NORWAY'S GROWTH 2.5%

IMF - Norway's economic momentum remains strong, and inflation is now above target. The authorities should therefore aim for some fiscal consolidation during the upturn, which would help rebuild fiscal buffers that could help cushion future shocks. House prices remain overvalued, albeit less so than last year, and household debt continues to rise. It is thus too early to loosen mortgage regulations. In addition, risks stemming from the commercial real estate market are growing and should be closely monitored. Favorable macroeconomic conditions mean now is the time to address important longer-term challenges, such as enhancing competitiveness, containing looming budgetary pressures, and sustaining high employment levels despite adverse demographic trends.

Outlook, Risks, Challenges

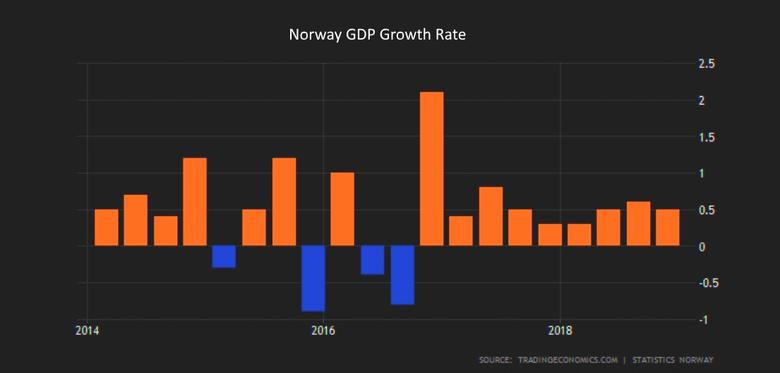

1. Norway's economic momentum remains strong . After growing by 2.2 percent in 2018, mainland economic activity is expected to accelerate further and rise by about 2.5 percent this year, before growth slows to 2.1 percent in 2020. Growth is supported by relatively high oil prices which are boosting investment, gains in competitiveness from the weak krone, and a robust labor market that is supporting incomes. The output gap, which is currently around zero, is projected to move into positive territory later in the year.

2. But downside risks cloud this positive near-term outlook. Global trade tensions persist, as does uncertainty about European growth. Separately, global market turbulence and higher risk premia could raise debt service costs, resulting in lower consumption among highly leveraged households. On the domestic side, residential house price growth has softened over the last year, while commercial real estate (CRE) prices are growing strongly and bear watching. One upside risk is that oil prices have been above the level underpinning our GDP projections.

3. Sustaining growth in the medium-term will require facing various headwinds. Recent pension reforms have boosted labor supply, but more will be needed to support employment levels in the face of population aging. Non-oil exports have started to recover thanks in part to the substantial krone depreciation during the 2013-2015 period. Looking into the future, as the growth impulse from the petroleum sector abates, non-oil competitiveness will need to be strengthened further.

Policy Discussions

The current strong macroeconomic conditions should not foster complacency, as this could accentuate imbalances. In addition, the authorities should take advantage of the positive context to tackle difficult reforms that would address long-run challenges.

Fiscal Policy

4. Fiscal policy has been broadly neutral over the last three years, a marked improvement relative to how policy was conducted in previous upswings. Following the better than expected outturn—and negative fiscal impulse—last year, the 2019 deficit is likely to imply a positive impulse this year. Overall, the structural non-oil deficit will be broadly unchanged over the 2017-19 period. This contrasts with previous upswings, during which non-oil deficits increased significantly simply because space under the rule was increasing.

5. The authorities should go beyond neutral and target some consolidation during the upturn. With growth projected to be above potential in 2019 and 2020 and the output gap turning positive, the authorities should target a ¼ to ½ percent of GDP annual fiscal consolidation. This would have various benefits, first and foremost to help build fiscal space for the next cyclical downturn, particularly given mounting external risks.

