DIVERSIFICATION IS IMPORTANT

PLATTS - Fatih Birol, executive director of the International Energy Agency, spoke to Paul Hickin about the new oil market dynamics unleashed by US shale production, challenges facing Venezuela, and heightened geopolitical risk.

In 2012, Fatih Birol predicted that the US would become the largest oil producer by the end of the decade. In an exclusive interview with S&P Global Platts at the IEA headquarters in Paris, Birol did not hold back in outlining the impact US supply is now having on OPEC. The ardent supporter of Turkish soccer team Galatasaray, who has never driven a car, is also worried that Middle East producers may score an own goal if they do not diversify their economies quickly.

What's your take on the oil markets right now?

I'm the chair of the energy board of the World Economic Forum, Davos and I have been going there 13 years in a row, participating in the meetings. This year, 2019, was the year when ministers and CEOs talked about geopolitics more than any other issue. Geopolitics is always part of the discussion, but this year it was talked about much more than demand and supply. And since the Davos forum in January, the geopolitical situation has worsened.

In addition to Iran and Venezuela, which are experiencing significant declines for different reasons in production and exports, we now have Libya going through a very difficult time, and of course, we don't know how things will evolve there; and then there is Algeria. When we look at those developments, plus the trade tensions between China, the US and other countries, geopolitics has become a key factor for oil markets for the next quarters to come. I am an energy man, therefore I don't like it, I would like to see oil markets determined by market forces rather than such developments.

So are the interventions by OPEC, and Russia and its other allies, helping to stabilize the oil market, or are their cuts counter to its smooth functioning?

OPEC, plus Russia, are very important countries. I can tell you two things. One relates to the short term and one is more strategic. In the short term, after the emergence of the shale oil revolution which the IEA foresaw some ten years ago, the ability to determine market developments through meetings and resolutions is diminishing.

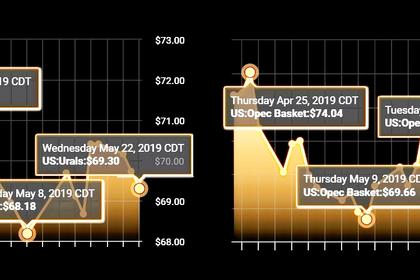

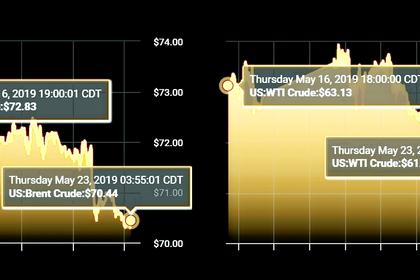

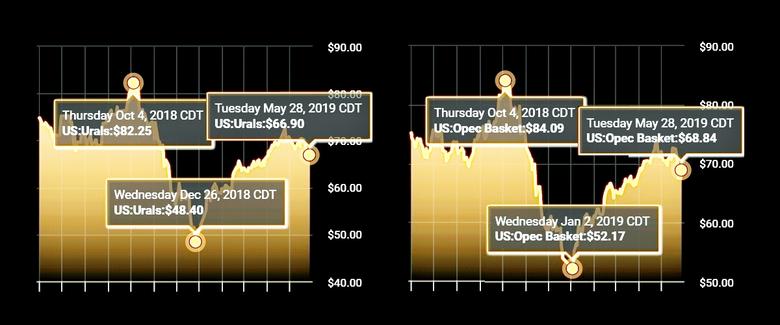

For example, last December those countries met in Vienna and took a decision [to cut output by 1.2 million b/d] with the expectation of bringing the prices up, and we see a few weeks later prices went significantly down because of the amount of potential [crude supply] coming out of the US. So we will see more competition between the resolutions in Vienna and the production in the Permian. Those days when oil markets, developments and prices were determined by resolutions, discussions and so on, are over. There are very strong market forces now, mainly driven by the US shale revolution. We see growth this year and we may well see acceleration in this respect.

I also have an important reminder to oil producing countries whose economies are heavily reliant on oil revenues. They are facing, in the medium term, two big challenges. One, because of shale oil, the amount of oil they are going to export will be lower. Our numbers show that the US may well be the number one oil exporter of the world, overtaking Russia and Saudi Arabia. So they will export less oil in terms of volumes, and they will not have the prices they would like to have. So the revenues will be less and their economies will be affected.

Second, there are new technologies coming into the picture. There are electric buses, very important, and there are electric cars and other clean energy technologies which will, not immediately, but in the longer term, eat at the share of oil in the global energy mix. Demand will still be there, but demand growth in the future will be slower than in the past.

To put these two things together, the shale oil affecting both the volume of export and the price, plus the developments in clean technologies, tell me that for those countries who meet in Vienna, it has never been more important for them to diversify their economies. We have seen in Algeria, for example, one of the main reasons is the low oil price and the impact on the economy, and the same with Venezuela and elsewhere.

My humble suggestion as a former OPEC employee is that it is now the highest time in history that they diversify their economic base.

How do you view crude quality and how it is likely to impact demand in the coming year?

It is working in the right direction. Global oil demand, the slate, is getting lighter, lighter products coming into the picture. My colleagues tell me the gravity today matches with the shale [oil] that is between 40 and 50 [API], and this also makes for a change – the complexities of the refineries will be less and less in the future. A reversal of the trends we have been seeing in the past. So from our point of view, we don't see a major problem and shale quality is very much in line with the development with the oil demand.

How quickly can Venezuela and Iran recover in a best case scenario, and are they the biggest supply risks?

I worked in the OPEC secretariat for several years and at that time PDVSA had a new strategy called "la apertura" which meant the opening up of the Venezuelan oil sector. Here the idea was building production to 5.5 million b/d, this was the target – this was in the 1990s. There was an increase in production but it never [reached that target] because of the political changes. No, the situation today is really very desperate, from the point of view of technology, decline rate, and the availability of skilled labour. But if there was a change in the current context, the rebound may not be as slow as many colleagues, who I call pessimistic, expect.

But there are two conditions to seeing a rebound similar to the "apertura" days. One, there is an army of skilled petroleum experts outside of Venezuela, they need to bring them back. And second, they need to find a way to get investment in the country.

From a geological point of view, I don't see this as the main challenge, the main challenge is bringing the skilled workers home. There is an appetite around the world, if there was a stable investment situation in Venezuela I would expect a huge appetite from many companies. It is one of the richest countries in terms of resources.

And Iran has some serious challenges with most of the members of the international community and I hope these problems are resolved. Here the issue is more than geology, it is political.

Do you see the plan for OPEC and Russia to formalize its relationship as an effective long-term plan in light of your comments about the US and shale? Do you see it taking hold?

When I read the statements from the OPEC countries and the Russian minister, I see the intention to transform the current partnership into a more strategic partnership. Of course, I don't know if this will work out from a political point of view but in my view, even a strategic partnership will try to put the markets in line with the resolution results in Vienna, [but] markets will not listen to those resolutions. The voice of Mozart will not be heard in Pennsylvania.

The economic effect is stubborn, there is a lot of oil coming onto the market with the expansion of the pipelines, and should those developments take place in the US this will increase the ability and speed of US shale to react to international price developments, big time. Therefore you will see oil markets will gradually move into the market direction rather than the resolution direction. But I want to underline that the world will need the oil of Middle Eastern countries, of Russia, and others, because there is still robust demand which will be with us for several years to come.

What does a balanced oil market look like? Is there an optimum price?

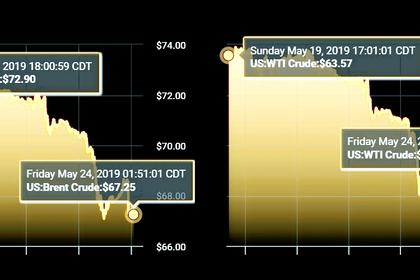

An optimum price for everyone to agree is very difficult. But to be honest with you, if the prices go high, $70/b plus, and the global economy is weaker this year compared to last year, and China is experiencing, as they say, some of the slowest growth in 30 years – and don't forget China was responsible for almost half of global growth of oil demand in the past 10 years – we will see the effect of that.

Higher prices will have a negative impact on the economy and very low prices will have a negative impact on investment, so our view is we should have a price that is not too high or too low either.

-----

Earlier: