OIL PRODUCTION DOWN, PRICES UP

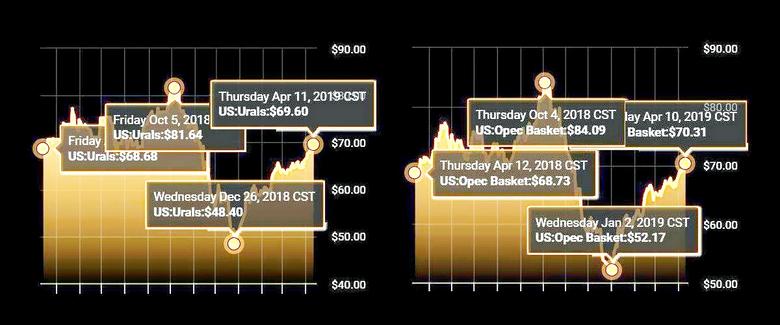

IEA - The huge increase in oil production we saw in 2H18 has reversed following the implementation of the new Vienna Agreement and the increasing effectiveness of sanctions against Iran and Venezuela. Production by OPEC countries in March was 2.2 mb/d lower than in November and now there is uncertainty concerning Libya. Production by non-OPEC producers in 1Q19 was 0.7 mb/d lower than in 4Q18. This turnaround in supply has contributed to a dramatic increase in prices, with Brent crude rising from $50/bbl at the end of December to more than $70/bbl today.

Tightness in the oil market, however, is not just a supply story. In recent months, the resilience of demand has received less attention than the vicissitudes of production, but it is very important too. Data for 2018 is still incomplete but we can be confident that demand growth was about 1.3 mb/d. As far as 2019 is concerned, amongst the analyst community there is an extraordinarily wide divergence of view as to how strong growth will be. We maintain our forecast of 1.4 mb/d, but accept that there are mixed signals about the health of the global economy, and differing views about the likely level of oil prices.

In terms of real numbers for 2019, although it is still early days the major centres of oil demand growth are performing strongly. In China, the economy seems to be reacting to the government's stimulus measures with purchasing managers' indices increasing and export orders recovering, although there are signs that air cargo volumes might be falling. Preliminary oil demand numbers for the January-February period show solid growth of 410 kb/d year-on-year. Elsewhere, demand was strong in the same period, with India growing by 300 kb/d, and the US, which continues to be supported by the petrochemical sector, by 295 kb/d.

Although the main sources of growth are doing well, there are mixed signals from elsewhere. Overall demand in the OECD countries fell by 0.3 mb/d y-o-y in 4Q18, the first such fall for any quarter since the end of 2014, and it is likely to have fallen again in 1Q19 due to weakness in some European economies, with perhaps more to come if there is a disorderly Brexit. There are uncertainties in Argentina and Turkey and signs of only modest demand recovery in the Middle East despite the stimulus provided by rising crude oil prices. Concerns about trade talks linger, and the mood will be influenced by the recent downgrade to global GDP growth by the International Monetary Fund, although it should be noted that the IMF does not expect a recession in the near term. Clearly, oil prices at $70/bbl for Brent, are less comfortable for consumers than they were at the start of the year and the IEA has regularly warned of the dangers of prices rising even higher. Only time will tell if our current demand forecast proves accurate, but the risks are currently to the downside.

When the first Vienna Agreement to cut oil production was made in 2017, progress was measured by total OECD stocks falling to the five-year average level. The second Agreement is underway, and data for February show that stocks are above the average by 16 mb. However, in terms of days of forward demand cover, which is a more relevant assessment, they are below it, and have been for some time. Incidentally, it is worth mentioning middle distillate stocks, particularly in light of January's implementation of new International Maritime Organisation fuel specifications. If half the increase in marine gasoil demand resulting from the regulations were in OECD countries, about 540 kb/d, current middle distillate stocks would represent 29.3 days of forward cover, about 3.5 days below the average.

The oil market shows signs of tightening as we move into 2Q19, but we see mixed signals in terms of the outlook for demand and whether stock levels are yet "normal".

-----

Earlier:

2019, April, 10, 11:35:00

OIL PRICES 2019-20: $65-$62Brent crude oil spot prices averaged $66 per barrel (b) in March, up $2/b from February 2019. Brent prices for the first quarter of 2019 averaged $63/b, which is $4/b lower than the same period in 2018. Despite lower crude oil prices than last year, Brent prices in March were $9/b higher than in December 2018, marking the largest December-to-March price increase since December 2011 to March 2012. |

2019, April, 10, 11:25:00

OIL MARKET HEALTHThe kingdom will pump about 9.8 million barrels a day in March and April and export less than 7 million barrels daily in both months, Al-Falih said in March. Saudi Arabia has a production target of 10.3 million barrels a day. |

2019, April, 10, 11:20:00

GLOBAL OIL STOCKS 2.88 BBLAccording to OPEC's latest monthly oil market report, global oil inventories stood at 2.88 billion barrels in January, about 19.1 million barrels above the five-year average that OPEC is targeting with its current output policy. |

2019, March, 27, 12:00:00

GLOBAL ENERGY DEMAND UP 2.3%IEA - Energy demand worldwide grew by 2.3% last year, its fastest pace this decade, an exceptional performance driven by a robust global economy and stronger heating and cooling needs in some regions. |

2019, March, 18, 13:10:00

BRENT OIL: UNDERVALUEDIn the context of supply and demand balance,the current price of BRENT oil is undervalued.Neither OPEC nor the IEA has considerably brought down their forecasts for global oil demand in the current year. |

2019, March, 15, 10:40:00

OPEC: OIL DEMAND GROWTH LESSIn 2018, world oil demand is estimated to have grown by 1.43 mb/d, down by 0.04 mb/d from the previous estimate amid downward revisions in both OECD and non-OECD regions. |

2019, March, 13, 11:30:00

OIL PRICES 2019-20: $63-$62Brent crude oil spot prices averaged $64 per barrel (b) in February, up $5/b from January 2019 and about $1/b lower than at the same time last year. |