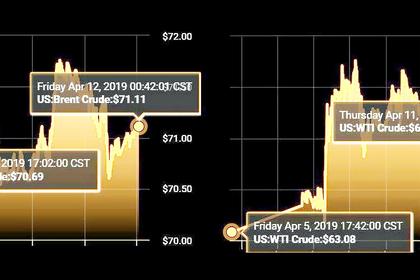

OIL PRICE: ABOVE $71

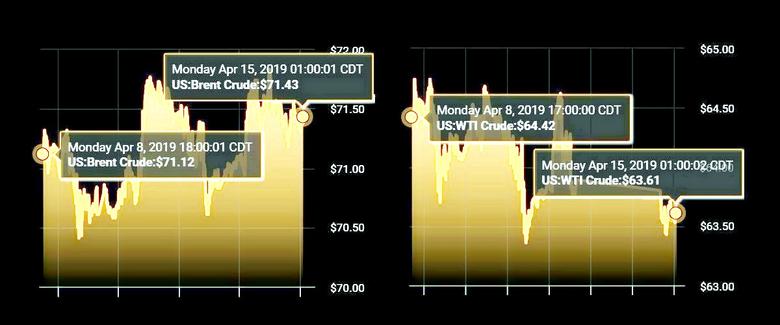

REUTERS - Oil prices nudged lower on Monday after international benchmark Brent hit a fresh five-month high in the previous session, with investors eyeing mixed signals on global supply.

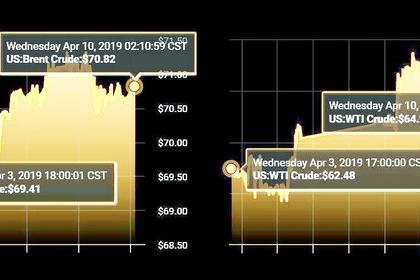

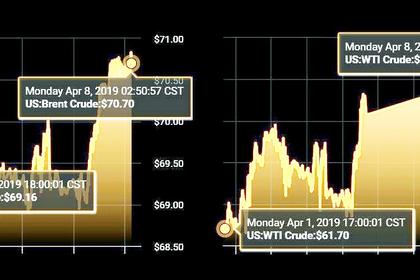

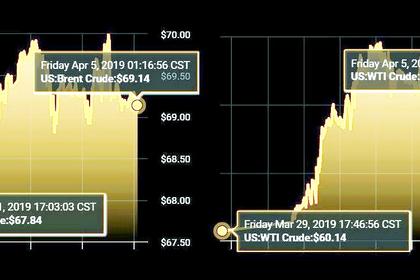

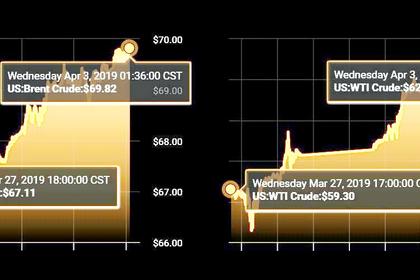

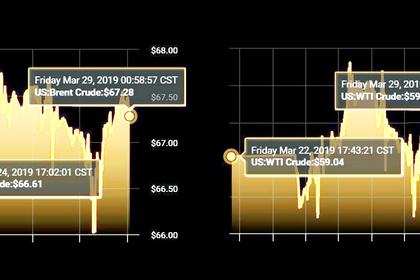

Brent crude oil futures were at $71.44 a barrel at 0629 GMT, down 11 cents, or 0.2 percent, from their last close, having hit their highest since Nov. 12 on Friday at $71.87.

U.S. West Texas Intermediate (WTI) crude futures were at $63.63 per barrel, down 26 cents, or 0.4 percent, from their last settlement.

"I would expect oil to trade in a relatively tight band around $70 per for the time being," said Virendra Chauhan, oil analyst at Energy Aspects in Singapore, pointing to differing signs from the United States and OPEC on future supply.

"Leading edge indicators on U.S. supply suggest activity levels are stepping up, which is supportive for strong production growth in the second half," said Chauhan.

But at the same time, "murmurings from various ministers of the OPEC+ pact suggest supply from the group will not be ramped up pre-emptively as per last summer," he said.

The Organization of the Petroleum Exporting Countries (OPEC) and its allies meet in June to decide whether to continue withholding supply. OPEC, Russia and other producers, are reducing output by 1.2 million bpd from Jan. 1 for six months.

OPEC's de facto leader, Saudi Arabia, is considered keen to keep cutting, but sources within the group said it could raise output from July if disruptions continue elsewhere.

The head of Libya's National Oil Corp warned on Friday that renewed fighting could wipe out crude production in the country.

Meanwhile, Russia's Finance Minister Anton Siluanov was quoted by the TASS news agency as saying on Saturday that Russia and OPEC may decide to boost production to fight for market share with the United States but this would push oil prices as low as $40 per barrel.

"The danger is to the downside as both contracts are still very overbought from a technical standpoint," said Jeffrey Halley, senior market analyst at OANDA in Singapore.

U.S. energy companies last week increased the number of oil rigs operating for a second week in a row, bringing the total count to 833, General Electric Co's Baker Hughes energy services firm said in its closely followed report on Friday.

The rig count fell for the past four months as independent exploration and production companies cut spending on new drilling to focus on earnings growth instead of increased output.

-----

Earlier: