OIL PRICE: ABOVE $68

REUTERS - Oil prices rose on Monday, adding to gains in the first quarter when the major benchmarks posted their biggest increases in nearly a decade, as concerns about supplies outweigh fears of a slowing global economy.

Positive Chinese factory gauges and signs of progress in Sino-U.S. trade talks also boosted sentiment, helping buoy regional stockmarkets.

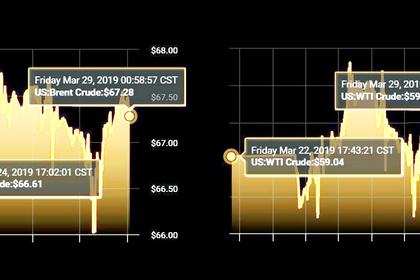

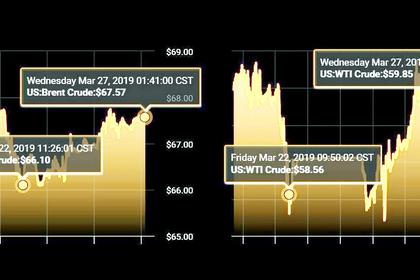

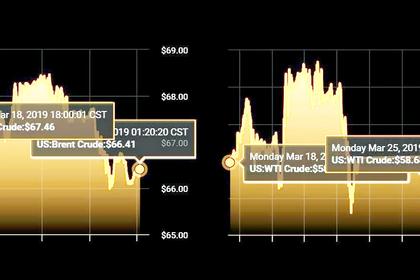

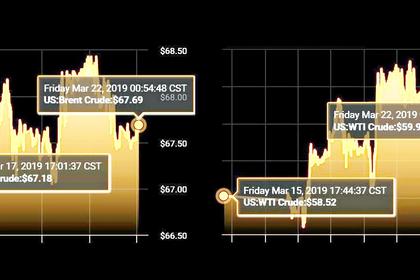

Brent crude for June delivery was up by 64 cents, or 1 percent, at $68.22 a barrel by 0606 GMT, having risen 27 percent in the first quarter.

U.S. West Texas Intermediate (WTI) futures rose 43 cents, or 0.7 percent, to $60.57 barrel, after posting a rise of 32 percent in the January-March period.

U.S. sanctions on Iran and Venezuela along with supply cuts by members of the Organization of the Petroleum Exporting Countries (OPEC) and other major producers have helped support prices this year, overshadowing concerns about global growth and the U.S.-China trade war.

However, future gains will be limited by potential softness in the global economy as well as the ability of U.S. oil producers to ramp up production when prices spike, said Phin Ziebell, senior economist at National Australia Bank in Sydney.

"It's tough to see a really big rally from here," he said.

Still, analysts have turned cautiously optimistic on crude oil prices this year, a Reuters poll showed on Friday.

U.S. production has also steadied, with the U.S. government reporting on Friday that domestic output in the world's top crude producer edged lower in January to 11.9 million bpd.

U.S. energy firms last week reduced the number of oil rigs operating to the lowest level in nearly a year, cutting the most rigs in a quarter in three years, Baker Hughes energy services firm said.

Sigal Mandelker, U.S. under-secretary of the Treasury for Terrorism and Financial Intelligence, told reporters in Singapore on Friday that the United States had placed further "intense pressure" on Iran.

U.S. officials are keen to ensure see that Malaysia, Singapore and others are fully aware of illicit Iranian oil shipments and the tactics Iran uses to evade sanctions, Mandelker said.

The U.S. has also instructed oil trading houses and refiners to further cut dealings with Venezuela or face sanctions themselves, even if the trades are not prohibited by published U.S. sanctions, three sources familiar with the matter said.

A deal between OPEC and allies such as Russia to cut output by around 1.2 million barrels per day, which officially started in January, has also supported prices.

Hedge funds and other money managers raised their net long U.S. crude futures and options positions to 243,209 in the week to March 26, the U.S. Commodity Futures Trading Commission (CFTC) said.

-----

Earlier: