SAUDIS DEBT WILL UP

REUTERS - Saudi Arabia plans to issue 118 billion riyals ($31.5 billion) in debt this year to help finance the national budget deficit, the country's Debt Management Office (DMO), part of the ministry of finance, said.

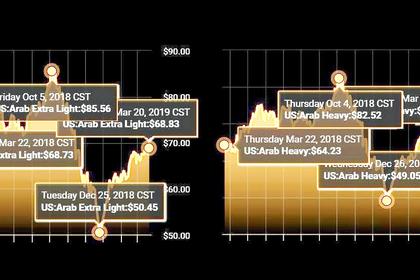

Saudi Arabia has borrowed extensively over the past few years to refill state coffers depleted by a drop in oil prices.

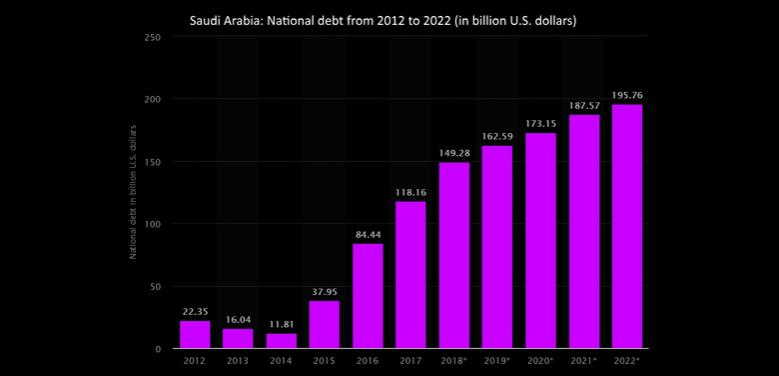

At the end of 2018, it had around $150 billion in outstanding government debt, 54 percent of which was in local currency and the rest denominated in U.S. dollars.

The kingdom issued $7.5 billion in international bonds in January. It said its foreign funding this year "would be positioned in a way in which (Saudi Arabia) could secure most of its funding in the first quarter", to reduce exposure to market risks and to allow Saudi government-related issuers to tap the debt markets.

The statement comes a few days before Saudi Aramco, the state-owned oil giant, is expected to issue its first bonds in the international markets.

Saudi Arabia's deficit funding requirements for this year are estimated at $35 billion, which will be funded with an approximate net debt issuance of $31.5 billion, while the rest will come from government deposits at the central bank, the DMO statement said.

By the end of 2019, Saudi Arabia plans to have around $181 billion in outstanding debt, corresponding to 21.7 percent of gross domestic product.

The DMO said this year it would try to "contain" the government's outstanding debt exposure to interest rate risk by reducing the percentage of floating-rate instruments in its portfolio.

At the end of 2018, 73 percent of Saudi debt issues had a fixed rate and 27 percent had a floating rate. By the end of 2019, the government wants to increase fixed-rate debt to 78 percent of its portfolio.

---

Earlier: