U.S., IRAN SANCTIONS

PLATTS - The US will end all waivers from Iran oil sanctions when they expire May 2, the White House announced Monday, a decision that drew an immediate threat from Iran to close the Strait of Hormuz, the world's busiest oil transit choke point.

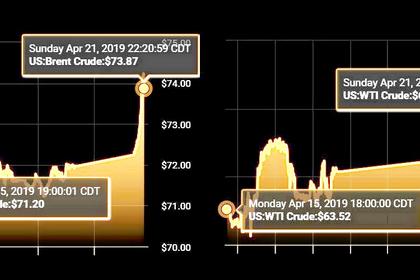

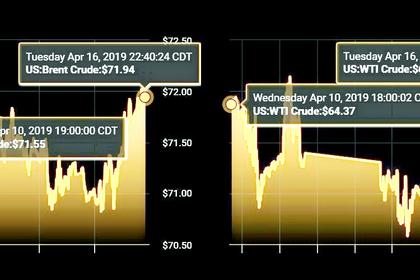

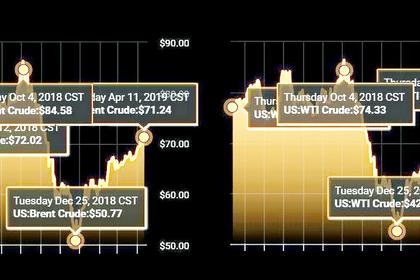

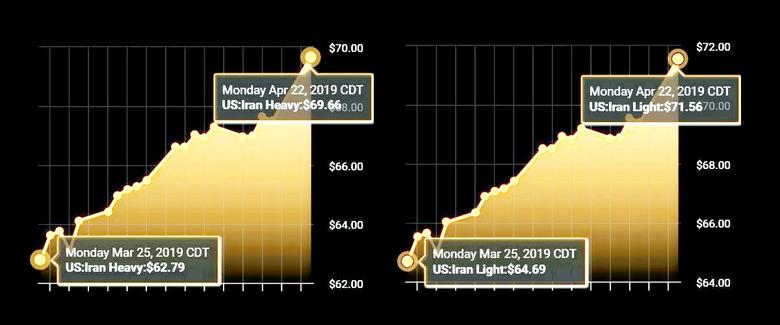

Crude futures settled at fresh six-month highs Monday as the market looked at an increasingly tight global supply picture in light of the White House decision. ICE June Brent settled up $2.07/b at $74.04/b, and NYMEX May WTI settled $1.70/b higher at $65.70/b. Monday marked the highest front-month settle for both contracts since late October, just before the US sanctions snapped back.

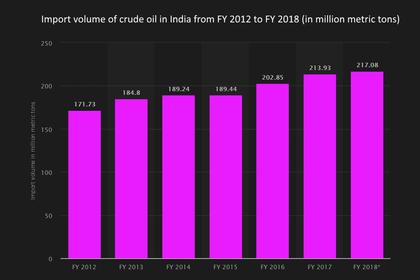

Iran's top oil customers - including China, India and Turkey - will be risking US sanctions enforcement if they continue to import Iranian oil after their waivers expire. The Trump administration aims to "bring Iran's oil exports to zero, denying the regime its principal source of revenue," the White House said in a statement.

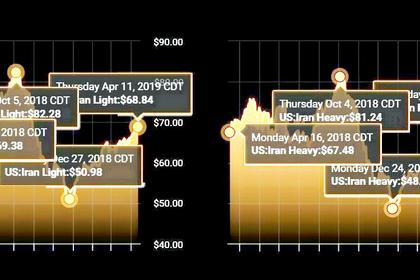

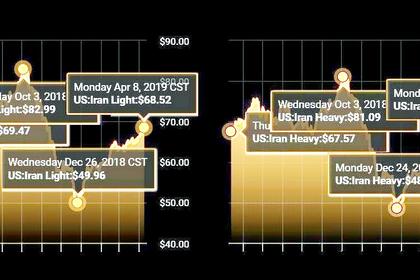

Iranian oil exports averaged more than 1.7 million b/d in March, including nearly 628,000 b/d sent to China and more than 357,000 b/d sent to India, according to S&P Global Platts cFlow trade flow data and shipping sources.

Iranian exports had fallen below 1.06 million b/d in November, when the US re-imposed sanctions, down from just below 2 million b/d in November 2017.

Analysts had widely expected the US to extend waivers for some of Iran's biggest buyers of crude and condensate, including China, India, South Korea and, potentially, Turkey.

"The decision will not only mean maximum pressure on Iran but also maximum pressure on oil markets, especially as we head into the high demand summer season," said Hedgeye analyst Joe McMonigle.

S&P Global Platts Analytics sees "much tighter" oil supply for the remainder of the year. The move "nearly exhausts the oil market's spare capacity in a time when risks to oil supply are high," said Shin Kim, S&P Global Platts' head of supply and production analytics.

CHINA QUESTION

China's response to tougher US oil sanctions on Iran will be crucial to the 2019 oil supply and price outlook, because the top importer accounted for 40% of Iran's shipments in the first quarter and has the ability to skirt sanctions without damaging its economy, analysts said.

India -- Iran's No. 2 customer, accounting 23% of Q1 shipments -- is expected to largely comply with US sanctions, analysts said. Japan and South Korea, which each accounted for 13% of Iran's Q1 exports, will almost certainly halt trading with Iran when their waivers expire, analysts said.

"China is the big $80-oil-barrel question, and one that oil markets will be closely following," said McMonigle."I think China will further reduce imports from Iran in a nod to US policy, but will continue buying Iranian crude in defiance of US sanctions."

Trade talks between the US and China complicate the question of Beijing's compliance with Iran sanctions. Analysts said the US may find a way to ease up on sanctions enforcement in exchange for concessions as part of any eventual trade deal.

STRICTLY ENFORCED

Still, US Secretary of State Mike Pompeo told reporters Monday the US would strictly enforce the sanctions and monitor compliance.

"Any nation or entity interacting with Iran should do its diligence and err on the side of caution," he said. "The risks are simply not going to be worth the benefits."

Pompeo said US officials "have used the highest possible care in our decision to ensure market stability," including discussions with importing countries to help find alternate supplies.

He said rising US oil production has also helped with the transition, citing US Energy Information Administration data on US output growth of 1.6 million b/d from 2017 to 2018 and expected growth of 1.5 million b/d in 2019.

Pompeo said he was confident Saudi Arabia and UAE would make up any supply gaps.

"They have committed to making sure that there's sufficient supply on the markets, and I'm confident that we'll achieve that. I'm confident that they'll support this policy that is consistent with their objectives as well."

President Donald Trump tweeted Monday that Saudi Arabia and others in OPEC will "more than make up the oil flow difference in our now full sanctions on Iranian oil."

Saudi energy minister Khalid al-Falih said Monday that the country would "coordinate with fellow oil producers to ensure adequate supplies are available to consumers while ensuring the global oil market does not go out of balance," according to a statement carried by state-run newswire SPA.

COOPERATION CHALLENGES

However, analysts said global output cooperation would be more challenging.

"The US wants to leave the impression that its Gulf partners will replace Iranian oil barrel for barrel," said Ellen Wald, an energy industry and policy consultant at Transversal Consulting. "But the Saudis can't publicly commit to anything more than a general market management."

Saudi Arabia has the physical capacity to replace the Iranian barrels, but spare capacity to replace other supply at risk, including Venezuela and Libya, will be reduced as well, according to analysts with Petromatrix.

Saudi Arabia, OPEC's largest producer, dropped its production by 280,000 b/d in March to 9.87 million b/d, its lowest output since February 2017, according to the latest S&P Global Platts survey.

"For the next month and a half, Saudi Arabia can increase production above 10.3 million b/d, if it wants, because its production over the last few months was lower," Wald said. "However, heading into the June 25 OPEC meeting, Saudi Arabia will need to convince its OPEC and non-OPEC partners that it is not beholden to a deal with the United States. Otherwise, Saudi Arabia will lose leverage in Vienna."

Monday's announcement came as the US is still considering secondary sanctions on Venezuelan oil exports, although analysts said those would likely be delayed.

In a note Monday, analysts with ClearView Energy Partners said that secondary sanctions, which would explicitly prohibit trade between Venezuela's state-owned PDVSA and non-US companies, have "become less likely, at least for a while."

Even before Monday's announcement, secondary sanctions on PDVSA were not expected to be imposed until after April 28, when prohibitions on trade in dollars with PDVSA are set to take effect. If imposed, secondary sanctions would cause Venezuelan crude output to fall from 740,000 b/d in March to 500,000 b/d by the fourth quarter of 2019, and to 375,000 b/d by the end of 2020, according to Platts Analytics.

DEFENDING HORMUZ

Iran on Monday repeated its threat to shut down the Strait of Hormuz, drawing a US military pledge to respond.

"According to international law, the Strait of Hormuz is a marine passageway and if we are barred from using it, we will shut it down," Alireza Tangsiri, commander of the Islamic Revolution Guards Corps Naval Forces, said in an interview with the state-run al-Alam news channel. "In case of any threat, we will have not even an iota of doubt to protect and defend the Iranian waters."

"The Strait of Hormuz is an international waterway, threats to close the strait impact the international community and undermine the free flow of commerce," Captain Bill Urban, a spokesman for US Central Command, told S&P Global Platts. "The US, along with our allies and partners, are committed to freedom of navigation and remain well-positioned to preserve the free flow of commerce."

The Strait of Hormuz, at the mouth of the Persian Gulf, is viewed as the most important oil chokepoint in the world, with Saudi Arabia, Iraq, Iran, Kuwait and the UAE all dependent on it move to crude and refined products on to the world market, primarily to Asian buyers.

In the first half of 2018, roughly 18 million b/d of crude and condensate, about 4 million b/d of petroleum products and about 300 million cubic1 meters per day of LNG were shipped through the strait, according to the US Energy Information Administration.

-----

Earlier: