RUSSIA'S ARCTIC ENERGY UP

CSIS - Every move that Russia makes to develop energy resources in the Arctic is seen as further proof for an unsettling proposition: unlike the United States, Russia takes a strategic view toward Arctic energy; it spends serious money to develop the region's resources; and it is using the Arctic to boost ties with China and, more recently, Saudi Arabia. There is truth in that worldview, but it also leaves much out.

The U.S. side of the Arctic is far from dormant, for one: there is a mini oil renaissance in Alaska, even if that story is often underappreciated in Washington, which tends to think about Alaskan oil in terms of the federal offshore or the Arctic National Wildlife Refuge (ANWR). For another, Russia's foray into Arctic energy is uneven. Oil is still nascent, more of a long-term aspiration than anything else so far, and unlikely to materialize soon or without Western partners. Success in natural gas is greater, but largely because Russia's major gas companies need the Arctic either to maintain production levels (Gazprom) or to maintain output as well as reach new markets (NOVATEK). U.S. companies have more options in the Lower 48, so they are less invested in the Arctic. Once these truths are accepted, it will be far easier to separate what is worrisome from what is not; and to understand the region's role in the global energy market.

Russia's Push into Arctic Energy

From the time that the Soviet Union ramped up its gas exports to Western Europe, the Arctic region has been the heartland of Russia's gas industry. Russia now hopes the Arctic will let it expand its market share in European gas, allow it to become a premier liquefied natural gas (LNG) exporter from the Yamal Peninsula and, one day, produce enough hydrocarbons to offset declines from existing fields or, better yet, grow the country's overall output.

No project better symbolizes Russia ambitions in the Arctic than Yamal LNG. The project cost $27 billion to construct, excluding the adjacent infrastructure paid for by the Russian Federation. The project was completed early and on budget despite U.S. sanctions that limited its ability to borrow in dollars. It opened a new shipping route to Asia. More importantly, it was done in partnership with a Chinese state-owned oil and gas company (CNPC) and a Chinese sovereign wealth fund (Silk Road Fund), mainly financed by the Chinese, and much of it was fabricated in China. Few projects tick so many boxes in a geopolitical scorecard.

After Yamal came online, NOVATEK, the project's sponsor, started to advance Arctic 2, a second project nearby. Progress has been speedy. Recent drilling has expanded the estimated resource base. The front-end engineering and design work (FEED) was finished in October 2018, narrowing the project's estimated cost and underscoring its commercial viability. One foreign partner has signed up (France's TOTAL), and others are in talks, including Saudi Aramco, Korea's KOGAS, and Japan's JOGMEC. And NOVATEK is already eyeing Arctic 3. Vladimir Putin wants Russia to be the world's top LNG producer—if that ever happens, LNG from the Arctic will deserve most of the credit.

LNG gets most of the press, but a few hundred miles away, Gazprom is hard at work too. In fact, Gazprom produces far more gas from Yamal peninsula than NOVATEK. In 2012, it brought online the supergiant Bovanenkovo field, which is ramping up to its first plateau. The company plans to develop deeper layers, as well as nearby fields; by 2030, it aims to produce 220 billion cubic meters (bcm) from the Yamal peninsula, about 10 times the output of Yamal LNG. If the market allows it, Gazprom could boost that output by 50 percent. Slowly but steadily, the gas that reaches Europe will come from the Yamal Peninsula.

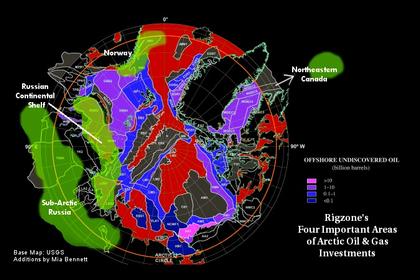

Progress in developing Arctic oil has been slower. The first offshore oil project in the Arctic came online in 2013, and two onshore projects were completed recently as well. Rosneft has amassed a lot of acreage that looks promising—it claims to have 26 partnerships with foreign companies, although after Western sanctions were imposed in 2014, many of those relationships lie dormant. Even so, Rosneft announced a discovery in 2014, just as ExxonMobil was scaling down its exploration program due to sanctions. The potential is there, even though without Western help, it might be hard to realize, especially if hydrocarbons are dispersed far and wide, which will prevent Russia from enjoying the infrastructure economies of scale that offshore developments depend on.

Alaska Strikes Back

The contrast between this picture and progress in the U.S. Arctic seems stark—at least when one listens to how most people in Washington talk about Alaskan energy. For decades, U.S. policymakers have disagreed on the need to develop hydrocarbons in the region. In the federal areas offshore Alaska, interest in hydrocarbons has oscillated based on market conditions—some lease sales garnered intense enthusiasm and high bids, and others did not. But even in areas open to development, high costs, in part due to regulation, have stymied activity. When Shell said in 2015 that it was suspending exploration in the Chukchi Sea, and then relinquished most of its leases soon thereafter, few were surprised.

The lack of consensus has been even starker in the case of ANWR, which has been off limits to hydrocarbon exploration and development for decades. A single well, drilled in 1986, is the last time anyone was able to probe in ANWR (the results are secret). Congress opened up ANWR in December 2017, but we are still at the very early stages of a long process toward producing oil or gas there. And the political pendulum could swing again to make conditions prohibitive for development.

The gas story in the Alaskan Arctic appears similarly dim. Since the 1970s, Alaskans have tried to commercialize gas in the North Slope. Over the years, every permutation has been tried and failed. The current iteration, which envisions a pipeline crossing the state to allow the LNG to be exported from Nikiski, in the south of Alaska, has made more progress than earlier efforts. But even in the best of cases, first gas would not come until the late 2020s. Once again, the contrast with Russia's Arctic development and plans seems wide.

Yet this picture only tells part of the story. For one, there is an investment boom in Alaska, one that gets little attention, but whose scale, in barrels and dollars, is serious. From 2009 to 2018, companies invested $27 billion in Alaska's North Slope, while they spent an additional $28.6 billion to run existing operations. Alaska's Department of Revenue expects a similar level of spending over the next 10 years ($54.4 billion). It is easy to toss around the $27 billion figure for Yamal LNG, but the equivalent number for Alaska is not zero, even though it is lower than in Russia's Arctic, and although Alaska's economy is still struggling.

The results from that investment on oil production are clear, however. Oil output peaked in 1988 and has since been in decline. But production actually increased in 2016 and 2017 (after 1988, production had only risen in 1991 and 2002). And for the first time in years, Alaskans are forecasting that they might be able to hold production steady through the next decade, a major reversal from successive outlooks that expected continuous decline, with an increase possible if all discovered fields enter into production. There is, in short, upside in Alaska, even if the underlying maturity of the basin means more investment and more oil is needed to keep the current pipeline that crosses Alaska in operation.

Russia Needs the Arctic, the United States Less So

The biggest contrast between the United States and Russia, however, is the need to develop Arctic energy. Consider ANWR. In 2016, the Energy Information Administration (EIA) modeled how much oil could be extracted from ANWR, a hugely uncertain exercise given how little we know about the area. In a high-case scenario, the EIA forecasted that output could exceed 1.2 million barrels a day (mb/d) in the mid-2040s (and plateau at that rate through 2050). By comparison, the Permian basin in Texas grew production by 1 mb/d between December 2017 and December 2018. The point is not that the United States does not need Arctic energy, only that with so many other options, company interest in the Arctic is narrower than it would otherwise be.

The same can be said for Gazprom's push into the Yamal peninsula. By the company's own estimates, Yamal will merely offset the decline rate in the company's existing fields. Even if Gazprom produces 220 bcm from the peninsula in 2030, its production will be unchanged relative to 2016 (any growth will come from the East to supply China). By contrast, the Marcellus, which straddles Pennsylvania, West Virginia, Ohio, and New York, produced around 200 bcm in 2018. Gazprom is going to the Arctic to sustain its production, while the United States has found more gas (and oil) without having to go to the Arctic.

The contrast in LNG more broadly is even starker. Yamal LNG is impressive, but its scale should not be overstated. It is smaller than the Sabine Pass facility that came online in Louisiana in 2016. In fact, there are three more LNG projects being built in the United States with a capacity just a bit smaller than Yamal (Cameron, Corpus Christi, and Freeport); and another was just sanctioned to start construction. While NOVATEK built Yamal LNG and is advancing Arctic 2, companies in the United States built four Yamal-scaled projects and are starting on a fifth—with more to come. If this is a race to LNG dominance, rather than a race to the Arctic, Russia is not winning. Russia will become a major LNG supplier, anchored by the Arctic, but will still trail Qatar, the United States, and Australia.

It is similarly necessary to add a few qualifiers to China's involvement in Yamal LNG. One can imagine a grand bargain between the Chinese and the Russians. But CNPC's involvement in Yamal LNG was not unusual: the equity it acquired is similar to its equity stakes in projects in Canada, Australia, or Mozambique. The contract to buy LNG from Yamal is similarly ordinary: the volumes involved would leave Russia far behind the dominant LNG suppliers into China (Australia and Qatar), and in line with second-tier suppliers (Malaysia, Indonesia, and Papua New Guinea). It is hard to look at CNPC's involvement in Yamal LNG and detect anything special.

China's financing of Yamal LNG was more unusual—likely due to U.S. sanctions. Chinese institutions have usually lent alongside other banks and export credit agencies. But in Yamal, China took a leading role. Even so, most of the financing came almost two and a half years after the project started construction, a sign of the complexities involved. And when the Silk Road Fund joined as a partner in the project, NOVATEK retained some (unspecified) risks. So, the deal reflected the uneven bargaining power between the two sides. If someone took a strategic view towards Yamal, it was the Russian government, which offered major concessions to make the project work, rather than the Chinese, which just exploited those concessions.

There is, however, stronger evidence that participation in Russia's LNG industry is a carrot extended to foreign partners—partly to reinforce Russia's desire to not be isolated by sanctions (but also for commercial reasons: to find buyers, raise equity, and secure debt). In Japan, interest in Russian LNG is propelled by a government desire to improve relations, even if Japanese industry has yet to follow through (the Japan Bank of International Cooperation lent €200 million to Yamal LNG). The political repercussions of any deal are harder to gauge through—whether we're talking about Western companies, Saudi Aramco, or Asian players. Experience tends to show that investments can help reinforce an existing rapprochement but might be sidelined or turn into liabilities if the politics turn. Extracting political dividends from such transactions is always hard, and there is no reason to think Arctic energy will be any different.

The way we talk about Arctic energy should thus change. No doubt, Russia is far more involved and invested in Arctic energy resources—but mostly in gas, not oil, and mostly because it has to. Sanctions have weakened its ability to develop its oil, and LNG depends in part on strong state support. The Chinese have been ready partners but without assuming excess risks. By contrast, the United States' relatively lower activity in the region is partly due to domestic politics and the inability to forge a consensus on the need to develop hydrocarbons in the Arctic. But more fundamentally, U.S. energy companies have more options to produce oil and gas—until that changes, the United States is unlikely to match what Russia is doing in Arctic energy. But nor does it have to.

-----

Earlier: