LIBYA'S OIL: 95% AT RISK

PLATTS - Armed conflict between groups vying for control of Libya is putting the country's lifeblood oil and gas industry at risk of almost total collapse, just as production is beginning to recover from years of war, the head of the country's state oil company said Saturday.

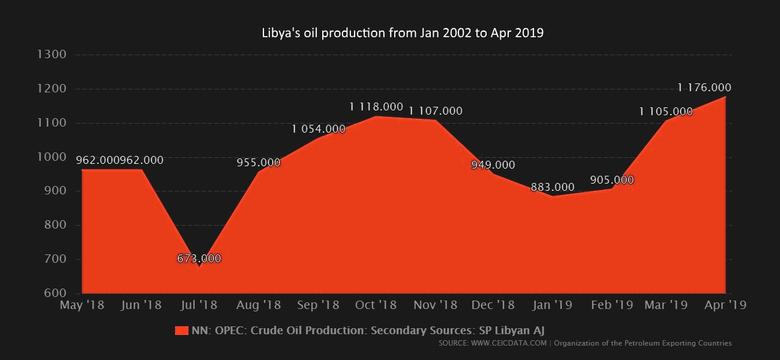

Libya is currently pumping almost 1.3 million b/d, National Oil Corporation Chairman Mustafa Sanalla told reporters. While production and exports have so far been unaffected by the recent escalation in fighting between the self-styled Libyan National Army, forces loyal to the UN-backed government and other militia groups, the violence threatens to destroy oil fields and export infrastructure, he said.

"The war is back. The war should be stopped," Sanalla told reporters, citing a rec"ent attack near the Zallah oil field in the Sirte Basin, about 750 km southeast of Tripoli. "The war should be stopped to keep production running."

Sanalla had just arrived in Jeddah, Saudi Arabia, where he will attend an OPEC/non-OPEC monitoring committee meeting Sunday.

Sanalla said the violence was detrimental to NOC's attempts to rebuild the oil sector. Oil and gas sales account for almost all of Libya's revenues.

"Our aim is to attract the investment. This chaos is like you fire the investors, unfortunately," he said. "If the situation will continue like this, I'm afraid that 95% of production will be lost."

LNA forces last month began advancing on the capital Tripoli, shattering a tenuous peace that had allowed oil production to recover above 1 million b/d in March, according to S&P Global Platts estimates.

As well as a key oil exporter, Libya is also an important gas producer, with exports averaging 13.7 million cu/day so far this year, Platts estimates.

Some international oil companies, such as Eni, have already begun evacuating staff from Tripoli, due to the fighting, some of which is occurring close to key oil and gas infrastructure.

This is the latest threat to Libya's oil and gas industry, which has been at the mercy of groups vying for control, with attacks on key pipelines and production facilities since the 2011 civil war.

Sanalla has said Libyan production could hit 1.4 million b/d this year, if security is maintained.

-----

Earlier:

2019, March, 11, 11:25:00

LIBYA'S OIL UP

Libya’s biggest oil field resumed production, adding another complication to OPEC’s effort to trim a global supply glut.

|

2019, January, 30, 10:50:00

LIBYA NEED INVESTMENT $60 BLN

PLATTS - Libya's state National Oil Corp. is targeting a $60 billion overhaul of its oil and gas sector as it strives to reach a pre-civil war output level of around 1.6 million b/d by the end of this year.

|

2019, January, 7, 09:45:00

LIBYA'S OIL REVENUE UP 78%

REUTERS - Libya’s oil revenue rose to $24.4 billion in 2018, up 78 pct from 2017, Libya’s National Oil Corporation (NOC) said in statement on Sunday.

|

2018, October, 10, 07:35:00

BP AND ENI IN LIBYA

BP - Libya’s National Oil Corporation, BP and Eni today signed an agreement expected to lead to Eni and BP working together to resume exploration activities on a major exploration and production contract in Libya.

|

2018, September, 3, 14:55:00

LIBYAN OIL UP

PLATTS - Libya's crude oil production edged up again this week, with increased output from two smaller fields in the east of the country, sources said Friday.

|