VENEZUELA'S OIL FOR CHINA WILL DOWN

PLATTS - PetroChina Ltd, the listed subsidiary of state-owned CNPC, expects its crude imports from Venezuela to drop by about a third to around 10 million mt (about 186,000 b/d) in 2019 from 15 million mt in 2018, a senior executive said late Thursday.

The decline in Venezuelan crude flows to China, among the biggest buyers of PDVSA's crude oil, underscores the impact of US sanctions despite supply commitments under oil-for-loan agreements with PetroChina.

The trading business with Venezuela is operating as usual, but crude import volumes will be at slightly over 10 million mt this year, due to supply issues in Venezuela, Hou Qijun, PetroChina's executive director and president, said on the sidelines of the company's annual briefing in Hong Kong.

State-owned PetroChina, which executed the loan-for-oil deal for China, received around 15 million mt of Venezuelan crude in 2018, executives said last year. The volume accounted for 90% of China's total crude imports of 16.63 million mt from the South American producer in 2018.

In 2017, China imported around 21.77 million mt of crudes from Venezuela, out of which around 70% was imported by PetroChina in return for loans.

Venezuelan crude exports have been falling sharply since US sanctions were imposed on state-owned PDVSA in January, crimping not just payment mechanisms but also the supplies of diluent needed to dilute heavy Venezuelan grades to enable exports.

PetroChina's international trading arm Chinaoil (Hong Kong) sold a cargo of 975,000 barrels of Nigerian Agbami crude for April 18-20 delivery to PDVSA as a diluent for the extra-heavy crude from the Orinoco Belt, Platts reported on Thursday.

This is an ad-hoc purchase by PDVSA that was carried out under a compensation mechanism, with Chinaoil receiving 1.8 million barrels of Merey 16 crude in a March 19-21 window in return, PDVSA sources said.

NO POLITICAL RISKS FOR UPSTREAM PROJECT

Meanwhile, PetroChina's investment in upstream Venezuela is being "run more or less as normal and there should be no [political] risk in the projects," Hou told Platts, adding that the only impact was from electricity cuts.

"The project has been approved by the government and parliament," Hou said.

In 2008, CNPC Exploration and Development Co Ltd, a 50:50 joint venture between PetroChina and a fully-owned subsidiary of CNPC, acquired a 40% stake in the Carabobo block in Monagas State in Venezuela.

The other 60% stake in the block, which produces heavy crude, is held by PDVSA, which is also the operator of the block.

For the year ended December 31, 2017, the block accounted for around 1.4% of PetroChina's total profit, according to filings with the US SEC in April 2018.

-----

Earlier:

2019, March, 20, 10:55:00

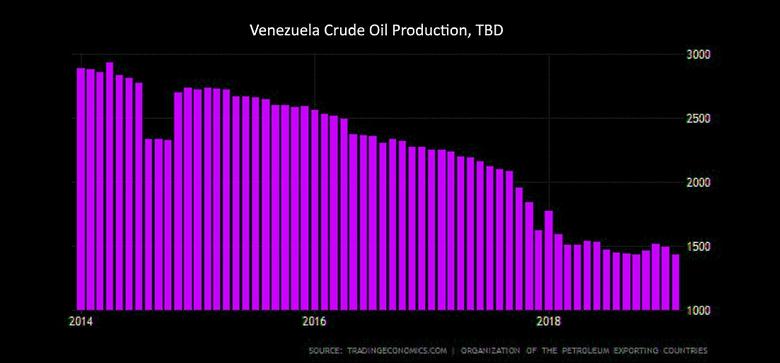

VENEZUELA'S OIL PRODUCTION 1.2 MBDIEA - Until recently, Venezuela’s oil production had stabilised at around 1.2 mb/d. During the past week, industry operations were seriously disrupted and ongoing losses on a significant scale could present a challenge to the market. |

2019, February, 27, 09:10:00

VENEZUELA'S OIL FOR CHINAPLATTS - China's crude imports from Venezuela surged 50.7% month on month to 411,000 b/d or 1.74 million mt in January, posting the fifth month in a row of increase after hitting a four-year low last September, data released by the General Administration of Customs showed |

2019, January, 9, 10:45:00

VENEZUELA'S OIL PRODUCTION: BELOW 1 MBDPLATTS - The US Energy Information Administration forecasts that Venezuelan oil production will fall below 1 million b/d in the second half of 2019, according to Erik Kreil, an international energy analysis team leader with the EIA. |

2018, September, 17, 15:00:00

VENEZUELA - CHINA COOPERATIONREUTERS - Venezuela gave China another stake in the OPEC nation’s oil industry and signed several other deals in the energy sector, but Beijing made no mention of new funds for Caracas during President Nicolas Maduro’s visit to his key financier on Friday. |

2018, July, 25, 09:15:00

VENEZUELA'S ECONOMIC COLLAPSEIMF - On Venezuela, it is difficult to discuss because it is in a state of economic collapse. We have not engaged with them in over a decade on their economic policies. |

2018, January, 10, 12:45:00

VENEZUELA'S OIL DOWN TO 1.7 MBDPLATTS - Venezuelan crude output plummeted in December to 1.70 million b/d, according to the latest S&P Global Platts OPEC survey released Monday. |

2017, September, 18, 12:30:00

RUSSIA - CHINA - VENEZUELA OIL“The principal risk regarding Russian and Chinese activities in Venezuela in the near term is that they will exploit the unfolding crisis, including the effect of US sanctions, to deepen their control over Venezuela’s resources, and their [financial] leverage over the country as an anti-US political and military partner,” observed R. Evan Ellis, a senior associate in the Center for Strategic and International Studies’ Americas Program. |