2019-05-08 11:50:00

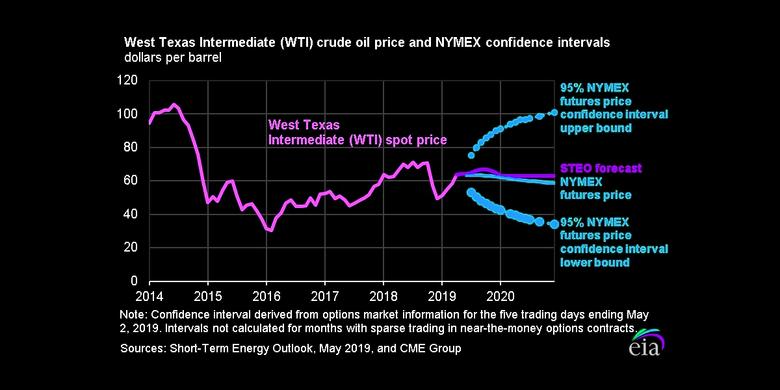

OIL PRICES 2019-20: $70 - $67

U.S. EIA - SHORT-TERM ENERGY OUTLOOK

Forecast Highlights

Global liquid fuels

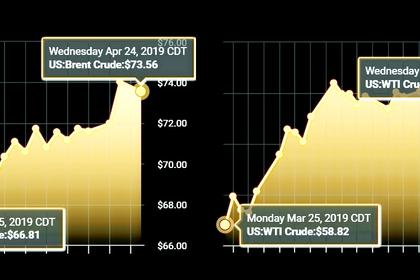

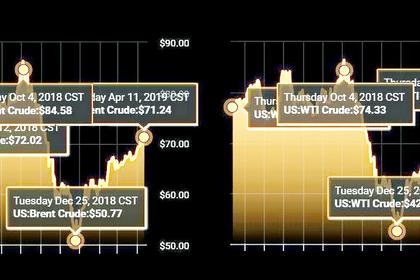

- Brent crude oil spot prices averaged $71 per barrel (b) in April, up $5/b from March 2019 and just below the price in April of last year. EIA forecasts Brent spot prices will average $70/b in 2019 and $67/b in 2020, both about $5/b higher than in last month’s STEO, compared with an average of $71/b in 2018. EIA’s higher Brent crude oil price forecast reflects tighter expected global oil market balances in mid-2019 and increasing supply disruption risks globally.

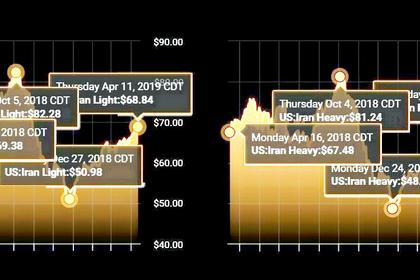

- EIA forecasts that crude oil production in the Organization of the Petroleum Exporting Countries (OPEC) will average 30.3 million barrels per day (b/d) in 2019, down by 1.7 million b/d from 2018. In 2020, EIA expects OPEC crude oil production to fall by 0.4 million b/d to an average of 29.8 million b/d. Production in Venezuela and Iran account for most of the OPEC output declines in 2019 and in 2020, but EIA expects these declines to be partially offset by production increases from other OPEC members.

- EIA forecasts global oil inventories will decline by 0.2 million b/d in 2019 and then increase by 0.1 million b/d in 2020. Global demand outpaces supply in 2019 in EIA’s forecast, but global liquid fuels supply then rises by 1.9 million b/d in 2020, with 1.5 million of that growth coming from the United States. Global oil demand rises by 1.5 million b/d in 2020 in the forecast, up from expected growth of 1.4 million b/d in 2019.

- For the 2019 summer driving season, which runs from April through September, EIA forecasts that U.S. regular gasoline retail prices will average $2.92 per gallon (gal), up from an average of $2.85/gal last summer. The higher forecast gasoline prices primarily reflect EIA’s expectation of higher gasoline refining margins this summer, despite slightly lower crude oil prices.

Natural gas

- The Henry Hub natural gas spot price averaged $2.64/million British thermal units (MMBtu) in April, down 31 cents/MMBtu from March. Prices fell as a result of warmer-than-normal temperatures across much of the United States, which reduced the use of natural gas for space heating and contributed to above-average inventory injections during the month. EIA expects strong growth in U.S. natural gas production to put downward pressure on prices in 2019 and in 2020. EIA expects Henry Hub natural gas spot prices will average $2.79/MMBtu in 2019, down 36 cents/MMBtu from 2018. The forecasted 2020 average Henry Hub spot price is $2.78/MMBtu.

- EIA forecasts that dry natural gas production will average 90.3 billion cubic feet per day (Bcf/d) in 2019, up 6.9 Bcf/d from 2018. EIA expects natural gas production will continue to grow in 2020 to an average of 92.2 Bcf/d.

- EIA estimates that natural gas inventories ended March at 1.2 trillion cubic feet (Tcf), 16% lower than levels from a year earlier and 29% lower than the five-year (2014–18) average. EIA forecasts that natural gas storage injections will outpace the previous five-year average during the April-through-October injection season and that inventories will reach 3.7 Tcf at the end of October, which would be 15% higher than October 2018 levels and about equal to the five-year average.

