OIL DEMAND GROWTH 2019: 1.3 MBD

IEA - The theme we identified in last month's Report of "mixed signals" is appropriate again this month, with geopolitics and industry disruptions confusing the supply outlook, and the first change to our 2019 demand outlook for several months. The ongoing geopolitical supply concerns around Libya, Iran, and Venezuela have been joined in the past few days by the attacks on shipping off Fujairah and on two pumping stations in Saudi Arabia. At the time of writing, there is no disruption to oil supplies and prices are little changed. The IEA is monitoring the situation, particularly in view of the proximity of Fujairah to the strategically vital Strait of Hormuz. We are also monitoring the impact of the contamination of Russian crude oil passing through the 1.4 mb/d Druzhba pipeline system. The issue will be resolved in due course, eased by commercial and government stock draws by Russia's customers. One consequence could be a loss of confidence in the quality of the crude flows and thus a search, where feasible, for alternative supplies that could intensify price pressures for heavy/medium sour crude oil.

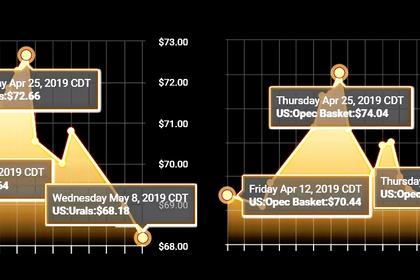

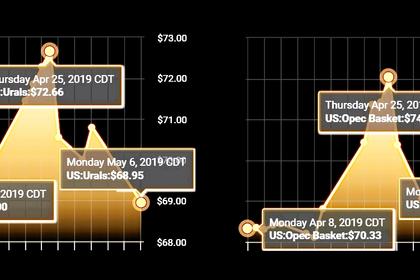

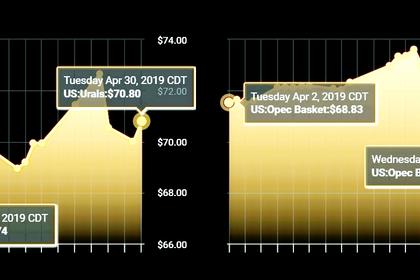

Despite the difficult geopolitical backdrop and other supply problems, headline oil prices are little changed from a month ago at just above $70/bbl for Brent. In the intervening period, the decision by the United States to cease the waiver programme for buyers of Iran's crude oil did see Brent briefly reach $75/bbl. However, there have been clear and, in the IEA's view, very welcome signals from other producers that they will step in to replace Iran's barrels, albeit gradually in response to requests from customers. There is certainly scope for other producers to step up production with our data showing that in April parties to the Vienna Agreement collectively produced 440 kb/d less than they promised, with Saudi Arabia producing 500 kb/d below its allocation. Of course, as we wrote in the February edition of this Report, there are quality issues for refiners used to processing Iranian barrels and the fact that increases in output come at the cost of reducing the global spare capacity cushion.

In this Report, there is a modest offset to supply worries from the demand side. Our headline growth estimate for 2019 has changed little since the middle of last year, but this month we cut it by 90 kb/d to a still healthy 1.3 mb/d. The reduction is mainly concentrated in 1Q19 on weaker than expected data for Brazil, China, Japan, Korea, Nigeria, and elsewhere lowering growth by 410 kb/d versus our last Report. Even so, slower demand growth is likely to be short-lived, as we believe that the pace will pick up during the rest of the year. An important implication of our revised demand data is that in 1Q19 the oil market saw an implied surplus of supply over demand of 0.7 mb/d, which was higher than previously suggested. As we move through 2Q19, while there is considerable uncertainty on the supply side, it is highly likely that the implied balance will flip into an indicative deficit of about the same size. Stocks in the OECD at the start of April have fallen back to the level seen in July in terms of days of forward cover and other stock indicators are pointing in the same direction.

For now, despite all the supply uncertainty, headline Brent oil prices are little changed from a month ago. However, the backwardation has steepened considerably and front month prices are about $3/bbl higher than for six months out. The decline of 230 kb/d in the North Sea loading programme for June versus May, although not a surprise, is another important factor adding to overall concerns about supply. Elsewhere, contract prices are rising sharply with Asian customers paying significantly more for barrels from Middle East sources as they seek to replace their normal supplies of Iranian crude. Basrah Light, for example, was reported as offered at its highest level for nearly eight years.

The IEA is reassured to see that the challenges posed by the supply uncertainties are being managed and we hope that major players will continue to work to ensure market stability.

-----

Earlier: