OCCIDENTAL SALES $8.8 BLN

МИНЭНЕРГО РОССИИ - Министр энергетики Российской Федерации Александр Новак в ходе заседания Правительства России под руководством Председателя Правительства РФ Дмитрия Медведева доложил о текущей ситуации с поставками российской нефти по нефтепроводу "Дружба".

Глава Минэнерго России напомнил, что по поручению Председателя Правительства Российской Федерации Дмитрия Медведева была создана межведомственная комиссия по проверке нарушения показателей качества нефти, транспортируемой по магистральному нефтепроводу "Дружба".

"По итогам проверки был определен источник загрязнения нефти - это узел учета "Лопатино" в Самарской области. Следственные действия выявили группу компаний, осуществлявших незаконную деятельность по сдаче в систему некондиционной нефти. Материалы проверки переданы в Генпрокуратуру России, возбуждено уголовное дело", - доложил глава Минэнерго России.

Что касается ситуации непосредственно на нефтепроводе "Дружба", Александр Новак рассказал, что уже было произведено оперативное изолирование источника загрязнения от системы магистральных нефтепроводов.

"В настоящий момент осуществляется работа по переориентации нефтепотоков, компанией "Транснефть" ведется ежесуточный режим контроля качества нефти на трубопроводах", - отметил Министр.

Минэнерго России, в свою очередь, продолжается планомерная работа и со странами-покупателями российской нефти, на данный момент дорожная карта по улучшению ситуации на нефтепроводе была согласована с Польшей, Республикой Беларусь, Украиной, Словакией и Венгрией, добавил Александр Новак.

"4 мая с опережением на два дня кондиционная нефть поступила на Мозырский НПЗ, 6 мая началась прокачка кондиционной нефти в сторону узла учета "Броды" для поставки европейским потребителям, сейчас мы ожидаем согласования прокачки нефти в Польшу. Параллельно продолжается прокачка нефти в сторону порта Усть-Луга, утром 8 мая нефть достигнет порта", - сказал он.

При этом ситуация на нефтепроводе "Дружба" не повлияла на объемы добычи и экспорта нефти Россией, заверил Александр Новак. По его словам, завершение всех мероприятий по ликвидации последствий загрязнения нефти на нефтепроводе "Дружба" ожидается во второй половине мая. Чтобы не допустить повторение подобных случаев в будущем, Минэнерго России были подготовлены соответствующие предложения по корректировке нормативно-правовой базы, добавил Александр Новак.

"Ключевое предложение касается изменений в ГОСТ по контролю качества нефти. В настоящее время ГОСТом предусмотрен обязательный контроль в транспортируемой нефти 11-ти показателей и содержания хлорорганики и парафинов не реже раза в 10 дней. Мы предлагаем внести изменения в ГОСТ по учету и контролю качества нефти с целью расширения перечня проверяемых показателей, методов отбора и хранения арбитражных проб нефти, то есть введения требований по ежедневному измерению", - пояснил глава Минэнерго России.

Кроме того, Минэнерго России предлагает внести поправки в закон "О промышленной политике России" для того, чтобы законодательно установить требования к качеству нефти, сдаваемой на транспортировку, а также закрепить неприменение хлорорганики, сообщил он.

По итогам работы комиссии, по словам Александра Новака, также предложено поручить Ростехнадзору и Росстандарту провести проверки всех коммерческих пунктов учета нефти, а Росстандарту и Росаккредитации - сделать обязательной процедуру аккредитации химико-аналитических лабораторий для проведения товарно-коммерческих операций с нефтью и нефтепродуктами. Также предлагается повысить административную ответственность юридических лиц за нарушения требований Техрегламента по нефти и по топливу - с нынешних 300 тыс. рублей до штрафа в размере 2% от оборота, заключил глава Минэнерго России.

-----

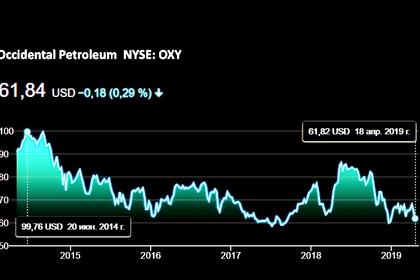

OCCIDENTAL SALES $8.8 BLN

REUTERS - Occidental Petroleum Corp said on Sunday that in connection with its proposal to acquire Anadarko Petroleum Corp, it agreed to sell Anadarko's Algeria, Ghana, Mozambique and South Africa assets to Total SA for $8.8 billion.

That sale, which is contingent upon Occidental completing its proposed purchase of Anadarko, would make Total the fourth biggest LNG producer in the world after Qatargas, Royal Dutch Shell Plc and Petronas, according to energy consultancy Wood Mackenzie.

Total was the sixth-biggest LNG producer in the world in 2018 with stakes in projects in several countries, including the United Arab Emirates, Qatar, Nigeria, Oman, Egypt, Norway, Angola, Australia and Russia.

"The potential acquisition of Anadarko's stake in Mozambique LNG is representative of Total's ambitious and aggressive expansion of its LNG position," Wood Mackenzie research director Nicholas Browne said.

Total acquired Engie SA's LNG business in 2018 and has stakes in several projects under construction or development, including Russia's Arctic LNG-2, Papua LNG, Nigeria's NLNG 7, Sempra Energy's Cameron in Louisiana and Costa Azul in Mexico, Tellurian Inc's Driftwood in Louisiana and an expansion project in Qatar, Wood Mackenzie said.

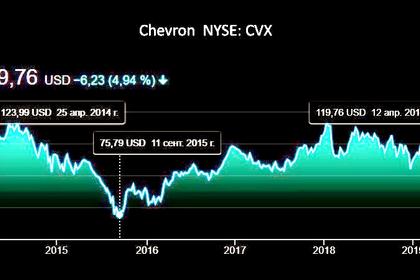

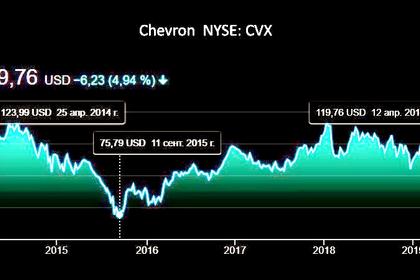

Chevron Corp, which is currently the fifth-biggest LNG producer in the world, is also seeking to buy Anadarko.

The addition of Anadarko, however, will not immediately change the LNG output of either Total or Chevron for several years since Anadarko's 12.9-million tonnes per annum (MTPA) Mozambique project is still in development. Anadarko has said it expected to make a final investment decision to build the project in the coming months.

-----

Earlier:

2019, April, 26, 10:20:00

ANADARKO NET LOSS $15 MLN

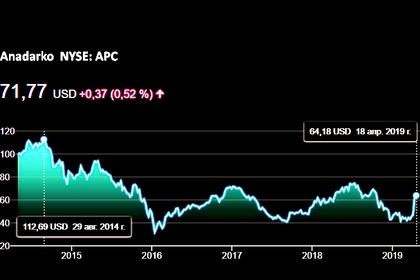

Anadarko Petroleum Corporation (NYSE: APC) announced 2019 first‑quarter results, reporting a net loss attributable to common stockholders of $15 million, or $0.03 per share (diluted).

2019, April, 15, 11:55:00

CHEVRON BUYS ANADARKO FOR $50 BLN

Chevron Corporation (NYSE: CVX) announced that it has entered into a definitive agreement with Anadarko Petroleum Corporation (NYSE: APC) to acquire all of the outstanding shares of Anadarko in a stock and cash transaction valued at $33 billion, or $65 per share. Based on Chevron’s closing price on April 11th, 2019 and under the terms of the agreement, Anadarko shareholders will receive 0.3869 shares of Chevron and $16.25 in cash for each Anadarko share. The total enterprise value of the transaction is $50 billion.

All Publications »

Tags:

OCCIDENTAL,

ANADARKO