6. In addition to these immediate considerations, Norway confronts significant looming fiscal challenges. The combination of demographic changes, dwindling oil and gas reserves and already high non-oil fiscal deficits will require a permanent fiscal adjustment of 4-5 percent of GDP in the long term. From a solvency perspective, the current strong net asset position of the public sector means Norway could in principle afford to spread these adjustments over many years. However, without more immediate action, space under the fiscal rule will become increasingly constrained over the next decade. This will crowd out any new budget initiatives unless the authorities are prepared to start increasing revenues or consolidating other spending soon.

7. These needs could be met through a combination of measures:

On the revenue side, the efficiency of the VAT system is only slightly above average by international standards. Efficiency is undermined by a range of exemptions and multiple rates. While some of these exemptions and lower rates are motivated by social objectives, the VAT system is a blunt and inefficient instrument to redistribute incomes, and Norway is capable of better-targeted and more sophisticated tools. Our calculations show that a realistic improvement in VAT efficiency through base broadening could yield an additional 1½ percent of GDP in annual revenue. Additional possible revenue measures include less generous tax incentives for home ownership.

On the expenditure side, reforms of sickness and disability pensions, while aimed primarily at increasing employment levels, would also have a positive budgetary impact. Spending on sickness and disability benefits is 2-3 percent of GDP higher per year than in other Nordic countries, where benefits are already generous by advanced economy standards.

Monetary and Financial Sector Policies

8. Monetary tightening should continue. After the recent increase, the key policy rate is at 1 percent, and Norges Bank now signals a preference for higher interest rates for the period up to end-2020 relative to its communication late last year. Both the tightening and the steepening of the interest rate path are appropriate, given above-target inflation and strong projected GDP, employment, and wage growth for this and next year.

9. Conversely, faster tightening does not seem warranted. Inflation expectations remain well anchored, and the high share of flexible-rate mortgages makes household consumption very sensitive to interest rate changes, creating the risk of a self-induced slowdown if rates are increased too rapidly. In addition, tightening faster at a time when other central banks are pausing their policy normalization cycles would widen interest rate differentials and create unwanted capital inflows and exchange rate appreciation.

10. Risks from residential housing prices have decreased but have not disappeared. House prices remain overvalued in our view (by around 5-20 percent in Oslo and 0-10 percent nationally), albeit less so than last year. In addition, household debt continues to increase from high levels. Mortgage regulations should therefore not be relaxed, nor should the stricter Oslo "speed limit" be increased to the national level.

11. Risks are growing in the commercial real estate (CRE) market where prices have increased substantially. Price growth has been especially high among prime properties in Oslo, where yields are now lower than in many other major European cities. Norwegian banks have substantial exposure to CRE loans. In this context, we support the increase in the countercyclical buffer requirement from end-2019. In addition, the authorities should continue their efforts to remedy shortcomings of available CRE data, which hamper the precise assessments of these risks.

12. Standing against these risks, the banks have robust liquidity and capital buffers. Banks comfortably meet the capital requirements; the average common equity tier 1 (CET1) is 15.7 percent (2018:Q3). On the liquidity side, the aggregate liquidity coverage ratio now stands at 140 percent, and the net stable funding ratio at 115 percent.

13. In the context of recent allegations of money laundering in several Nordic banks, a solid de-facto and de-jure Anti-Money Laundering and Countering Financing of Terrorism (AML/CFT) framework is paramount. Parliament has recently approved a new AML/CFT law that grants sanction powers to the FSA, broadening its toolkit. It is also timely that the FSA has received higher budgetary resources to step up supervision of AML/CFT compliance. Going forward, we welcome the ongoing efforts to close remaining gaps in the AML/CFT framework, as well as to strengthen regional cooperation on AML/CFT issues.

Structural Policies

14. Ensuring durable longer-term growth requires a continued rebalancing of the economy away from oil and gas. Norway has diversified its economy to a greater extent than many other commodity exporters, not least thanks to its responsible management of oil revenues. However, the fact that oil and gas production are projected to start declining relatively soon is a stark reminder of the task at hand. The weak krone is helping competitiveness in some non-oil and gas sectors, notably in the fish and tourism industries, whereas traditional manufacturing industries have responded to a lesser extent than could have been expected given the size of the 2014-15 depreciation. Beyond the weak krone, restraint in wage settlements will be important to deepen recent competitiveness gains. The social partners have again demonstrated their commitment to moderate wage increases in this year's bargaining round, settling for nominal wage growth in manufacturing, the wage-leading sector in the Norwegian bargaining system, to 3.2 percent. It will be important to preserve this sense of shared responsibility.

15. Another key challenge will be to sustain high employment levels in the face of population aging. Sickness and disability benefits are the single most important priority in this area. About 10 percent of the working age population receives permanent disability pensions, and still more are on temporary disability. This is much higher than in Nordic peers. There is also an increasing number of young beneficiaries, many of whom are likely to remain trapped in the system and out of the labor force over the long term. We welcome the government-appointed commission's recent recommendations, which will now be discussed with the social partners. In our view, a suitable reform package would ideally consist of combination of measures aimed at achieving three key elements: (i) tightening eligibility criteria and certification procedures; (ii) enhancing education and retraining programs for beneficiaries, in particular those with more limited employment opportunities; and (iii) reducing benefit levels, which are high compared to peer countries, especially for the young (who often earn more through the benefits than through work). As was emphasized by the commission, poorer and less educated people are more likely to be on sickness and disability benefits, hence the distributional consequences of any reform will have to be carefully weighted.

16. Efforts to increase employment rates among non-OECD immigrants and refugees should continue. Norway scores relatively highly on the integration of these groups into the labor market among international peers. Nevertheless, the planned standardization of the curriculum under the Integration Program is likely to further enhance its effectiveness, as will efforts to make duration more flexible depending on individual circumstances.

-----

Earlier:

2019, May, 6, 11:25:00

NORWAY'S FUND RETURNED 9.1%

The Government is allowing for the Government Pension Fund Global to be invested in unlisted renewable energy infrastructure under the dedicated environmental mandates. Such investments shall be subject to the same profitability and transparency requirements as the other investments of the Fund, says Siv Jensen, Minister of Finance.

|

2019, April, 8, 11:10:00

NORWAY'S RENEWABLE INVESTMENT $14 BLN

The Government is allowing for the Government Pension Fund Global to be invested in unlisted renewable energy infrastructure under the dedicated environmental mandates. Such investments shall be subject to the same profitability and transparency requirements as the other investments of the Fund, says Siv Jensen, Minister of Finance.

|

2019, March, 13, 11:15:00

NORWAY EXCLUDE OILGOVERNMENT.NO - The Government is proposing to exclude companies classified as exploration and production companies within the energy sector from the Government Pension Fund Global to reduce the aggregate oil price risk in the Norwegian economy. |

2019, March, 1, 11:25:00

NORWAY'S FUND RETURNED -6%NB - The Government Pension Fund Global returned -6.1 percent, or -485 billion kroner, in 2018. |

2019, February, 20, 10:55:00

NORWAY'S RESOURCES UPNPD - The Norwegian Petroleum Directorate’s estimate for total proven and unproven petroleum resources on the Norwegian Continental Shelf is about 15.6 billion standard cubic metres of oil equivalents. |

2018, November, 28, 12:00:00

NORWAY'S FUND ENDSREUTERS - Norway’s sovereign wealth fund, the world’s largest, will no longer exclude Cairn Energy Plc (CNE.L) and Kosmos Energy Ltd (KOS.N) from its portfolio of investments, the Norwegian central bank said on Tuesday. |

2018, October, 26, 12:45:00

NORWAY'S FUND RETURNED 2%NORGES BANK - The Government Pension Fund Global returned 2.1 percent, or 174 billion kroner, in the third quarter of 2018. |