GAZPROM'S SALES DOWN 10%

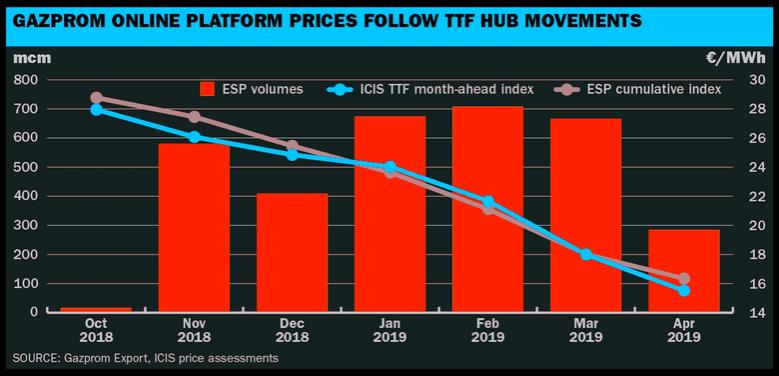

PLATTS - Gazprom's sales of Russian gas dropped 10% in the first quarter, analysis of quarterly results showed, as sales from storage dipped compared with 2018.

The Russian gas group sold a total of 59.7 Bcm to all its export markets -- both sales from storage and direct pipeline flows -- in Q1, down from 66.6 Bcm in Q1 2018.

European gas demand was impacted by mild temperatures through the first quarter, with Gazprom's head of pricing, Sergei Komlev, saying at the Flame conference in Amsterdam this week that there had been "no winter".

Lower sales from storage was the main driver behind the overall decline. Last year, sales from storage were boosted by severe cold weather across much of Europe.

Direct pipeline flows from Russia to Europe in Q1 were more or less flat year on year, according to S&P Global Platts Analytics.

Gazprom said last month it had 6.4 Bcm of working gas in storage across sites in Europe -- which include the Rehden site in Germany and Haidach in Austria as well as capacity in the Bergermeer facility in the Netherlands -- having begun the injection season with stocks of 5 Bcm.

All Gazprom data are for volumes according to Russian standard conditions (calorific value of 8,850 kcal per cu m at 20 degrees Celsius).

So, Gazprom's 59.7 Bcm, as per Russian standard conditions, equates to 54.7 Bcm in standard European measurements.

Germany, Turkey declines

Sales to Germany -- by far Gazprom's biggest export market -- fell 5.7% year on year to 15.2 Bcm in Q1 as German gas demand dropped and Norwegian supplies picked up.

There was also a major shift in Russian gas sales to Turkey, which fell to 4.5 Bcm in Q1 from 7.9 Bcm in the same period last year.

Turkey continues to try to reduce gas consumption in order to address the country's current account and trade deficits. Its gas imports fell 9% to 50.4 Bcm in 2018. Gas consumption for the year was down 8.3% to 48.91 Bcm, largely as a result of pressure on the power sector to reduce gas burn.

Turkish state gas importer Botas raised the price it charges power plant for gas by 49.5% in August, over three times the rise implemented for other consumers, with the specific aim of reducing gas burn.

Imports from Russia have been hit by a reduction in purchases by the country's private importers, which all import via contracts with Gazprom and have continued to find it difficult to sell gas into a shrinking market.

Turkey has gone from being the second-biggest supply market for Gazprom to the fourth largest, behind Germany, Italy and Belarus.

Eastern Europe

Gas sales in Poland -- eastern Europe's biggest Russian gas consumer -- also fell sharply in Q1 to 1.97 Bcm, compared with 3.22 Bcm in Q1 2018.

Poland has increased its LNG imports as it looks to diversify away from Russian pipeline imports.

Elsewhere in eastern Europe, Gazprom's gas sales in Hungary, the Czech Republic and Slovakia were higher year on year.

The increase has been attributed to a desire to increase gas storage stocks ahead of the upcoming winter on fears that gas supplies via Ukraine could be disrupted from the start of January.

Akos Kriston, deputy CEO at Hungarian state-owned storage company MFGT, said this week Hungary aimed to fill its gas storage stocks to 100% of their 6.3 Bcm capacity ahead of the "real threat" that Russian gas supply via Ukraine will be disrupted

Hungary has only filled its storage stocks to an average of around 40%-60% full over the past five years, but bookings for the upcoming winter are 100%, Kriston said.

There has been concern that if Russia's Gazprom and Ukraine's Naftogaz failed to agree a new transit deal for Russian gas to Europe before the current agreement expires at the end of 2019 that supply disruption could ensue.

-----

Earlier: