EUROPE GAS STRATEGY: €139 BLN

GI - Currently, about 70 million European industrial and private customers are supplied by a gas grid 2.2 million kilometres in length. Natural gas, not only as a product, consists of various positive habits for heating, power generation and transport. Even in light of the political goals for a massive reduction of greenhouse gas emissions in Europe, there is still a lot of potential lying in gas-based supply. Coal to gas switching – for example, decided in German policy at the beginning of 2019 - provides 'low hanging fruits' for rapid, low-cost carbon emission reductions. In the heating sector about 7 million oil - fired heating systems are installed only in the German market. Another coal-fired heating systems still exist.

Study on contribution of gas and heat networks to efficient greenhouse gas reduction

In November 2017, Rheinenergie AG, Open Grid Europe and Gelsenwasser AG conducted a study with the Institute of Energy Economics of the University of the City of Cologne (EWI) that investigates what contribution existing gas and heating networks can make to efficient greenhouse gas reduction by 2030 and 2050.

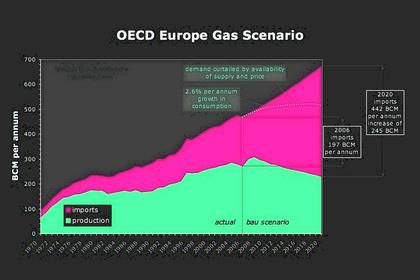

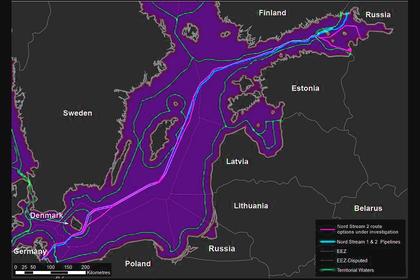

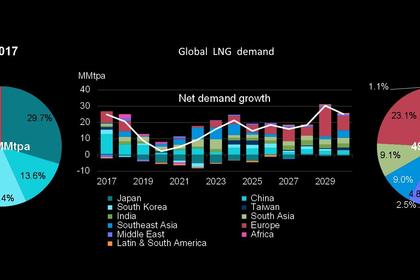

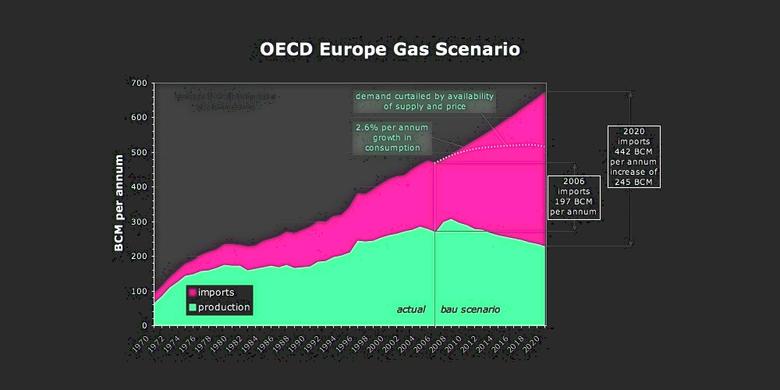

The main conclusion of the study was that reduction targets can be achieved even in a non-technology-specific scenario (Evolution) by using the networks. A GHG reduction of 55% by 2030 and 95% by 2050 (relative to 1990 levels) was achieved for the energy industry, buildings and industry €139 billion cheaper than in a highly regulated approach with electrification by means of heat pumps (Revolution). The Evolution scenario offers more flexibility and opportunities for uncertain future developments than an early commitment to a specific technology. Much of the next decade could, therefore, see robust demand and a need for more pipeline gas and LNG imports (and probably new import infrastructure) due to declining domestic production, reduced use of coal and nuclear power, and gas use in power generation as back-up for renewables.

Storage and flexible generation will be key

But no doubt, the future energy system of Europe will be based on intermittent renewable energy sources to a high extent. The specified GHG reduction targets require the electricity mix to have lower CO2 emissions. It's not clear to what extent heating and transport will be electrified. Power generation for sure will have shares of 50% and more of volatile wind onshore and photovoltaic generation. In both scenarios of the study electricity generation from renewable energies doubles by 2030 and quadruples by 2050.

A system based on so much volatility will need large scale back-up generation and storage in order to ensure a 24/7 security of supply. According to EWI, the installed capacity of gas-fired power stations will increase from the current 30 GW to 110 GW in 2050. Even in the Evolution scenario, the installed capacity of gas-fired power stations increases to 75 GW in 2050. Regarding storage, chemical energy carriers provide the highest energy density and especially gas provides the highest existing storage capacity. Batteries can only help during short (e.g. less than a day) load peaks but not over a longer period. It is obvious to use the surplus of renewables for the creation of synthetic natural gas by Power-to-Gas technologies. Synthetic fuels are an essential requirement in both scenarios in order to meet ambitious climate goals and are largely imported. Consequently, with 448 TWh (Revolution) and 634 TWh (Evolution), there is a significant requirement for synthetic fuels in 2050 in order to meet climate targets.

Finding perspectives for post-2030

The technical feasibility of several concepts has been shown in several research projects. CCU has no acceptance by the people and politicians - at least in Germany. But by doing focused research on hydrogen and the possibilities of blending in transmission and distribution grids, methanation and synthetic methane we have to find out if these technologies can be integrated into the daily operation of European energy supply.

At the moment it is unclear whether, and at what cost, methane storages could be converted to hydrogen. And we have to find out the legal and fiscal barriers for the market entry especially regarding the framework and address them to politicians. An almost decarbonised energy system within which the gas industry has made no substantial effort to reduce its carbon footprint is likely to deal with dramatically lower gas consumption by 2050.

-----

Earlier: