FRAGILE OIL MARKET

SHANA - Iranian Minister of Petroleum Bijan Zangeneh said the current crude oil market was in a fragile state, adding, "If the US decided to exert more pressure on Iran, the oil market would become unpredictably more fragile."

Speaking in a live radio interview, Mr. Zangeneh reacted to rumors that oil facilities had been built on land in order to reduce costs leading to drying up of wetlands in oil-rich areas, saying that such rumors were spread by enemies of the Iranian nation.

"There are films from oil facilities in wetlands that are swarmed with water," he said.

He emphasized that there were no prohibitions on the issue of Hoor al-Azim Wetland from the Iranian Ministry of Petroleum, adding, "Our policies have always been concerned with the ecosystem of the wetland as a living system and, for that matter, we have incurred a lot of expenses."

Highlighting the latest US President Donald Trump' threats on Iran, Mr. Zangeneh said, "We continue to work, but what's important is that the oil market is in a fragile state, and that there is not so much supply for the demand."

"Such statements are mostly propaganda-oriented rather than calming the market. But that will not be the case. The price of oil is rising day by day, reflecting growing concerns in the market," he said.

The official argued that "Mr. Trump should choose whether to add more pressure on Iran or keep fuel prices low on gas stations in the US."

"Venezuela is now in difficulty; Russia has been banned; Libya is in a state of unrest and the US has lost a part of its oil output. These indicate that the state of production, supply and demand are fragile. If they want to add pressure on Iran, this fragility will be unpredictably exacerbated."

Zanganeh, in response to the a question that if Sudan's current state as a pivot supported by Saudi Arabia was to end, and that of pressures continued on Venezuela, then would the United States succeed in furthering pressure on Iran, said such issues concerned northern Sudan while the country produced most of its oil in its southern regions, adding continuation of the status quo in Venezuela could only increase pressure on the US.

-----

Earlier:

2019, April, 12, 12:00:00

OIL PRICE: NEAR $71Oil prices edged up on Friday, lifted by ongoing supply cuts led by producer club OPEC and by U.S. sanctions on petroleum exporters Iran and Venezuela. |

2019, April, 12, 11:55:00

2019 GLOBAL OIL DEMAND EXCEED 100 MBDTotal world demand for the year is now expected to reach 99.91 mb/d and exceed the 100.00 mb/d threshold during 2H19. OECD oil demand growth is projected to reach 0.21 mb/d, with OECD Americas leading the increase, while oil demand in the non-OECD region is projected to rise by around 1.0 mb/d, with Other Asia and China being the primary contributors to growth. |

2019, April, 12, 11:45:00

RUSSIA COMMITTED TO OPEC+“Russia will not increase its output unless in coordination with the rest of OPEC and OPEC+ countries,” Mazroui said. “I believe in the wisdom of Russia, and I believe that Russia has benefited from this agreement... I don’t see any reason for Russia not to continue with us.” |

2019, April, 12, 11:40:00

OIL PRODUCTION DOWN, PRICES UPProduction by OPEC countries in March was 2.2 mb/d lower than in November and now there is uncertainty concerning Libya. Production by non-OPEC producers in 1Q19 was 0.7 mb/d lower than in 4Q18. |

2019, April, 12, 11:35:00

GLOBAL ECONOMY CHANGESWith this weakness expected to persist into the first half of 2019, our new World Economic Outlook (WEO) projects a slowdown in growth in 2019 for 70 percent of the world economy. Global growth softened to 3.6 percent in 2018 and is projected to decline further to 3.3 percent in 2019. |

2019, April, 10, 11:35:00

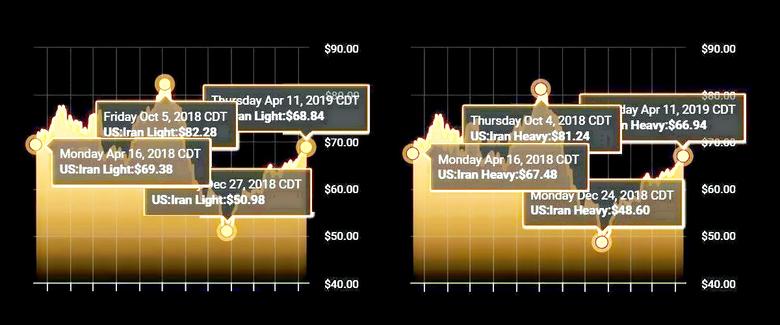

OIL PRICES 2019-20: $65-$62Brent crude oil spot prices averaged $66 per barrel (b) in March, up $2/b from February 2019. Brent prices for the first quarter of 2019 averaged $63/b, which is $4/b lower than the same period in 2018. Despite lower crude oil prices than last year, Brent prices in March were $9/b higher than in December 2018, marking the largest December-to-March price increase since December 2011 to March 2012. |

2019, April, 10, 11:05:00

IRAN'S OIL RECOVERYPLATTS - Iranian oil exports, which have been laboring under US sanctions since late last year, have recovered close to prior levels, supported by unflinching demand from China and South Korea, data from shipping sources and provisional tanker tracking data showed Tuesday. |