OIL PRICE: THE FASTEST UP

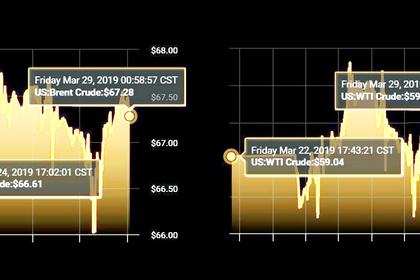

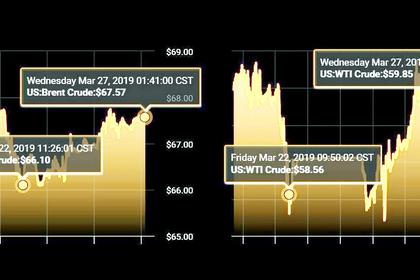

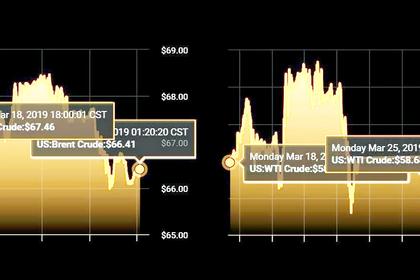

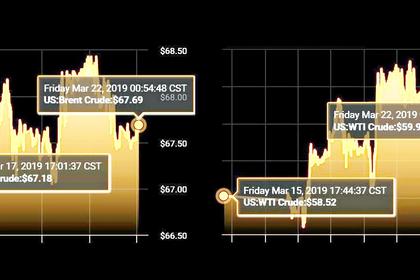

AAA - Oil prices rose about 1 percent on Friday, posting their biggest quarterly rise in a decade.

Among others, lifting prices this year has been a deal between the Organization of the Petroleum Exporting Countries and allies such as Russia to cut output by around 1.2 million barrels per day, which officially started in January.

Russian Energy Minister Alexander Novak denied that Moscow may agree only to a three-month extension of the pact cutting oil supply.

"We will discuss this in May. There are currently no Russian suggestions on the matter," TASS agency quoted Novak as saying.

Three sources familiar with the matter said Thursday that OPEC is struggling to keep Russia on board with the oil cut.

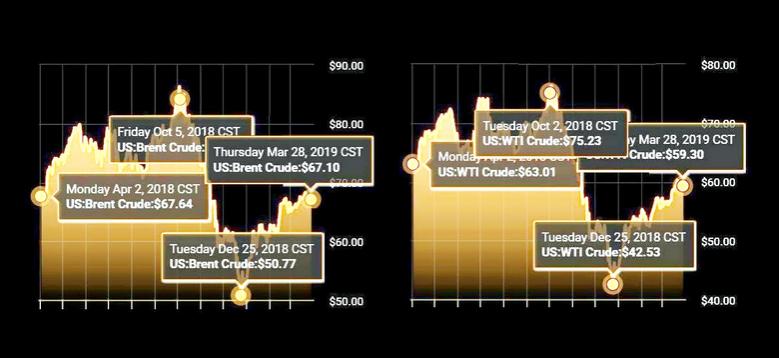

A monthly Reuters survey of economists and analysts forecast Brent would average $67.12 a barrel in 2019, about 1 percent higher than the previous poll's $66.44.

Hedge funds and other money managers raised their net long US crude futures and options positions to 243,209 in the week to March 26, the US Commodity Futures Trading Commission (CFTC) said.

"With slower global economic growth, oil demand will not be very dynamic this year," said Frank Schallenberger, head of commodity research at LBBW. "But if OPEC sticks to its production cuts and the US doesn't loosen sanctions against key producers Iran and Venezuela, higher prices are here to stay as we will head to a supply deficit in the second half of 2019."

Major producers, led by OPEC and Russia, will meet on June 25-26 in Vienna to review their supply cuts. Top exporter Saudi Arabia has advocated an extension of the curbs until the year-end.

OPEC compliance with the agreed cuts stood at 94 percent, while non-OPEC was at 51 percent in February, the International Energy Agency (IEA) said.

Analysts expect growth in global oil demand to be steady, at 1.2–1.5 million barrels per day (bpd) in 2019.

The IEA, in its March outlook, kept its demand growth forecast unchanged at 1.4 million bpd this year.

Brent is expected to rise to $68.85 in the third quarter from $67.55 the previous quarter, the poll showed, before higher US output and economic woes bring prices down to $68.40 in the final quarter.

"The end of 2019 is likely to see oil prices come under pressure as the US exports greater volumes of its light shale oil supply to international markets and the global economy, in our view, experiences a synchronized slowdown," said Harry Tchilinguirian, strategist at BNP Paribas.

-----

Earlier: