GLOBAL OIL STOCKS 2.88 BBL

PLATTS - Global oil inventories remain above the "normal level," Saudi energy minister Khalid al-Falih said Monday, speaking just weeks before an OPEC technical meeting scheduled to discuss oil market fundamentals and compliance with organization's current production to cut deal.

"I think we are getting to a point where inventories are starting to stabilize, but they are still above what I would call a normal level," Falih said during the Gulf Intelligence Forum in Riyadh.

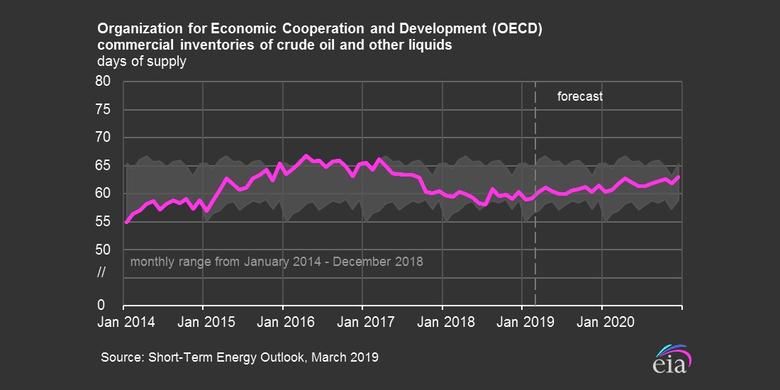

According to OPEC's latest monthly oil market report, global oil inventories stood at 2.88 billion barrels in January, about 19.1 million barrels above the five-year average that OPEC is targeting with its current output policy.

Falih's comments come less than a week after OPEC Secretary General Mohammed Barkindo said OPEC and its allies will not relax their crude production quotas as inventories levels need to drop further despite "marked improvement in market conditions".

Since the most recent round of production cuts were agreed in December 2018, oil futures prices have continued to strengthen on the back of the tightening supply.

In March, OPEC tightened the oil market considerably, slashing 570,000 b/d from its February output, as Saudi Arabia continued to implement production cuts, according to an S&P Global Platts survey of OPEC and oil industry officials as well as traders and analysts. The survey found that Saudi Arabia, OPEC's biggest producer, dropped its production by 280,000 b/d in March to 9.87 million b/d, the lowest since February 2017.

Noting a recent uptick in active rigs working in the shale-rich Lower 48 US states, Falih said he sees signs of higher shaling drilling activity as a "healthy" response to firmer oil prices.

"I consider the US rig count going up to be healthy, it gives me an indication that the market is coming back to health," Falih said.

The number of rigs working onshore in the Lower 48 US states last week turned positive for the first time in seven weeks, according to oilfield services firm Baker Hughes.

MARKET STABILIZING

Falih's comments on market stability were echoed by the UAE energy minister Suhail al-Mazrouei, who said separately in Dubai on Monday that the market is heading towards a supply-demand balance.

"We are achieving that balance," Mazrouei said in his speech at a conference.

In accordance with the organization's plans to draw down inventories and remove 1.2 million b/d from global markets, OPEC canceled a meeting in April to re-evaluate its policy and its next meeting - a Joint Ministerial Monitoring Committee meeting - will take place on May 19 on Jeddah. The next full OPEC meeting is scheduled for June.

"Ultimately the 1.2 [million b/d cut] was agreed assuming certain things from supply and demand," Falih said. "The longer we wait until June, the more informed we will be about our decision."

Aside from the agreed cuts, supply disruptions have materialized from countries such as Venezuela and Iran, which are both under sanctions from the US.

Venezuela suffered from extensive power outages on top of US sanctions, hurting its production, the survey further revealed. In March, Venezuela 's production fell to 740,000 b/d, the lowest in more than 16 years, according to Platts data.

In the medium term, Falih outlined strong demand in Asia as a bullish factor for oil demand.

"The underlying drivers for oil will be there, [with] people moving from rural to big cities, that's not going to be dented significantly by GDP growth," he said.

Demand from OECD countries could flatten due to policies targeting lower fuel use in trucking and driving, Falih said.

-----

Earlier:

2019, March, 22, 10:20:00

U.S. OIL INVENTORIES DOWN 9.6 MBUS crude oil inventories for the week ended Mar. 15, excluding the Strategic Petroleum Reserve, decreased 9.6 million bbl from the previous week, data from the US Energy Information Administration showed. |

2019, March, 18, 13:15:00

OPEC+ JOB NOT ENOUGHSaudi Arabia said on Sunday OPEC’s job in rebalancing the oil market was far from done as global inventories were still rising despite harsh U.S. sanctions on Iran and Venezuela, signaling it may need to expand output cuts into the second half of 2019. |

2019, February, 1, 11:15:00

U.S. OIL INVENTORIES UP 900,000 BBLOGJ - US crude oil inventories for the week ended Jan. 25, excluding the Strategic Petroleum Reserve, increased by 900,000 bbl from the previous week, data from the US Energy Information Administration showed. |

2019, January, 7, 09:55:00

U.S. OIL INVENTORIES 441.4 MBBLOGJ - US commercial crude oil inventories, excluding the Strategic Petroleum Reserve, remained virtually unchanged for the week ended Dec. 28, 2018, |

2018, November, 16, 09:10:00

U.S. OIL INVENTORIES UPU.S. EIA - U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 10.3 million barrels from the previous week. |

2018, October, 4, 14:40:00

U.S. OIL INVENTORIES DOWNU.S. EIA - Crude oil inventories held at Cushing, Oklahoma, decreased by more than half since this time last year, recently falling to lows last reached in 2014. Logistical factors and strong demand for crude oil from both domestic refining and exports markets have contributed to the steep year-over-year decrease. |

2018, May, 28, 11:20:00

OIL INVENTORIES DOWNPLATTS - "With Saudi Arabia stressing the need for more capex to meet future oil demand and replace the natural decline from aging fields, and thus presumably a higher price to incentivize investment, supply cuts, in one form or another, may be extended to 2019," the note said. |