LNG FOR NETHERLANDS

PE - The Netherlands is now officially a net gas importer, as dwindling domestic gas output means it is no longer a key European supplier. As a result, the country has nearly tripled LNG imports into its sole terminal, at Rotterdam, to ensure it can meet domestic demand.

Dutch LNG imports rose 167pc in 2018 to a record-breaking 4.05bn m³, government data shows. The Netherlands' own gas production, mainly from the giant Groningen gas field, was for the first time in nearly six decades insufficient to meet annual domestic demand.

GasTerra, the official wholesaler of Dutch gas, says the Netherlands' reliance on imports is bound to rise over the coming years. "Ever since the first molecules of gas started flowing from Groningen, the Netherlands has been self-sufficient," says Annie Krist, GasTerra's chief executive. "This is no longer the case. The turning point at which we went from net exporter to net importer has already been crossed. Our country is becoming a 'standard' European gas country."

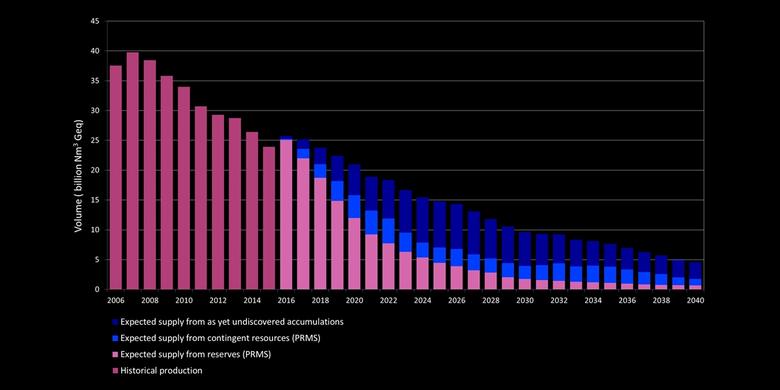

A government decision in 2018 to accelerate the shutdown of the Groningen gas field, due to concerns over exploration-linked earth tremors, has sped up the process. Overall Dutch production fell to 36.48bn m3 in 2018, down 17pc year-on-year, mainly due to a steep decline in Groningen output, which over the last five years has fallen by 65pc to 18.83bn m3. It was also the first year in which production fell short of domestic gas demand, which totalled 40.77bn m3, according to government and field operator data.

The sudden need to fill the gap with flexible LNG supply meant that the Gate LNG import terminal in Rotterdam—after years of under-utilisation—experienced record levels of activity in 2018. It carried out 104 ship operations, during which 8.3mn m3 of LNG were unloaded and 3.9mn m3 were loaded, including transhipments.

"The Netherlands has enough capacity to replace the declining production from Groningen through LNG. In the long term they will be a lot more reliant on pipeline gas, but they have immediate flexibility from Gate," says Carlos Torres Dias, head of gas and power markets at Norwegian-based consultancy Rystad Energy.

Gate unlocked

This projected rise in LNG imports is a boon for the Gate terminal, owned by Dutch gas grid operator Gasunie and tank storage company Vopak. The operators are expecting business to go so well that they launched an 'open season' in March to test demand for an increase in its capacity by 2bn m³/yr from the current 12bn m³/yr. Gate says the expanded terminal could be operational from September 2021 and has invited interested parties to submit bids for capacity contracts for at least five years up to August 2031.

Most LNG deliveries into the Gate terminal are short-term or spot deliveries, but offtakers have also concluded long-term agreements with established suppliers such as Qatargas.

"The Netherlands [government] has no policy for sourcing gas from a specific country, but leaves this to the market," says Ben Oudman, oil and gas director at consultancy DNV GL. The Netherlands imported LNG from a variety of countries last year, including Russia, Norway, Qatar and the US. This has allowed the Netherlands to diversify its gas import portfolio beyond those countries to which it is physically linked by pipeline.

But growing reliance on spot LNG imports also means higher exposure to price fluctuations. Last year, the Netherlands was able to benefit from weak LNG prices, but Rystad Energy forecasts a tightening market after 2022 which would increase spot prices.

By then, Dutch domestic production and long-term gas import agreements are both likely to have dropped to low levels, according to analysis carried out by IHS Markit and published in November 2018.

"Under the current contractual situation, the balance of supplies—70pc in 2018, 86pc in 2020, and the whole market in 2022—will need to be purchased in the spot markets on a short-term basis," it says.

Even allowing for the negotiation of new contracts before then, the picture is one of heavy dependence on the whims of the spot gas markets by the early 2020s.

-----

Earlier:

2019, February, 13, 11:35:00

NETHERLANDS GDP UP 2.6%

IMF - The Dutch economy has performed very well in recent years. Growth is estimated at 2.6 percent in the 2018, owing to strong domestic demand and robust net exports.

|

2018, May, 16, 12:10:00

СОТРУДНИЧЕСТВО РОССИИ И НИДЕРЛАНДОВ

МИНЭНЕРГО РОССИИ - Двусторонний диалог в таком формате возобновился спустя пять лет. При этом сотрудничество в области ТЭК играет значимую роль в торгово-экономических отношениях России и Нидерландов. Совместно реализуются значимые для обеих стран энергетические проекты - «Турецкий поток», «Сахалин – 2», «Северный поток 2», «Балтийский СПГ», «Каспийский трубопроводный консорциум», проект разработки Салымских месторождений, проект локализации производства ветроэнергетических установок в России.

|

2017, July, 21, 09:05:00

СОТРУДНИЧЕСТВО РОССИИ И НИДЕРЛАНДОВ

Особое внимание было уделено текущему статусу и перспективам реализации совместных проектов в нефтегазовой сфере, области возобновляемых источников энергии и развитию научно-технического сотрудничества в ТЭК.

|

2015, June, 12, 20:45:00

RUSSIA & NETHERLANDS GAS DOWN

Global trade of natural gas via pipelines fell the most on record last year as Russia halted exports to Ukraine and shipments declined from the Netherlands, the European Union’s biggest producer, according to BP.

|