2019 GLOBAL OIL DEMAND EXCEED 100 MBD

OPEC - Monthly Oil Market Report, 10 April 2019

Oil Market Highlights

Crude Oil Price Movements

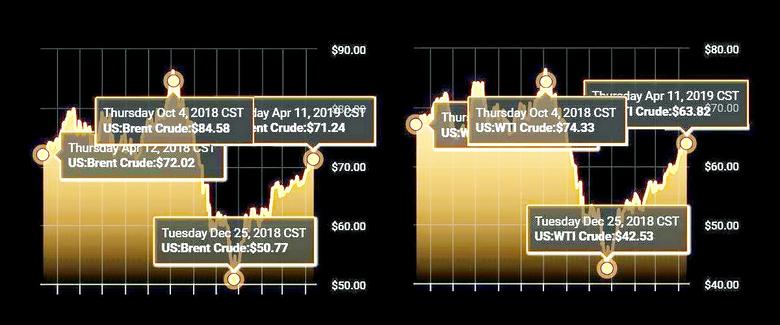

In March 2019, the OPEC Reference Basket (ORB) rose by $2.54, or 4.0%, month-on-month (m-o-m), settling at $66.37/b, amid strengthening oil market fundamentals and improving market sentiment, which were supported by the commitment of OPEC and participating non-OPEC countries to restore global oil market stability. Crude oil futures prices extended gains in March, with both ICE Brent and NYMEX WTI reaching their highest since last October, amid uncertainties about the supply outlook from several regions.

ICE Brent averaged a m-o-m rise of $2.60, or 4.0%, to $67.03/b, while NYMEX WTI rose $3.19, or 5.8%, m-o-m to $58.17/b. However, year-to-date (y-t-d), ICE Brent was $3.40, or 5.1% lower, at $63.83/b, and NYMEX WTI was $7.99, or 12.7%, lower at $54.90/b. The ICE Brent price structure flipped into backwardation, the NYMEX WTI price structure remained in steep contango, while DME Oman continued to see significant backwardation. Hedge funds and other money managers further raised their bullish positions in both ICE Brent and NYMEX WTI, reaching the highest level since October 2018.

World Economy

The global economic growth projection remains estimated at 3.6% for 2018, while for 2019 it is revised slightly downward to 3.2% from the 3.3% projected last month. The main downward revisions are made for the OECD economies. US 2018 growth remains unchanged at 2.9%, but 2019 growth was revised down from 2.5% to 2.4%. Euro-zone 2018 growth remains unchanged at 1.8%, while 2019 growth was revised down from 1.3% to 1.2%. Similarly, GDP growth in Japan was revised lower from 0.7% to 0.6% for 2019, compared with 0.8% in 2018. In the non-OECD economies, the main 2018 and 2019 forecasts remain unchanged. China’s growth forecast remains at 6.1%, after reaching 6.6% in 2018. India’s growth forecast remains at 7.1%, following 7.3% in 2018. Growth in Brazil remains unchanged at 1.8% in 2019, after seeing 1.1% in 2018, while Russia’s 2019 GDP growth forecast is also unchanged at 1.6%, following an upward revision of 2.3% for 2018.

World Oil Demand

In 2018, global oil demand growth was revised down by 20 tb/d from last month’s assessment amid weaker 4Q18 oil demand data from OECD Asia Pacific. Global oil demand in 2018 is now estimated to have increased by 1.41 mb/d y-o-y, reading 98.70 mb/d. Similarly, global oil demand in 2019 is revised downward by 30 tb/d from 1.24 mb/d to around 1.21 mb/d compared with last month’s projection and this is due to slower-than-expected economic activity compared with the expectations of a month earlier. As a result, total world demand for the year is now expected to reach 99.91 mb/d and exceed the 100.00 mb/d threshold during 2H19. OECD oil demand growth is projected to reach 0.21 mb/d, with OECD Americas leading the increase, while oil demand in the non-OECD region is projected to rise by around 1.0 mb/d, with Other Asia and China being the primary contributors to growth.

World Oil Supply

Non-OPEC oil supply growth in 2018 was revised upward by 0.16 mb/d from the previous month’s report and is now estimated at 2.90 mb/d to average 62.37 mb/d. The adjustment was mainly due to upward revisions in the UK, Brazil and China. The main drivers of growth for the year were the US with 2.26 mb/d, along with Canada, Russia, the UK, Kazakhstan, and Qatar. Meanwhile Mexico, Norway and Vietnam are estimated to have seen the largest declines. In contrast, non-OPEC oil supply growth in 2019 was revised downward by 0.06 mb/d to average 2.18 mb/d, mainly due to extended maintenance in Kazakhstan, Brazil and Canada, which was partially offset by upward revisions to the US and Russia. Total non-OPEC supply in 2019 is now forecast to average 64.54 mb/d, with the US, Brazil, the UK, Australia and Ghana being the major contributors to growth, while Mexico, Kazakhstan, Norway, Indonesia and Vietnam are projected to see the largest declines. OPEC NGLs and non-conventional liquids are estimated to have grown by 0.04 mb/d in 2018, unchanged from the previous estimate, to average 4.98 mb/d, and are forecast to grow by 0.09 mb/d in 2019 to average 5.07 mb/d. In March 2019, OPEC crude oil production decreased by 534 tb/d to average 30.02 mb/d, according to secondary sources.

Product Markets and Refining Operations

Global product markets showed solid gains over the month of March 2019. Refining margins saw an extension of the upward trend recorded in the previous month, reaching the highest levels seen y-t-d, and boosted by a sharp recovery in gasoline cracks after steep multi-month declines. In the US, a combination of planned and unplanned refinery outages affected gasoline production, resulting in considerable declines in inventory levels and lending strong support to refining economics. In Europe, strength emerged from larger gasoline exports to the US and Africa, despite weaker middle distillate fundamentals due to narrower arbitrage opportunities. Meanwhile, in Asia, robust performance at the top of the barrel, supported by scheduled and unscheduled refinery maintenance, provided relief to the oversupply environment witnessed in recent months.

Tanker Market

Average dirty tanker spot freight rates declined further in March 2019, continuing the negative trend seen so far in the first quarter of 2019. Lower rates were seen in most reported dirty classes. This was mainly attributed to high vessel supply, while market activities remained thin in general. Clean tanker spot freight rates showed some improvement in the West, supported mainly by higher rates in Northwest Europe on the back of balanced tonnage availability and occasional shortages in prompt vessel supply. In the East, a lack of activity dominated different classes, resulting in a drop in rates across several routes.

Stock Movements

Preliminary data for February showed that total OECD commercial oil stocks fell by 18.3 mb m-o-m to stand at 2,863 mb. This was 7.0 mb higher than the same time one year ago, and 7.5 mb above the latest five-year average. Compared with the latest five-year average, crude indicated a surplus of 25 mb, while product stocks showed a deficit of 17.5 mb. In terms of days of forward cover, OECD commercial stocks rose by 0.4 days m-o-m in February to stand at 60.6 days. This was 0.2 days above the same period in 2018, but 1.1 days below the latest five-year average.

Balance of Supply and Demand

Demand for OPEC crude in 2018 is estimated at 31.4 mb/d, 1.5 mb/d lower than the 2017 level. In 2019, demand for OPEC crude is forecast at 30.3 mb/d, around 1.1 mb/d lower than the estimated 2018 level.

-----

Earlier:

2019, April, 10, 11:35:00

OIL PRICES 2019-20: $65-$62Brent crude oil spot prices averaged $66 per barrel (b) in March, up $2/b from February 2019. Brent prices for the first quarter of 2019 averaged $63/b, which is $4/b lower than the same period in 2018. Despite lower crude oil prices than last year, Brent prices in March were $9/b higher than in December 2018, marking the largest December-to-March price increase since December 2011 to March 2012. |

2019, April, 10, 11:25:00

OIL MARKET HEALTHThe kingdom will pump about 9.8 million barrels a day in March and April and export less than 7 million barrels daily in both months, Al-Falih said in March. Saudi Arabia has a production target of 10.3 million barrels a day. |

2019, April, 10, 11:20:00

GLOBAL OIL STOCKS 2.88 BBLAccording to OPEC's latest monthly oil market report, global oil inventories stood at 2.88 billion barrels in January, about 19.1 million barrels above the five-year average that OPEC is targeting with its current output policy. |

2019, March, 27, 12:00:00

GLOBAL ENERGY DEMAND UP 2.3%IEA - Energy demand worldwide grew by 2.3% last year, its fastest pace this decade, an exceptional performance driven by a robust global economy and stronger heating and cooling needs in some regions. |

2019, March, 18, 13:10:00

BRENT OIL: UNDERVALUEDIn the context of supply and demand balance,the current price of BRENT oil is undervalued.Neither OPEC nor the IEA has considerably brought down their forecasts for global oil demand in the current year. |

2019, March, 15, 10:40:00

OPEC: OIL DEMAND GROWTH LESSIn 2018, world oil demand is estimated to have grown by 1.43 mb/d, down by 0.04 mb/d from the previous estimate amid downward revisions in both OECD and non-OECD regions. |

2019, March, 13, 11:30:00

OIL PRICES 2019-20: $63-$62Brent crude oil spot prices averaged $64 per barrel (b) in February, up $5/b from January 2019 and about $1/b lower than at the same time last year. |