Electricity, coal, renewables, and emissions

- EIA expects the share of U.S. total utility-scale electricity generation from natural gas-fired power plants to rise from 35% in 2018 to 37% in 2019 and to 38% in 2020. EIA forecasts that the share of electricity generation from coal will average 24% in 2019 and 22% in 2020, down from 27% in 2018. The nuclear share of generation was 19% in 2018, and EIA forecasts that it will stay near that level in 2019 and in 2020. The generation share of hydropower averages 7% of total generation in EIA’s forecast for 2019 and 2020, similar to 2018. Wind, solar, and other nonhydropower renewables together provided about 10% of electricity generation in 2018. EIA expects they will provide 11% in 2019 and 13% in 2020.

- EIA forecasts that all renewable fuels, including wind, solar, and hydropower, will produce 18% of U.S. electricity in 2019 and almost 20% in 2020. EIA expects that wind generation will surpass hydropower generation for the first time to become the leading source of renewable electricity generation in 2019 and maintain that position in 2020.

- EIA estimates that U.S. coal production in the first quarter of 2019 was 170 million short tons (MMst), 22 MMst (12%) lower than the previous quarter and 17 MMst (9%) lower than production in the first quarter of 2018. EIA expects that coal production will fall during the forecast period as demand for coal (domestic consumption and exports) declines. EIA forecasts that coal production will total 700 MMst in 2019 and 638 MMst in 2020 (declining by 7% and 9%, respectively).

- After rising by 2.7% in 2018, EIA forecasts that U.S. energy-related carbon dioxide (CO2) emissions will decline by 2.1% in 2019 and by 0.8% in 2020. EIA expects emissions to fall in 2019 and in 2020 as forecast temperatures return to near normal after a warm summer and cold winter in 2018 and because the forecast share of electricity generated from natural gas and renewables increases while the forecast share generated from coal, which produces more CO2 emissions, decreases. Energy-related CO2 emissions are sensitive to weather, economic growth, energy prices, and fuel mix.

----

Earlier:

2019, May, 2, 17:00:00

OPEC + RUSSIA OBLIGATIONS

Russia is meeting its obligations under the OPEC/non-OPEC crude production agreement, and participants remain committed to the arrangement, despite ongoing uncertainty over world energy market developments.

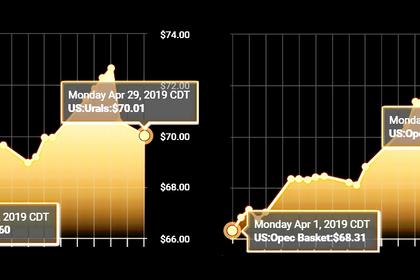

2019, April, 29, 11:30:00

OIL PRICE: WILL BE $100

"Not extending the oil waivers of some countries is another side of the US measures against Iran. But if Iran's oil is fully sanctioned, oil price will go higher than $100 per barrel,"

2019, April, 26, 11:25:00

OIL PRICES 2019-20: $66 - $65

Crude oil prices are expected to average $66 a barrel in 2019 and $65 a barrel in 2020,

2019, April, 24, 11:30:00

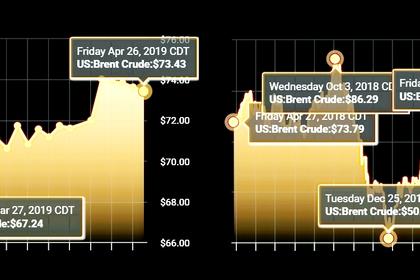

OIL MARKET IS FINE

The International Energy Agency is monitoring developments in global oil markets, and notes that markets are now adequately supplied, and that global spare production capacity remains at comfortable levels.

2019, April, 24, 11:05:00

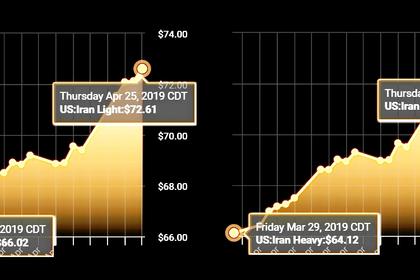

OIL PRICES: SHALE & FRACKING

As the BRENT surges past 73$/barrel, it's expected that Brent trades at a premium with regards to the Brent-Dubai Spread Chart.

2019, April, 15, 12:10:00

FRAGILE OIL MARKET

Iranian Minister of Petroleum Bijan Zangeneh said the current crude oil market was in a fragile state, adding, “If the US decided to exert more pressure on Iran, the oil market would become unpredictably more fragile.”

2019, April, 12, 11:55:00

2019 GLOBAL OIL DEMAND EXCEED 100 MBD

Total world demand for the year is now expected to reach 99.91 mb/d and exceed the 100.00 mb/d threshold during 2H19. OECD oil demand growth is projected to reach 0.21 mb/d, with OECD Americas leading the increase, while oil demand in the non-OECD region is projected to rise by around 1.0 mb/d, with Other Asia and China being the primary contributors to growth.