BRAZIL'S OIL UP

PLATTS - Brazil is stepping on the oil and gas accelerator, hoping to further develop its upstream assets with additional E&P bid rounds later this year – all amid the country's efforts to improve the investment climate.

The new government, under President Jair Bolsonaro, wants to keep investor interest growing in the energy sector – and beyond. With this goal in mind, representatives of his administration, as well as Brazilian oil and gas companies, have had a strong presence at events in Houston this spring, as they try to court international upstream developers.

Marcio Felix, secretary of oil, gas and biodiesel at Brazil's Ministry of Mines & Energy, advocated strongly for upstream opportunities in Brazil at one of the world's biggest E&P events – the Offshore Technology Conference (OTC) in Houston, Texas. Felix touted Brazil's greater regulatory certainty and improved contract enforcement, as well as pension reform and privatization. Brazil has seen a dramatic opening of its upstream oil and gas markets in the past few years with bids on various blocks, and last year one of those bid rounds drew more than $2 billion from producers.

Felix put a spotlight on the country's upcoming 16th bid round in October and November, which will feature a host of new onshore, offshore and pre-salt blocks. He also highlighted the transfer of rights (TOR) blocks, saying that the TOR bid round would be a "turning point" for Brazil's E&P sector, opening up significant new areas for exploration. The offer of TOR blocks has been made possible by the settlement of a longstanding dispute between the government and the state-owned Brazilian oil and gas company Petrobras.

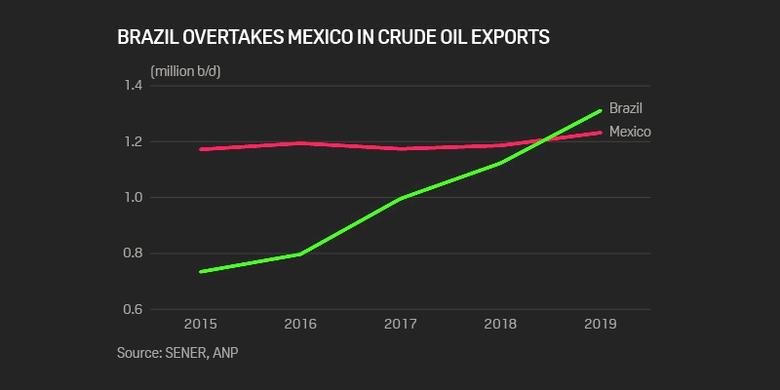

Since opening up its markets, Brazil has moved into the lead as Latin America's largest crude oil producer and exporter. In the first quarter of this year, monthly crude oil exports exceeded those of Mexico, data from Brazil's regulatory agency show.

Brazil has seen its exports of crude grow from 734,000 b/d in 2015 to 1.3 million b/d in Q1 of this year. In contrast, Mexico, which was once a powerhouse of oil production, has maintained its export status only through curtailment of domestic refining, not increased crude oil output.

Felix said Brazil's government wants to continue to drive upstream investment in order to monetize its pre-salt natural gas resources, attract midstream investment, and achieve more affordable domestic energy, which it believes will in turn drive downstream industry development.

On the heels of OTC, a Houston-based seminar focusing on Brazil sought to draw out investors, putting Brazilian government speakers on the agenda. The seminar coincided with Brazil's largest independent oil and gas producer, PetroRio, hosting an event at the Houston Museum of Natural Science's Weiss Energy Hall – where it further pitched its business to US-based investors.

Petro Rio has seen its production go from zero to 30,000 b/d in the past four years, and it is moving to maintain a rapid pace of growth with new acquisitions such as a stake in Chevron's Frade field in Brazil in January. On the back of this acquisition, the company is looking to raise equity to continue expanding and developing in Brazil, a PetroRio executive stated on the sidelines of the company's Houston event.

While Brazil works to attract investment, a key factor for those upstream investors eyeing the opportunities in Latin America's oil and gas markets, will be the price of oil and gas along with the cost to produce.

Martin Stauble, Shell's Exploration and Production Vice President of North American and Brazil, noted during his presentation at Houston's OTC that since 2014, the breakeven costs for deep-water exploration have dropped from $78/bbl to $49/bbl in 2018. "The industry has driven down cost," he said. "I don't think we've reached the bottom yet."

The progress on fiscal and regulatory policies, along with falling costs and firmer oil prices have helped drive more investment in Latin America. With the 2018 average oil price around $71/b, Stauble said, and breakeven costs falling, the dynamic has changed, generating more interest in bid rounds and in gearing up actual drilling activity. In Mexico, as an example, Shell expects to drill its first well by the end of 2019, and plans to drill another four to five wells in 2020. In addition, Shell has plans for five wells in Brazil.

Nevertheless, the timeline from lease acquisition to drilling is long, Stauble noted. It can run to 18-24 months in Mexico and about 12-18 months in Brazil. "There's still a lot of work to be done in Mexico," he said. "And in Brazil, it is still quite difficult to get seismic permits." In Mexico, as Shell prepares to drill its first well in December, it still needs to finalize some regulatory issues. "That's the wildcard," Stauble said.

-----

Earlier: