AUSTRALIA'S LNG UPDOWN

МИНЭНЕРГО РОССИИ - Министр энергетики Российской Федерации Александр Новак в ходе заседания Правительства России под руководством Председателя Правительства РФ Дмитрия Медведева доложил о текущей ситуации с поставками российской нефти по нефтепроводу "Дружба".

Глава Минэнерго России напомнил, что по поручению Председателя Правительства Российской Федерации Дмитрия Медведева была создана межведомственная комиссия по проверке нарушения показателей качества нефти, транспортируемой по магистральному нефтепроводу "Дружба".

"По итогам проверки был определен источник загрязнения нефти - это узел учета "Лопатино" в Самарской области. Следственные действия выявили группу компаний, осуществлявших незаконную деятельность по сдаче в систему некондиционной нефти. Материалы проверки переданы в Генпрокуратуру России, возбуждено уголовное дело", - доложил глава Минэнерго России.

Что касается ситуации непосредственно на нефтепроводе "Дружба", Александр Новак рассказал, что уже было произведено оперативное изолирование источника загрязнения от системы магистральных нефтепроводов.

"В настоящий момент осуществляется работа по переориентации нефтепотоков, компанией "Транснефть" ведется ежесуточный режим контроля качества нефти на трубопроводах", - отметил Министр.

Минэнерго России, в свою очередь, продолжается планомерная работа и со странами-покупателями российской нефти, на данный момент дорожная карта по улучшению ситуации на нефтепроводе была согласована с Польшей, Республикой Беларусь, Украиной, Словакией и Венгрией, добавил Александр Новак.

"4 мая с опережением на два дня кондиционная нефть поступила на Мозырский НПЗ, 6 мая началась прокачка кондиционной нефти в сторону узла учета "Броды" для поставки европейским потребителям, сейчас мы ожидаем согласования прокачки нефти в Польшу. Параллельно продолжается прокачка нефти в сторону порта Усть-Луга, утром 8 мая нефть достигнет порта", - сказал он.

При этом ситуация на нефтепроводе "Дружба" не повлияла на объемы добычи и экспорта нефти Россией, заверил Александр Новак. По его словам, завершение всех мероприятий по ликвидации последствий загрязнения нефти на нефтепроводе "Дружба" ожидается во второй половине мая. Чтобы не допустить повторение подобных случаев в будущем, Минэнерго России были подготовлены соответствующие предложения по корректировке нормативно-правовой базы, добавил Александр Новак.

"Ключевое предложение касается изменений в ГОСТ по контролю качества нефти. В настоящее время ГОСТом предусмотрен обязательный контроль в транспортируемой нефти 11-ти показателей и содержания хлорорганики и парафинов не реже раза в 10 дней. Мы предлагаем внести изменения в ГОСТ по учету и контролю качества нефти с целью расширения перечня проверяемых показателей, методов отбора и хранения арбитражных проб нефти, то есть введения требований по ежедневному измерению", - пояснил глава Минэнерго России.

Кроме того, Минэнерго России предлагает внести поправки в закон "О промышленной политике России" для того, чтобы законодательно установить требования к качеству нефти, сдаваемой на транспортировку, а также закрепить неприменение хлорорганики, сообщил он.

По итогам работы комиссии, по словам Александра Новака, также предложено поручить Ростехнадзору и Росстандарту провести проверки всех коммерческих пунктов учета нефти, а Росстандарту и Росаккредитации - сделать обязательной процедуру аккредитации химико-аналитических лабораторий для проведения товарно-коммерческих операций с нефтью и нефтепродуктами. Также предлагается повысить административную ответственность юридических лиц за нарушения требований Техрегламента по нефти и по топливу - с нынешних 300 тыс. рублей до штрафа в размере 2% от оборота, заключил глава Минэнерго России.

-----

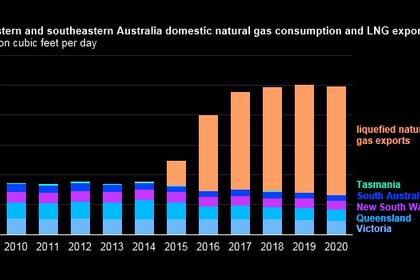

AUSTRALIA'S LNG UPDOWN

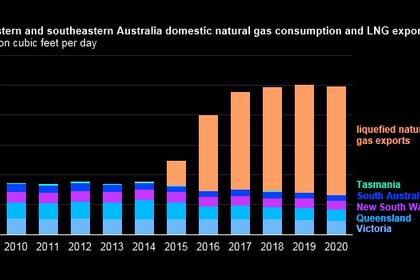

PLATTS - Exports of LNG from the Port of Gladstone in Queensland, Australia, in April eased back from the all-time record set in March while volumes to South Korea and Japan slumped, data from the Gladstone Ports Corporation showed Monday.

The port, on Australia's east coast and home to the region's three LNG terminals, exported 1.78 million mt of the fuel during the month, up 6% year on year but down 8% from the March high of 1.93 million mt, the data showed.

Terminals at the port include the Origin-ConocoPhillips Australia Pacific LNG, the Santos-led Gladstone LNG and Shell's Queensland Curtis LNG.

Together they have an annual nameplate capacity of 25.3 million mt. The April result translated to an annualized rate of 22.43 million mt, which if maintained for 12 months would leave 2.87 million mt of unused capacity. The March record was also below capacity, at an annualized rate of 22.69 million mt.

Energy consultancy EnergyQuest said recently the volumes from Australia's east coast were likely to be "as good as it gets" and that by the middle of the next decade two of the six trains at Gladstone could be shut down.

Wood Mackenzie said Monday the forthcoming Australian federal election and expected Labor win over the incumbent Liberal-National Coalition could cause issues for Australia developing upstream supply.

The comments were centered around Labor announcing late last year its intention to strengthen the existing Australia Domestic Gas Supply Mechanism, which is designed to curb LNG exports in the event of a forecast shortage of domestic gas. Labor said it would make it permanent rather than its current temporary status.

"Introducing a permanent export control trigger is not the solution to rising east coast gas prices. Cheap supply of gas will no longer be available. By 2030, the development cost of new upstream supply to meet both the LNG and domestic gas demand will be around the LNG net back price. Fundamentally, the cost to deliver new gas to market is increasing and, therefore, wholesale gas prices are on the rise," Wood Mackenzie senior research analyst David Low said.

"Intervening in the market when prices are too high will discourage operators from bringing on new supply of gas where the development cost is above the price trigger. This will exacerbate the gas shortage crisis," Low said.

GLADSTONE EXPORTS

Gladstone's LNG exports to South Korea during April hit a six-month low of 169,691 mt, which was down 27% year on year and 25% from March, the GPC data showed.

Volumes bound for Japan were at 67,166 mt, a 50% drop from a year earlier and 52% fall from March. It was the least sent to Japan in a single month since last August.

Gladstone's largest recipient of LNG, China, was sent 1.29 million mt, which was up 15% year on year and 2% lower than March.

Malaysia, meanwhile, saw a record 249,114 mt, which was double the volume registered in April last year and 34% higher than the March total.

-----

Earlier:

2019, April, 19, 09:25:00

AUSTRALIA'S LNG PRODUCTION UP 11%

Australia's largest gas producer, Woodside, Thursday said LNG production from its three facilities rose 11% year on year in the January-March quarter, and maintained its 2019 production guidance.

2019, April, 17, 10:40:00

AUSTRALIA'S SANTOS PRODUCTION UP 33%

First quarter production of 18.4 mmboe was a record for Santos and 33% higher than the corresponding quarter, primarily due to sustained strong asset performance and the acquisition of Quadrant Energy.

All Publications »

Tags:

AUSTRALIA,

LNG,

GAS