CHEVRON BUYS ANADARKO FOR $50 BLN

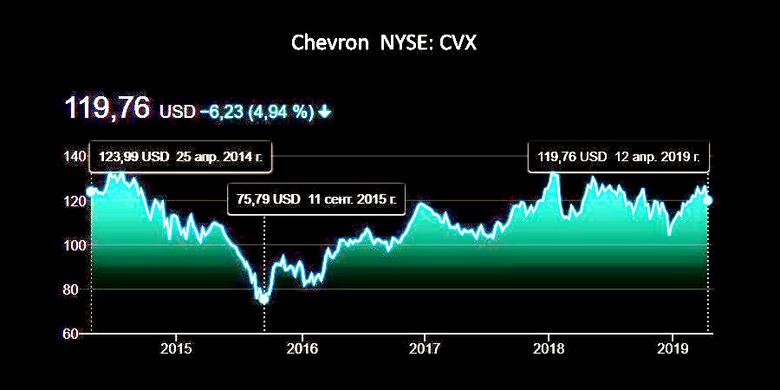

CHEVRON - April 12, 2019 – Chevron Corporation (NYSE: CVX) announced today that it has entered into a definitive agreement with Anadarko Petroleum Corporation (NYSE: APC) to acquire all of the outstanding shares of Anadarko in a stock and cash transaction valued at $33 billion, or $65 per share. Based on Chevron's closing price on April 11th, 2019 and under the terms of the agreement, Anadarko shareholders will receive 0.3869 shares of Chevron and $16.25 in cash for each Anadarko share. The total enterprise value of the transaction is $50 billion.

The acquisition of Anadarko will significantly enhance Chevron's already advantaged Upstream portfolio and further strengthen its leading positions in large, attractive shale, deepwater and natural gas resource basins. Furthermore, Western Midstream Partners, LP (NYSE: WES) is a successful midstream company whose assets are well aligned with the combined companies' upstream positions, which should further enhance their economics and execution capabilities. "This transaction builds strength on strength for Chevron," said Chevron's Chairman and CEO Michael Wirth. "The combination of Anadarko's premier, high-quality assets with our advantaged portfolio strengthens our leading position in the Permian, builds on our deepwater Gulf of Mexico capabilities and will grow our LNG business. It creates attractive growth opportunities in areas that play to Chevron's operational strengths and underscores our commitment to short-cycle, higher-return investments." "This transaction will unlock significant value for shareholders, generating anticipated annual run-rate synergies of approximately $2 billion and will be accretive to free cash flow and earnings one year after close," Wirth concluded. "The strategic combination of Chevron and Anadarko will form a stronger and better company with world-class assets, people and opportunities," said Anadarko Chairman and CEO Al Walker. "I have tremendous respect for Mike and his leadership team and believe Chevron's strategy, scale and operational capabilities will further accelerate the value of Anadarko's assets."

Transaction Benefits

• Strong Strategic Fit: Anadarko's assets will enhance Chevron's portfolio across a diverse set of asset classes, including:

o Shale & Tight – The combination of the two companies will create a 75-mile-wide corridor across the most attractive acreage in the Delaware basin, extending Chevron's leading position as a producer in the Permian.

o Deepwater – The combination will enhance Chevron's existing high-margin position in the deepwater Gulf of Mexico (GOM), where it is already a leading producer, and extend its deepwater infrastructure network.

o LNG – Chevron will gain another world-class resource base in Mozambique to support growing LNG demand. Area 1 is a very cost-competitive and well-prepared greenfield project close to major markets.

• Significant Operating and Capital Synergies: The transaction is expected to achieve run-rate cost synergies of $1 billion before tax and capital spending reductions of $1 billion within a year of closing.

• Accretive to Free Cash Flow and EPS: Chevron expects the transaction to be accretive to free cash flow and earnings per share one year after closing, at $60 Brent.

• Opportunity to High-Grade Portfolio: Chevron plans to divest $15 to $20 billion of assets between 2020 and 2022. The proceeds will be used to further reduce debt and return additional cash to shareholders.

• Increased Shareholder Returns: As a result of higher expected free cash flow, Chevron plans to increase its share repurchase rate from $4 billion to $5 billion per year upon closing the transaction.

Transaction Details

The acquisition consideration is structured as 75 percent stock and 25 percent cash, providing an overall value of $65 per share based on the closing price of Chevron stock on April 11th, 2019. In aggregate, upon closing of the transaction, Chevron will issue approximately 200 million shares of stock and pay approximately $8 billion in cash. Chevron will also assume estimated net debt of $15 billion. Total enterprise value of $50 billion includes the assumption of net debt and book value of non-controlling interest.

The transaction has been approved by the Boards of Directors of both companies and is expected to close in the second half of the year. The acquisition is subject to Anadarko shareholder approval. It is also subject to regulatory approvals and other customary closing conditions.

Upon closing, the Company will continue be led by Michael Wirth as Chairman and CEO. Chevron will remain headquartered in San Ramon, California.

-----

Earlier:

2019, February, 6, 10:30:00

MOZAMBIQUE LNG FOR CHINAPLATTS - US-based Anadarko Petroleum has agreed to sell 1.5 million mt/year of LNG from its planned 12.9 million mt/year Mozambique LNG project to China's CNOOC for a period of 13 years. |

2019, January, 25, 08:20:00

U.S. - VENEZUELA SANCTIONSPLATTS - Chevron, PBF Energy, Valero and Citgo, which is owned by PDVSA, are the largest US refiners of Venezuelan crude, according to the US Energy Information Administration. Spokesmen for those four companies did not respond to requests for comment Wednesday. |

2018, November, 7, 10:45:00

CHEVRON'S NET INCOME $4 BLNCHEVRON - Chevron Corporation (NYSE: CVX) reported earnings of $4.0 billion ($2.11 per share – diluted) for third quarter 2018, compared with $2.0 billion ($1.03 per share – diluted) in the third quarter of 2017. |

2018, October, 31, 12:50:00

ANADARKO NET INCOME $363 MLNANADARKO - Anadarko Petroleum Corporation (NYSE: APC) announced 2018 third‑quarter results, reporting net income attributable to common stockholders of $363 million, or $0.72 per share (diluted). |

2018, October, 3, 08:15:00

EQUINOR ACQURIES 40%EQUINOR - Equinor has signed an agreement to acquire Chevron’s 40% operated interest in the Rosebank project, one of the largest undeveloped fields on the UK Continental Shelf (UKCS). |

2018, July, 30, 13:25:00

CHEVRON EARNINGS $3.4 BLNCHEVRON - Chevron Corporation (NYSE: CVX) reported earnings of $3.4 billion ($1.78 per share – diluted) for second quarter 2018, compared with $1.5 billion ($0.77 per share – diluted) in the second quarter of 2017. Included in the current quarter was a receivable write-down of $270 million charged to operating expense. Foreign currency effects increased earnings in the 2018 second quarter by $265 million, compared with an increase of $3 million a year earlier. |

2018, June, 29, 10:35:00

MOZAMBIQUE'S LNG DEVELOPMENTFT - Anadarko has estimated the reserves in its Area 1 acreage off the coast of Mozambique at about 75tn cubic feet, implying a resource life of about 120 years at the initial production rate of 12.88m tonnes of LNG per year, but the consortium intends to expand the plant every five years to add more capacity. |