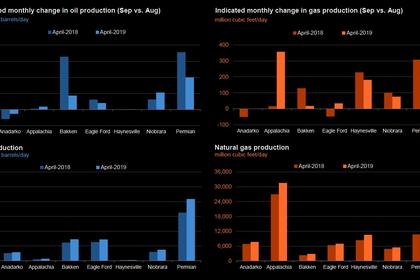

U.S. PRODUCTION: OIL + 85 TBD, GAS + 883 MCFD

U.S. EIA - Crude oil production from the major US onshore regions is forecast to increase 85,000 b/d month-over-month in April from 8,507 to 8,592 thousand barrels/day , gas production to increase 883 million cubic feet/day from 78,137 to 79,020 million cubic feet/day .

2019, March, 15, 10:35:00

U.S. GAS PRODUCTION RECORD

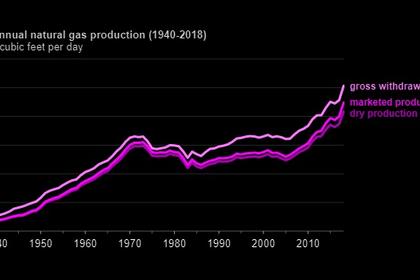

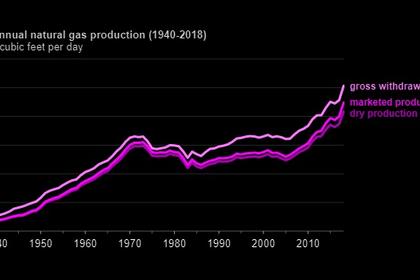

U.S. natural gas production grew by 10.0 billion cubic feet per day (Bcf/d) in 2018, an 11% increase from 2017. The growth was the largest annual increase in production on record, reaching a record high for the second consecutive year

2019, March, 15, 10:30:00

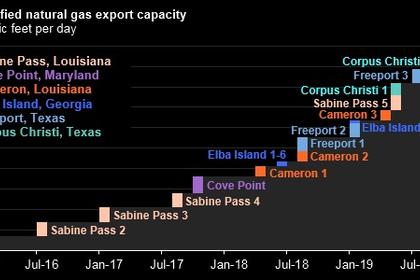

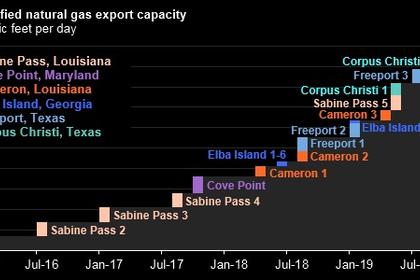

LNG U.S. ACCELERATION

Exports of liquefied natural gas (LNG) from the U.S. continue to rise, as the use of natural gas for power generation increases in countries such as China, South Korea, Japan, and Mexico.

All Publications »

Tags:

USA,

OIL,

GAS,

PRODUCTION