VENEZUELA'S PAYMENT TO CONOCO $8.7 BLN

PLATTS - An international tribunal on Friday ordered Venezuela to pay ConocoPhillips roughly $8.7 billion in compensation for the seizure of company assets in 2007.

Among other payments, the World Bank Group's International Center for Settlement of Investment Disputes ordered Friday that Venezuela must pay nearly $4.5 billion to compensate for the seizure of ConocoPhillips' Hamaca project and nearly $3.4 billion to compensate for the seizure of its Petrozuata project. In addition to those two heavy oil projects in the Orinoco Belt, the tribunal ordered Venezuela to pay more than $562 million in compensation for the seizure of ConocoPhillips' Corocoro projects in the southwestern Gulf of Paria.

ConocoPhillips helped Venezuela develop the Petrozuata, Hamaca and Corocoro projects with "industry-leading technology and substantial long-term investments," before the projects were seized by the then-Chavez government in 2007, the company said.

The award announced Friday follows an April 2018 award of $2 billion against Venezuela, state-owned oil company PDVSA and two subsidiaries, to ConocoPhillips for the seizure of the Hamaca and Petrozuata projects. Arbitration against PDVSA on the Corocoro project is still pending, ConocoPhillips said.

Friday's decision "upholds the principle that governments cannot unlawfully expropriate private investments without paying compensation," Kelly Rose, ConocoPhillips' senior vice president, legal, general counsel and corporate secretary, said in a statement.

It is unclear how US sanctions on PDVSA, aimed at removing Venezuelan President Nicolas Maduro from power, will impact Friday's decision.

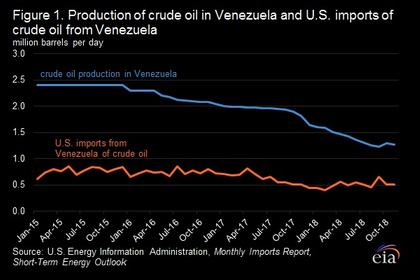

On January 28, the US Department of the Treasury unveiled sweeping sanctions on PDVSA, setting an immediate ban on US exports of diluent to Venezuela and requiring payments made to PDVSA to be through blocked accounts, setting up a de facto ban on US imports of Venezuela crude. The US, and dozens of other nations, recognize opposition leader Juan Guaido as Venezuela's legitimate president.

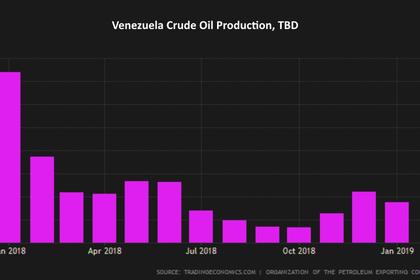

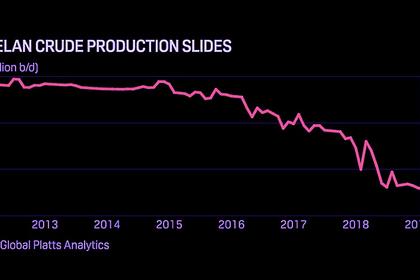

S&P Global Platts Analytics forecasts that US sanctions will cause Venezuelan crude output, which averaged about 1.2 million b/d in January, to fall to 825,000 b/d in the fourth quarter of this year and then to fall to an average of 750,000 b/d in 2020.

Venezuela produced 1.10 million b/d of crude in February, down 60,000 b/d month on month, according to an S&P Global Platts survey released Thursday.

Venezuela's oil production has fallen 910,000 b/d in two years and is at its lowest point since a strike in late 2002 and early 2003, according to Platts survey data.

-----

Earlier: