CHINA'S OIL INVESTMENT $74 BLN

NAR - China's three state-owned oil companies are boosting domestic and overseas investment with the aim of increasing crude oil and natural gas output.

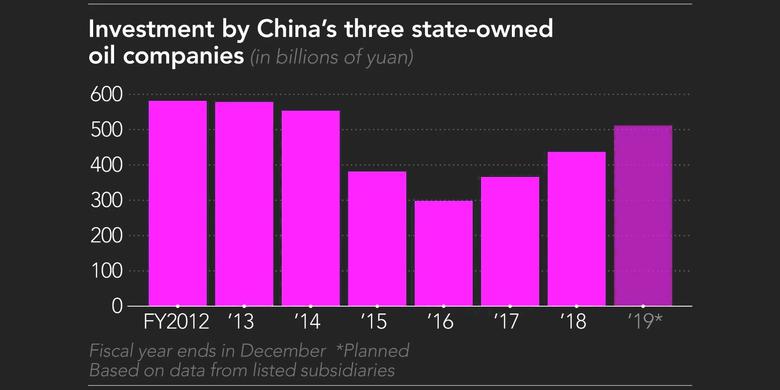

Total investment by the three companies is expected to rise nearly 20% in the fiscal year through December 2019, and is likely to reach 500 billion yuan ($74.4 billion) for the first time in five years.

Average crude oil prices rose to $68 from $50 per barrel in fiscal 2018. That has lifted the earnings of the Chinese companies, which are trying to guarantee greater energy security in case relations between Beijing and Washington fail to improve. The three companies' dependence on foreign oil topped 70% for the first time in 2018, and that on natural gas was 45%.

The U.S. and China -- which are at odds over trade and high tech -- have common interests when it comes to natural gas. The U.S. wants China to import more liquefied natural gas, and China is hoping for cheap U.S. energy as domestic demand increases.

But the U.S. is becoming increasingly wary of China's technical and military capabilities, and some observers in China believe the friction between the world's two largest economies will continue for a while.

Washington is ready to impose sanctions against Chinese companies if necessary. Chinese telecommunication equipment company ZTE briefly ran into financial trouble after the U.S. government banned it from buying chips from U.S. companies in 2018.

In this climate, Beijing wants to strengthen its energy security by diversify its supply, so the state-owned companies are ramping up their spending.

PetroChina, a listed subsidiary of China National Petroleum Corp., said the company will spend more money to increase crude oil and natural gas output more quickly and stably, Chairman Wang Yilin said on March 21.

In fiscal 2018, the company saw its sales increase 16.8% on the year to 2.35 trillion yuan, and net profit grew 130% to 52.5 billion yuan. Its investment is forecast to jump 17.4% on the year to 300.6 billion yuan this fiscal year.

Nearly 80% of PetroChina's investment will go toward developing oil and natural gas fields. The company will put more emphasis on natural gas, as the government under President Xi Jinping is trying to shift from coal to gas to cut air pollution.

PetroChina's investment peaked in fiscal 2012, and it started cutting back due to sluggish oil prices. After bottoming out in fiscal 2016, investment started rising again, reaching 300 billion yuan this year for the first time in six years. The company is beefing up exploration and development of natural gas in inland China.

Overseas, PetroChina in 2018 decided to acquire an interest in the Abu Dhabi oil field and a liquefied natural gas project in Canada. It is also considering participating in the new Arctic 2 LNG project in Russia.

In Iran, which has been under U.S. sanctions, the company is considering acquiring an interest in the South Pars natural gas field from French oil company Total.

CNOOC, a listed subsidiary of China National Offshore Oil Corp., the country's second-largest producer of crude oil and other petroleum products, is also boosting investment. Most of its investment is in the exploration, development and production of oil fields. It plans to increase spending this fiscal year to 70 billion yuan to 80 billion yuan from 62.6 billion yuan.

China Petroleum and Chemical, better known as Sinopec, is expected to boost its investment by 16% to 136.3 billion yuan this fiscal year. Investment in oilfield development will be increased by 41% to 59.6 billion yuan.

The three state-owned oil companies remain bullish, but there are worries about the slowing domestic economy. Net profit at Sinopec, which is susceptible to changes in the supply-demand balance of gas and chemical products in the country, in the fourth quarter dropped to about 10% that of the previous three quarters.

There has been a change in stable growth, which is creating worries and uncertainty, PetroChina Executive Director Hou Qijun said.

-----

Earlier:

2019, April, 5, 10:25:00

CHINA NEED GASChina’s LNG imports last year were about 54 million tonnes. CNPC accounts for about 60 percent of China’s overall gas imports and 70 percent of domestic production, Ling said. “LNG price will become one of the decisive factors for the amount of LNG imports,” he also said in his presentation. |

2019, March, 27, 12:00:00

GLOBAL ENERGY DEMAND UP 2.3%IEA - Energy demand worldwide grew by 2.3% last year, its fastest pace this decade, an exceptional performance driven by a robust global economy and stronger heating and cooling needs in some regions. |

2019, March, 27, 11:50:00

SAUDI'S OIL FOR CHINA UP 28.5%China's crude oil imports from Saudi Arabia surged 28.5% year on year to 1.56 million b/d in February, surpassing Russia to become the top crude supplier in the month, latest data from the General Administration of Customs showed. |

2019, March, 25, 11:35:00

POWER OF SIBERIA STARTUPThe Power of Siberia natural gas pipeline from Russia to China is on track and gas supply is expected to commence by December this year, a senior executive at state-run PetroChina, China's biggest gas importer and producer, said |

2019, March, 22, 09:55:00

PETROCHINA NET PROFIT UP 130.7%PetroChina Company Limited (“the Company”, HKSE: 0857; NYSE: PTR; SSE: 601857) announced that the Company’s high-quality development is starting to achieve good results, with net profit increasing substantially by 130.7% year-on-year in 2018. |

2019, March, 22, 09:50:00

CNOOC NET PROFIT UP 113.5%Net profit increased significantly and financial status remained healthy All-in cost of US$30.39/boe, down 6.6% YoY; Net profit of RMB 52.69 billion, up 113.5% YoY; Final dividend of HK$0.40 per share (tax inclusive) |

2019, February, 25, 12:00:00

CHINA'S LNG IMPORTS UP AGAINREUTERS - China’s liquefied natural gas imports in January rose to a record as an increase in residential heating demand during the winter after the country’s shift to gas heating spurred higher shipments, customs data showed on Saturday. |