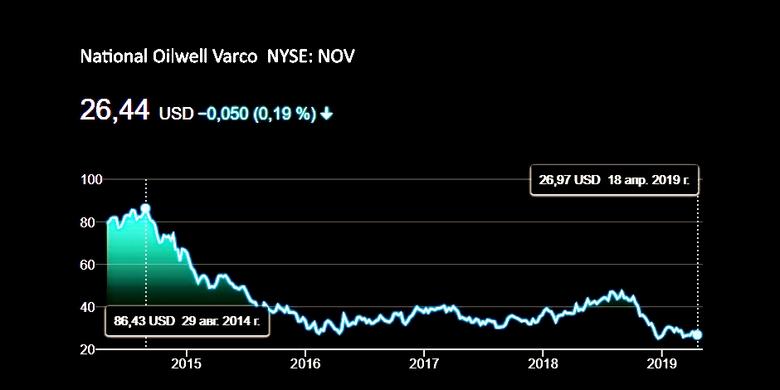

NOV VARCO NET LOSS $77 MLN

NOV VARCO - National Oilwell Varco, Inc. (NYSE: NOV) reported first quarter 2019 revenues of $1.94 billion, a decrease of 19 percent compared to the fourth quarter of 2018 and an increase of eight percent from the first quarter of 2018. Operating loss for the first quarter of 2019 was $48 million, net loss was $77 million, and Adjusted EBITDA (operating profit excluding depreciation, amortization, and other items) was $140 million, or 7.2 percent of sales. Adjusted EBITDA decreased $139 million sequentially and $20 million compared to the first quarter of 2018. Other items totaled $11 million, pre-tax, and include restructure costs for facility closures, inventory write downs, severance payments and adjustments of certain reserves.

"Two big challenges negatively impacted our quarter—oilfield service customers cut expenditures due to low year-end oil prices and sliding producer activity outlook, and offshore sales declined following the accelerated equipment deliveries we saw in the fourth quarter," commented Clay Williams, Chairman, President, and CEO. "Additionally, the volume of orders for new capital equipment fell sharply in late 2018 and remained sparse through the first two months of the year. Nevertheless, customer confidence improved month-by-month through the first quarter as commodity prices strengthened. Strong order acceleration in March enabled NOV to post a sequential increase in bookings, improving our outlook for the second quarter and remainder of 2019."

"While we expect modestly improving activity in international and offshore markets, along with growing market penetration for NOV's proprietary technologies and services, capital austerity in the North American land market leaves our near-term outlook uncertain. Consequently, we are renewing our focus on controlling what we can, namely our cost structure, as we streamline our operations to improve our organization's profitability, regardless of the market environment."

|

NATIONAL OILWELL VARCO, INC. CONSOLIDATED STATEMENTS OF INCOME (LOSS) (Unaudited) (In $ millions, except per share data) |

|||

| Three Months Ended | |||

| March 31, | December 31, | ||

| 2019 | 2018 | 2018 | |

| Revenue: | |||

| Wellbore Technologies | 807 | 711 | 884 |

| Completion & Production Solutions | 581 | 670 | 788 |

| Rig Technologies | 603 | 483 | 804 |

| Eliminations | (51) | (69) | (78) |

| Total revenue | 1,940 | 1,795 | 2,398 |

| Gross profit | 256 | 287 | 409 |

| Gross profit % | 13.2 | 16.0 | 17.1 |

| Selling, general, and administrative | 304 | 288 | 322 |

| Operating profit (loss) | (48) | (1) | 87 |

| Interest and financial costs | (25) | (24) | (22) |

| Interest income | 6 | 7 | 7 |

| Equity income (loss) in unconsolidated affiliates | — | 2 | (2) |

| Other income (expense), net | (18) | (47) | (29) |

| Income (loss) before income taxes | (85) | (63) | 41 |

| Provision (benefit) for income taxes | (10) | 3 | 26 |

| Net income (loss) | (75) | (66) | 15 |

| Net (income) loss attributable to noncontrolling interests | 2 | 2 | 3 |

| Net income (loss) attributable to Company | (77) | (68) | 12 |

| Per share data: | |||

| Basic | (0.20) | (0.18) | 0.03 |

| Diluted | (0.20) | (0.18) | 0.03 |

| Weighted average shares outstanding: | |||

| Basic | 380 | 377 | 379 |

| Diluted | 380 | 377 | 383 |

-----

Earlier:

2019, February, 8, 11:05:00

NOV VARCO NET LOSS $31 MLN

NOV - National Oilwell Varco, Inc. (NYSE: NOV) reported fourth quarter 2018 revenues of $2.40 billion, an increase of 11 percent compared to the third quarter of 2018 and an increase of 22 percent from the fourth quarter of 2017. Operating profit for the fourth quarter of 2018 was $87 million, or 3.6 percent of sales, Adjusted EBITDA (operating profit excluding depreciation, amortization, and other items) was $279 million, or 11.6 percent of sales, and net income was $12 million. Operating profit increased 19 percent sequentially, and Adjusted EBITDA increased 14 percent sequentially and 42 percent compared to the fourth quarter of 2017. Other items totaled $21 million, pre-tax, and were primarily related to charges associated with the closure of one of the Company’s facilities.

|