6 UNDERVALUED ENERGY STOCKS

РЕЙТЕР -

-----

Раньше:

2018, March, 14, 11:45:00

REUTERS - U.S. West Texas Intermediate (WTI) crude futures CLc1 were at $60.77 a barrel at 0753 GMT, up 6 cents, or 0.1 percent, from their previous settlement. Brent crude futures LCOc1 were at $64.62 per barrel, down just 2 cents from their last close.

|

2018, March, 7, 15:00:00

РЕЙТЕР - К 9.17 МСК фьючерсы на североморскую смесь Brent опустились на 0,85 процента до $65,23 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $62,07 за баррель, что на 0,85 процента ниже предыдущего закрытия.

|

2018, March, 7, 14:00:00

EIA - North Sea Brent crude oil spot prices averaged $65 per barrel (b) in February, a decrease of $4/b from the January level and the first month-over-month average decrease since June 2017. EIA forecasts Brent spot prices will average about $62/b in both 2018 and 2019 compared with an average of $54/b in 2017.

|

2018, March, 5, 11:35:00

РЕЙТЕР - К 9.28 МСК фьючерсы на североморскую смесь Brent поднялись на 0,33 процента до $64,58 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $61,44 за баррель, что на 0,31 процента выше предыдущего закрытия.

|

2018, March, 4, 11:30:00

МИНФИН РОССИИ - Средняя цена нефти марки Urals по итогам января – февраля 2018 года составила $ 65,99 за баррель.

|

2018, February, 27, 14:15:00

РЕЙТЕР - К 9.18 МСК фьючерсы на североморскую смесь Brent опустились на 0,15 процента до $67,40 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $63,80 за баррель, что на 0,17 процента ниже предыдущего закрытия.

|

2018, February, 27, 14:05:00

МИНФИН РОССИИ - Средняя цена на нефть Urals за период мониторинга с 15 января по 14 февраля 2018 года составила $66,26457 за баррель, или $483,7 за тонну.

|

6 UNDERVALUED ENERGY STOCKS

|

|

|

Davide Tavazza, author.

Experienced Investor with more than 20 years in the financial services industry.

My investment approach encompass a range of strategies including listed undervalued securities , HY and distressed bonds.

From January 2019 Investor, Owner and Author of the site Not Only Equity - www.notonlyequity.com (Investment and Analysis website).

|

NOT ONLY EQUITY- Here an updated article on Energy stocks after my previous post I wrote on April.

Let's see which companies are still undervalued and which ones are out of my radar. Some of them reached their fair value and some other stopped to satisfy my parameters.

For new readers , my preference go toward undervalued large companies with good competitive advantage (MOAT) with solid balance sheet, low debt and rich in cash flow.

In this updating I added a new filter : Eps forecast .

Metrics :

- Large Cap Energy Companies

- Competitive advantage (Moat) ≥ narrow

- Low Debt

- Positive FCF

- Positive EPS Forecast

- Trading lower than their Price/Fair Value (Morningstar DCF model)

- P/E or Fwd P/E ≤ benchmark (MSCI Energy Index)

- Dividend Yield higher than benchmark

Good reading , and do your own due diligence before investing. Thanks.

(Source : Morningstar, Finviz, Reuters, MSCI.com)

-----

Earlier:

2019, May, 6, 11:45:00

SHELL CCS EARNINGS $5.3 BLN

CCS earnings attributable to shareholders excluding identified items were $5.3 billion, reflecting lower realised chemicals and refining margins, decreased realised oil prices and lower tax credits, partly offset by stronger contributions from trading as well as increased realised LNG and gas prices compared with the first quarter 2018. In addition, there was a negative impact of $43 million related to the implementation of IFRS 16.

2019, May, 2, 16:10:00

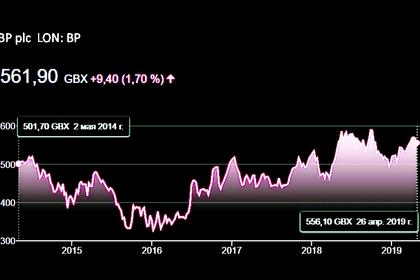

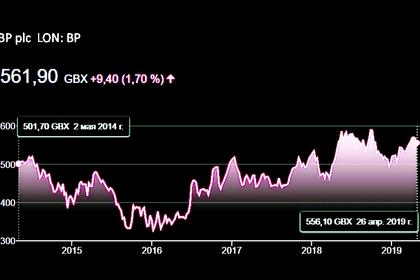

BP'S RC PROFIT $2 BLN

For the first quarter, underlying replacement cost (RC) profit* was $2,358 million, compared with $2,586 million in 2018. Underlying RC profit is after adjusting RC profit* for a net charge for non-operating items* of $252 million and net adverse fair value accounting effects* of $11 million (both on a post-tax basis).

RC profit was $2,095 million for the first quarter, compared with $2,389 million in 2018.

2019, May, 2, 16:00:00

SHELL BUYBACK PROGRAMME TRANCHE $6.75 BLN

Royal Dutch Shell plc (the ‘company’) today announces the commencement of trading in the next tranche of its share buyback programme previously announced on July 26, 2018.

2019, April, 15, 11:55:00

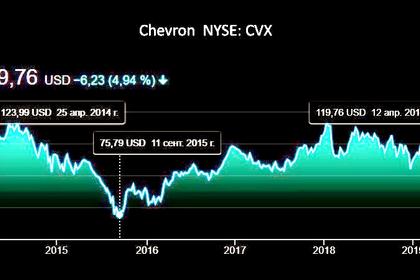

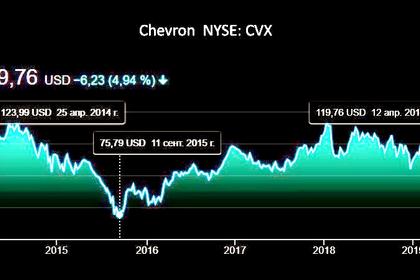

CHEVRON BUYS ANADARKO FOR $50 BLN

Chevron Corporation (NYSE: CVX) announced that it has entered into a definitive agreement with Anadarko Petroleum Corporation (NYSE: APC) to acquire all of the outstanding shares of Anadarko in a stock and cash transaction valued at $33 billion, or $65 per share. Based on Chevron’s closing price on April 11th, 2019 and under the terms of the agreement, Anadarko shareholders will receive 0.3869 shares of Chevron and $16.25 in cash for each Anadarko share. The total enterprise value of the transaction is $50 billion.

2019, April, 12, 11:05:00

SHELL SELLS MEXICO $965 MLN

Brent crude oil spot prices averaged $66 per barrel (b) in March, up $2/b from February 2019. Brent prices for the first quarter of 2019 averaged $63/b, which is $4/b lower than the same period in 2018. Despite lower crude oil prices than last year, Brent prices in March were $9/b higher than in December 2018, marking the largest December-to-March price increase since December 2011 to March 2012.

2019, April, 8, 11:35:00

8 UNDERVALUED ENERGY STOCKS

Investors with a long-term horizons could give a look to Energy Industry. According a Value Line Report on Petroleum Industry, Oil Price above $50 a barrel provide some assurance that existing dividend will be maintained.

All Publications »

Tags:

ENERGY,

INVEST,

STOCK,